- For Broadcom, this breakthrough deal cements its role as a key player in the AI infrastructure sector.

- Broadcom’s shares are rising thanks to the OpenAI agreement.

- For Broadcom, this breakthrough deal cements its role as a key player in the AI infrastructure sector.

- Broadcom’s shares are rising thanks to the OpenAI agreement.

OpenAI has announced a strategic partnership with Broadcom aimed at developing and deploying its first independently designed artificial intelligence chips. This move responds to the company’s rapidly growing computational needs as it develops advanced generative models like ChatGPT. The new chips are scheduled to be launched in the second half of 2026, with a combined power capacity of 10 gigawatts—more than five times the energy generated by the Hoover Dam and enough to power over 8 million households in the United States. Following the announcement, Broadcom’s stock jumped nearly 8% at the start of trading!

Under the agreement, OpenAI will handle the design of the graphics processing units (GPUs), while Broadcom will be responsible for their technical development, manufacturing, and integration with servers and data center infrastructure. The new systems will be deployed both in OpenAI’s own facilities and in data centers managed by external partners. The entire setup will rely on Broadcom’s networking technology, including Ethernet solutions, which could serve as a viable alternative to Nvidia’s currently dominant standard.

This agreement fits into OpenAI’s broader strategy to reduce dependency on Nvidia’s limited supply and high-cost chips. Previously, OpenAI signed a contract with AMD for 6 gigawatts worth of chips and is collaborating with Nvidia to build infrastructure with an additional 10 gigawatts of capacity. Altogether, this amounts to 26 gigawatts of contracted computing power—more than the total summer electricity consumption of New York City.

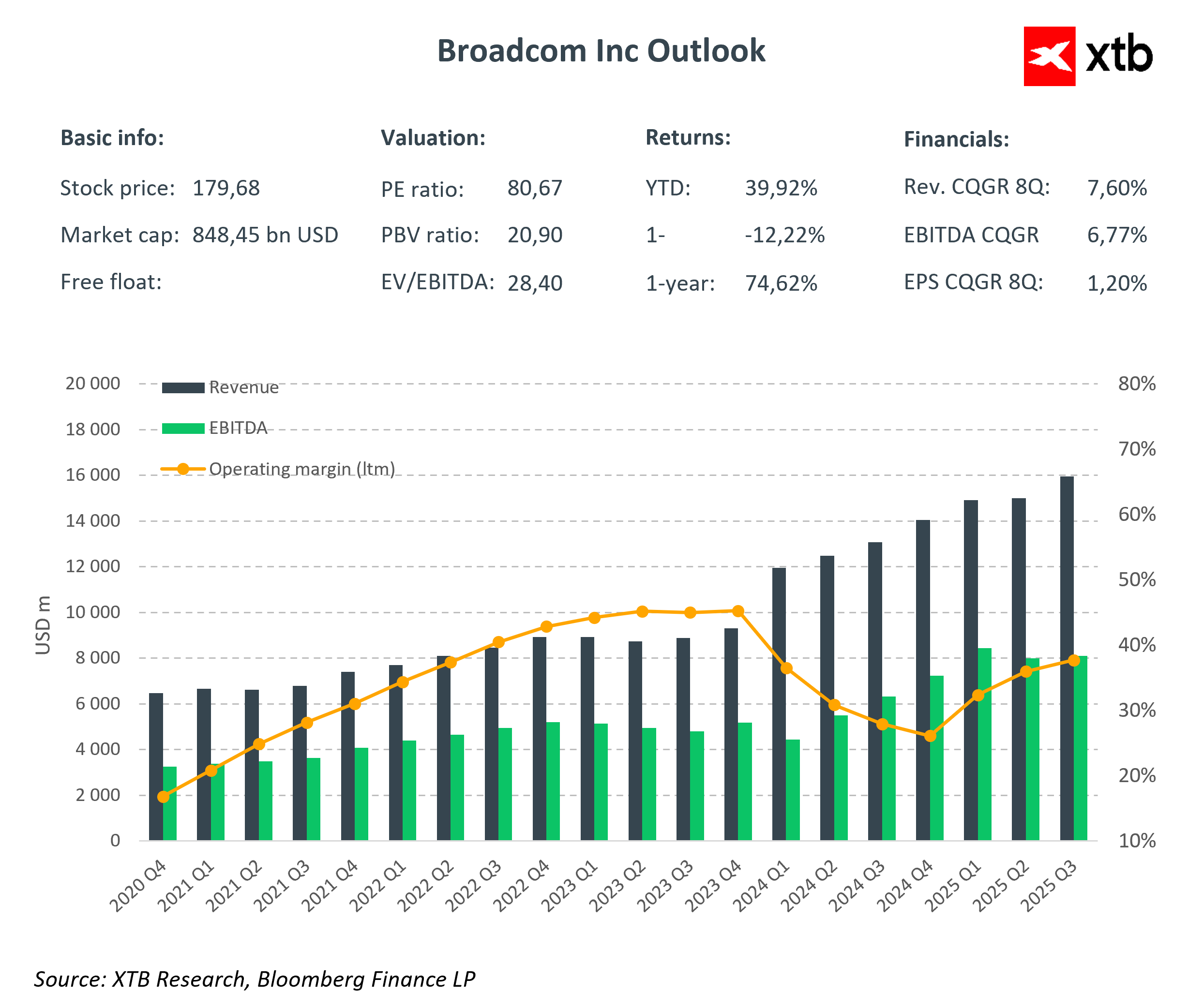

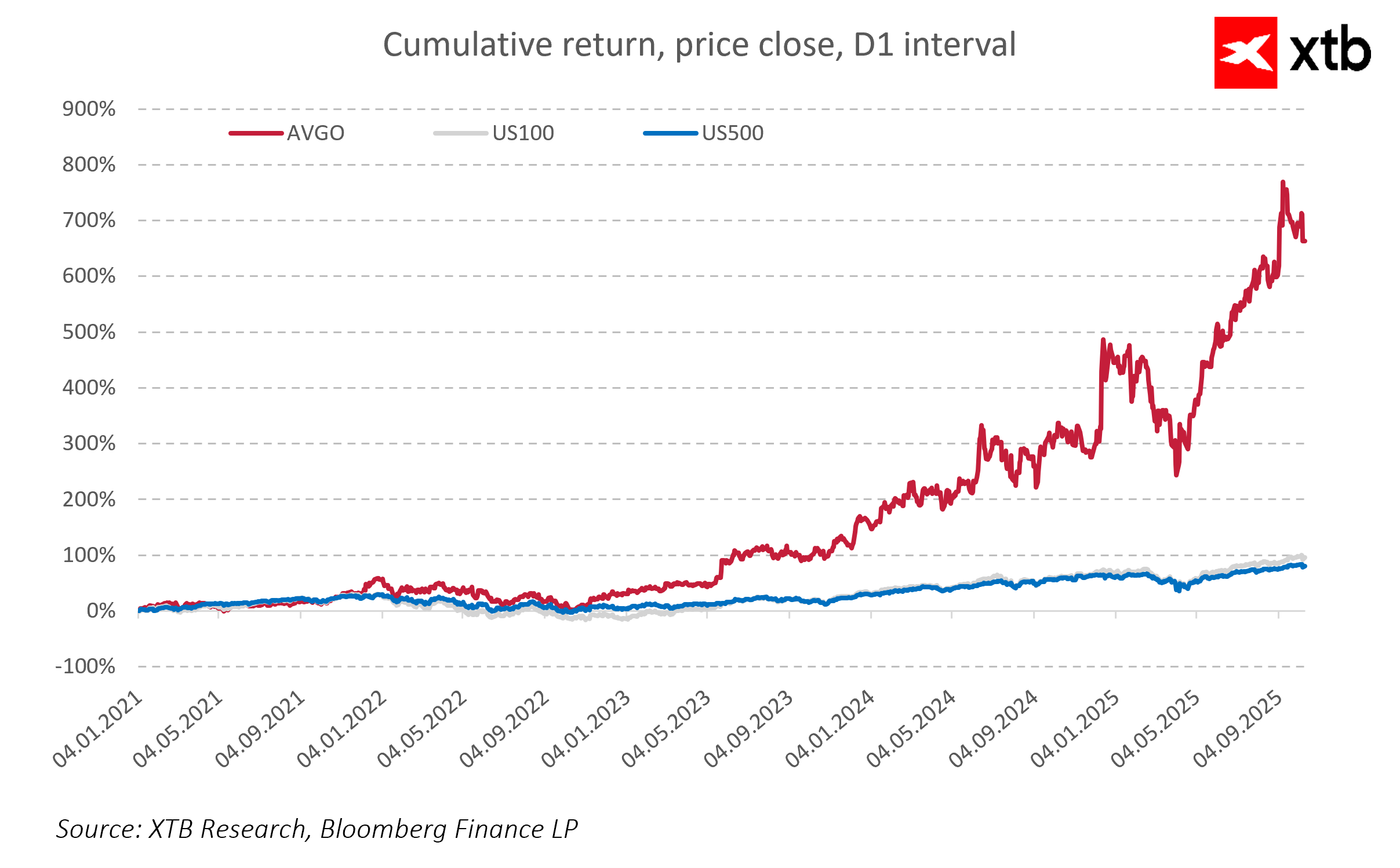

For Broadcom, this is one of the largest and most prestigious contracts in the company’s history. Traditionally known for networking chips and telecommunications solutions, Broadcom is now becoming a key player in the emerging AI infrastructure segment. Since the end of 2022, Broadcom’s stock price has been in a strong upward trend, rising nearly sixfold. Moreover, Broadcom’s revenue grows quarter after quarter, with each financial report confirming the increasing importance of the AI chip segment in the company’s overall revenue structure. The partnership with OpenAI further strengthens Broadcom’s position as a major beneficiary of the global artificial intelligence boom.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.