- Precious metals lose momentum today after Donald Trump Remarks

- Gold loses 2% and silver is down more than 4%

- Precious metals lose momentum today after Donald Trump Remarks

- Gold loses 2% and silver is down more than 4%

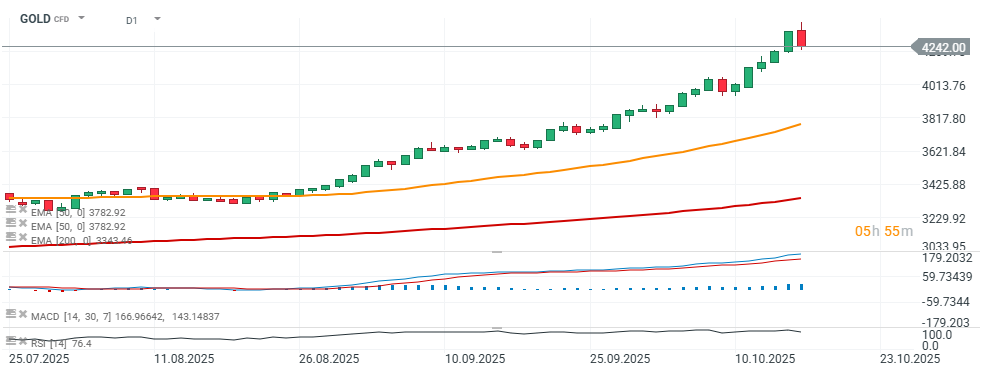

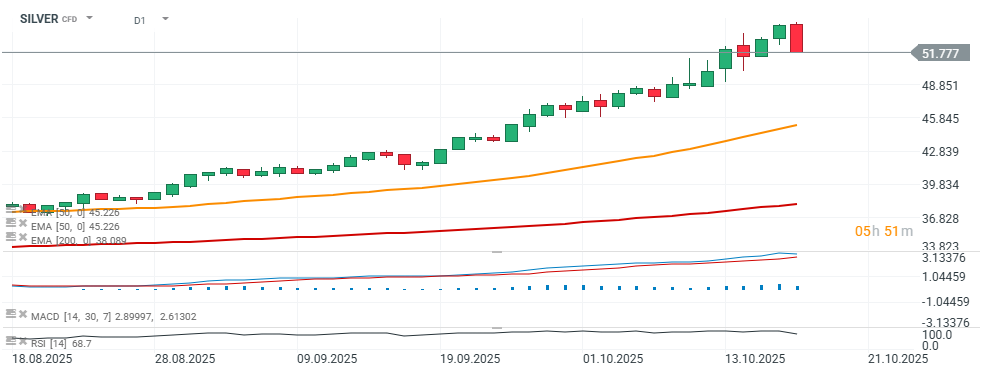

Precious metals fell as the U.S. dollar strengthened, following President Donald Trump’s remark that a “full-scale” tariff on China would be unsustainable in the long term. For a moment, gold appeared ready to extend its biggest rally since the 2008 collapse of Lehman Brothers, but prices later retreated as Trump adopted a calmer tone on trade policy. The announcement of a meeting between the U.S. president and Chinese leader Xi helped ease market sentiment and reduce demand for safe-haven assets.

Source: xStation5

Even so, the metal has gained more than 60% this year, driven by geopolitical tensions, central bank purchases, and expectations of U.S. interest rate cuts. Standard Chartered forecasts an average gold price of $4,488 in 2026, while HSBC sees $5,000 as a realistic target. Physical demand in Asia remains strong, with Indian spot gold premiums reaching decade highs.

Source: xStation5

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.