- Oracle stock has experienced rapid growth and decline recently.

- The market expects the company to deliver tangible growth, failure might result in harsh declines

- It's paramount that the management board "reads the room" on CAPEX

- Oracle stock has experienced rapid growth and decline recently.

- The market expects the company to deliver tangible growth, failure might result in harsh declines

- It's paramount that the management board "reads the room" on CAPEX

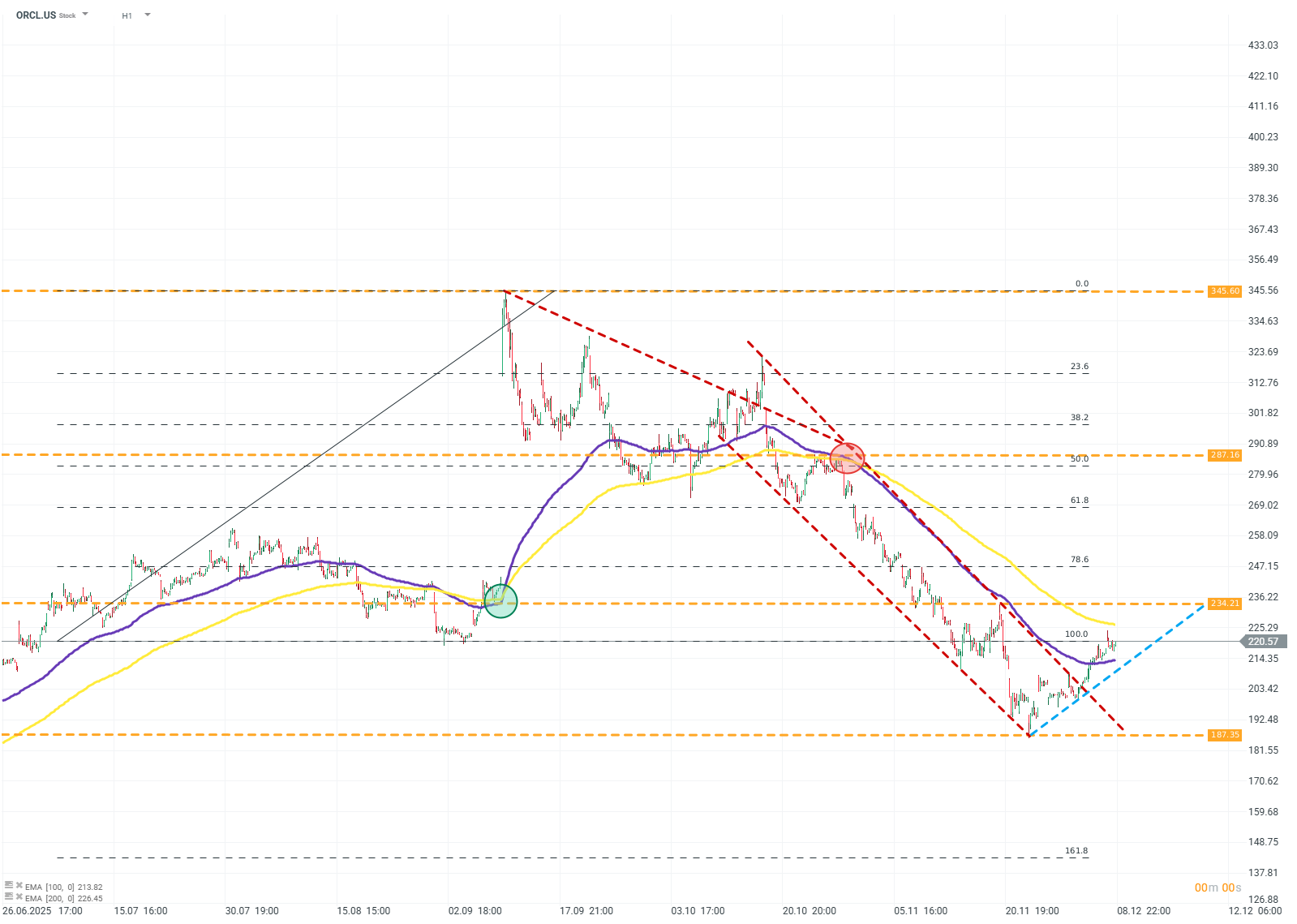

Oracle, one of the leaders in cloud services and infrastructure, will be releasing its results after the close of Wednesday's session in the USA. The company's valuations have experienced a year of dramatic changes in valuation and sentiment.

A proper increase in revenues and profits, combined with an unprecedented backlog growth driven by the agreement with OpenAI, has propelled Oracle's valuations to new heights. However, investors quickly began to scrutinize the company's planned cash flows, particularly CAPEX. The company is attempting to generate CAPEX at the level of so-called mega-caps, despite not being one itself. Additionally, it is trying to do so under conditions where Oracle is already burdened with a debt-to-equity ratio of approximately 450%. This has raised significant concerns, leading to the company losing about 30% of its valuation in recent months, along with a noticeable increase in CDS contract activity.

What are the expectations for the results?

Recent publications have often disappointed investors in terms of revenues and profits, but they have compensated with prospects, forecasts, investments, or dynamic development in key areas. This time, however, shareholders may demand the realization of at least some of these promises.

Earnings expectations are around $1.64 per share, with revenues expected to be around $16.19 billion. Another disappointment in these areas may not be received with the same patience by investors as in previous conferences. Importantly, investors will ultimately pay more attention to profitability than revenue.

What may prove absolutely critical is the proper interpretation by the company's management of the market's attitude towards CAPEX. They are no longer a value in themselves, and further increases in the current situation may provoke further devaluation.

ORCL.US (H1)

Source: xStation5

Amazon shares tumble 10% as investors recoil at the price of AI dominance

Daily summary: Red dominates on both sides of Atlantic

US OPEN: Market under pressure from lacklustre tech earnings season

Palantir after earnings: another quarter, another record

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.