- OpenAI plans to invest over $1 trillion in AI infrastructure and services over the next five years, backed by partnerships with leading tech companies.

- Collaborations with firms like AMD, NVIDIA, Broadcom, and Oracle bring significant gains to both OpenAI and its partners, strengthening their positions in the tech ecosystem.

- OpenAI plans to invest over $1 trillion in AI infrastructure and services over the next five years, backed by partnerships with leading tech companies.

- Collaborations with firms like AMD, NVIDIA, Broadcom, and Oracle bring significant gains to both OpenAI and its partners, strengthening their positions in the tech ecosystem.

OpenAI has unveiled an ambitious five-year investment strategy, with planned spending exceeding $1 trillion. The initiative aims to develop advanced computing infrastructure and expand the company’s portfolio of AI-powered products and services.

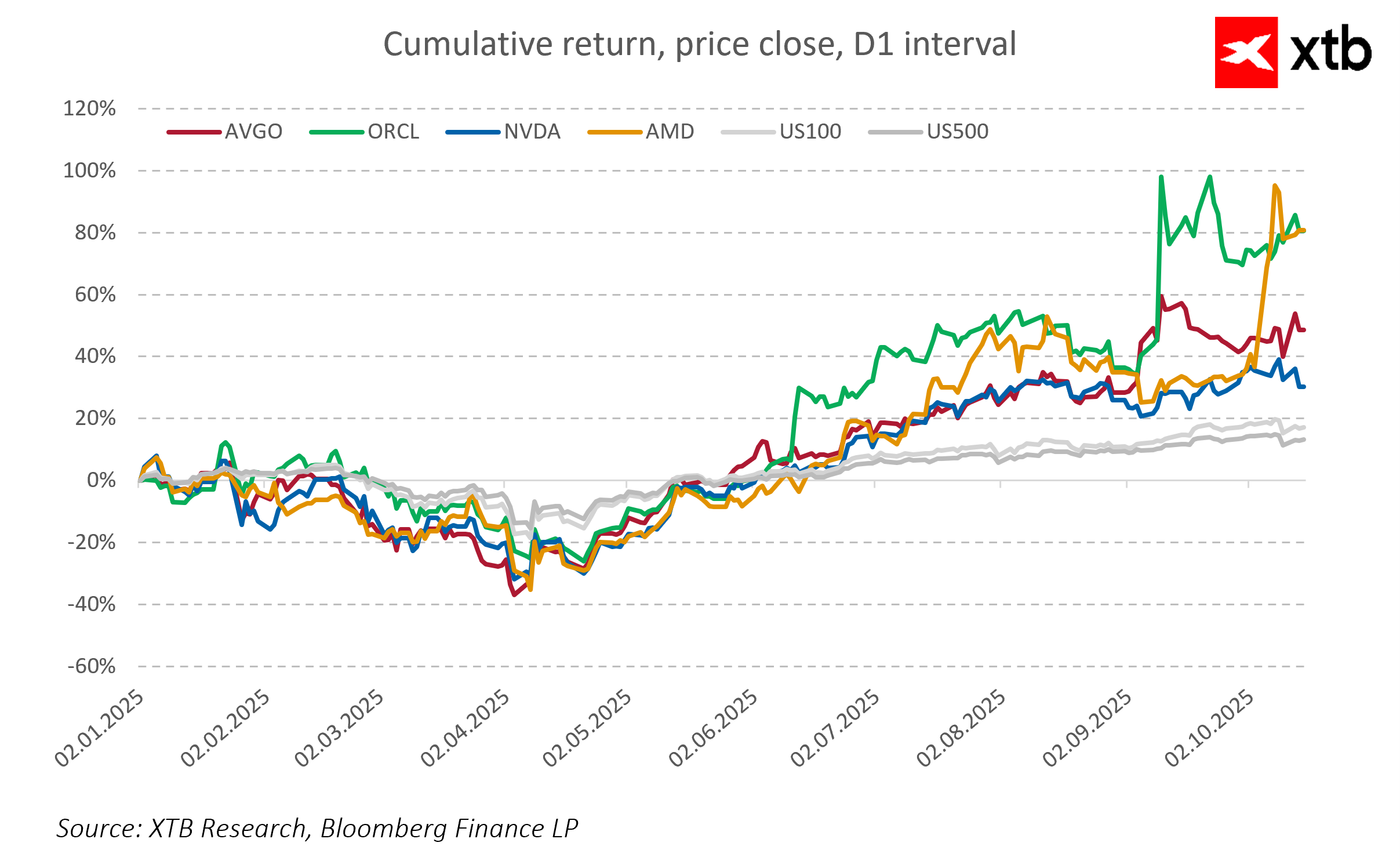

To finance this massive undertaking, OpenAI intends to establish new revenue streams, including expanding services for enterprises and public institutions, developing AI tools to support e-commerce, as well as creating autonomous AI agents and video generation technologies. Strategic partnerships with tech giants such as AMD, NVIDIA, Broadcom, and Oracle play a key role in this strategy. Notably, OpenAI has signed major agreements, including a deal with Broadcom to supply 10 GW of compute power, and a $300 billion data center development partnership with Oracle.

As part of the plan, OpenAI is also advancing "Project Stargate" — a global network of data centers designed to provide widespread access to cutting-edge AI technology and contribute to its global democratization.

Despite the high cost, OpenAI anticipates strong revenue growth, projecting up to $13 billion in annual income, the majority of which is expected to come from ChatGPT subscriptions. The company also plans to double its number of paying users and expand further into developing markets.

Importantly, OpenAI’s partnerships are mutually beneficial. Companies like AMD, NVIDIA, Broadcom, and Oracle are seeing significant returns through hardware and service contracts as well as infrastructure development tied to AI demand. These alliances are strengthening all involved players, accelerating innovation and driving growth in the technology sector.

Experts note that while OpenAI’s plans are highly ambitious and could transform the AI landscape, they come with challenges — including substantial financial demands, dependency on strategic partners, and the potential for increasing regulatory scrutiny.

If realized, this five-year roadmap could position OpenAI as one of the dominant forces in the AI industry, accelerating the development of technologies set to reshape multiple sectors of the global economy.

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Arista Networks closes 2025 with record results!

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.