The likely nomination of Kevin Warsh to succeed Jerome Powell is a signal the markets are reading clearly: the era of hyper-dovish expectations has come to a close. While his selection gratifies proponents of monetary discipline, it heralds a tighter policy stance in the medium term. It remains to be seen whether Donald Trump will eventually rue his choice should Warsh refuse to pivot toward lower rates. Conversely, Trump’s primary motivation may be less about interest rate policy and more about resolving a personal grievance with Powell.

1. Dollar Response: The End of the Sell-off and a Return to Yields

The mere confirmation of Warsh as the frontrunner was sufficient to halt the decline of the US currency.

-

DXY Rebound and Rising Yields: The dollar is bouncing aggressively from recent lows as Treasury yields climb. Warsh is viewed as a "market-friendly" candidate, yet one significantly more hawkish than rivals such as Hassett or Rieder.

-

Recalibrated Expectations: Investors are now pricing in a decelerated pace of rate cuts. Nevertheless, Warsh himself has frequently argued that the Fed remains too backward-looking rather than anticipating future trends.

-

Market Reaction: EUR/USD responded with an immediate slide following reports that the Trump administration has "locked in" the Warsh candidacy. Precious metals are experiencing their steepest decline in months.

2. A New Chapter for the Fed: Between Hawkish Roots and Political Pressure

Kevin Warsh maintains a reputation as an orthodox hawk who has historically been a vocal critic of excessively loose monetary conditions.

-

Data-Dependent Discipline: His nomination suggests a shift toward a data-dependent strategy, characterized by caution regarding the cost of capital and a priority on the durable suppression of inflation.

-

Mitigating Independence Concerns: As an "institutional" candidate, Warsh provides some reassurance to markets fearing the complete subordination of the central bank to the White House. However, political pressure remains a latent risk, particularly given Trump’s vocal demands for lower rates.

3. Economic and Market Implications: The Shadow of Higher Costs

-

Short Term: A resurgent dollar and higher yields are tightening financial conditions. While this aids the fight against inflation and reinforces the US "safe haven" status, it weighs heavily on American exports and emerging market stability. It has also triggered an extreme sell-off in gold and silver.

-

Medium Term: The "higher for longer" prospect may cool domestic demand, the housing market, and capital expenditure (CAPEX). While this stabilizes price levels, it poses a risk to growth momentum.

-

Risk Assets Under Pressure: For the technology (growth) sector and cryptocurrencies, the Warsh narrative is bearish. Tighter policy translates to diminished liquidity and a higher cost of capital—factors analysts are already flagging as primary risks.

4. Institutional Conflict Risk

The Warsh nomination takes place against a backdrop of unprecedented friction—including the DOJ investigation into Powell and public disputes over Fed autonomy.

-

The Core Conflict: A tangible risk exists of a collision between Trump’s pro-growth, populist agenda and Warsh’s conservative monetary instincts. Should markets perceive that political pressure is eclipsing the mandate for price stability, long-term confidence in the dollar could be severely tested.

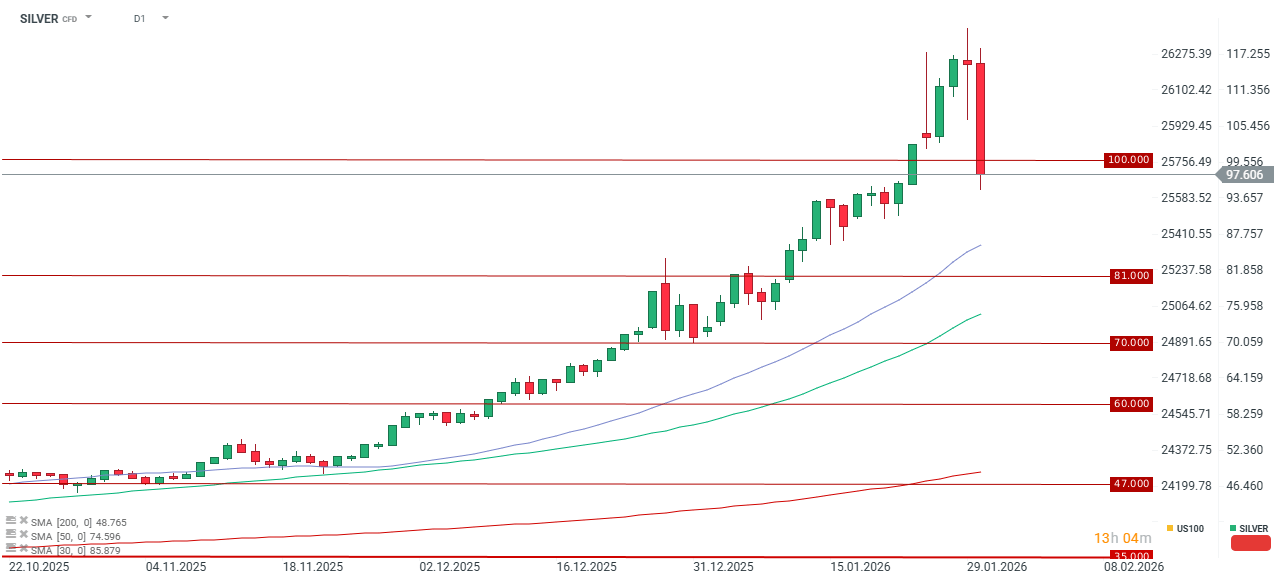

Silver has retreated by as much as 15%, falling below the $100 mark. The next significant support levels are situated within the $80 to $90 per ounce range. Source: xStation5

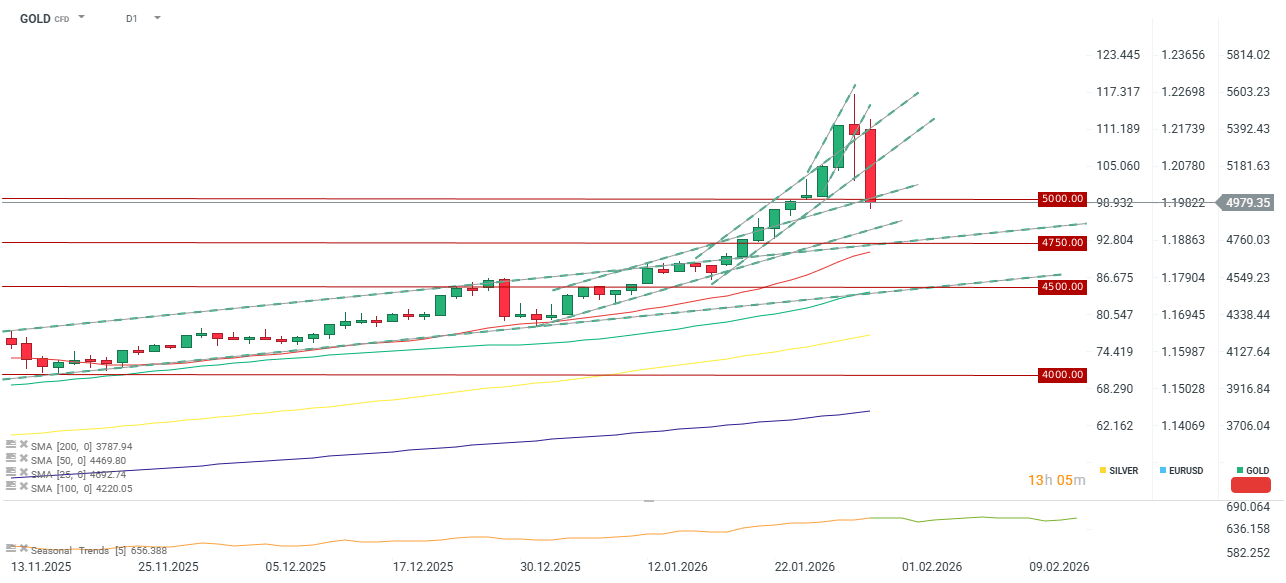

Gold has slipped below $5,000 today. This 7% decline represents a volatility rarely seen in this asset class. The next key support levels are $4,750 and $4,500. Source: xStation5

Daily Summary: Precious metals are bleeding, and the US government is shut down again!🔒

Palantir Preview: Perfection already priced in?

Another US Gov. Shutdown: What can it mean this time?

US Open: America rises, precious metals fall!

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.