Silver continues its strong upward momentum in the final session of the week, a phenomenon that cannot be attributed to a single factor. Currently, speculative demand is rising very sharply, although it is primarily visible in the ETF options market. Bloomberg suggests that investors holding short positions in options will be forced to generate additional speculative demand for silver in order to limit their losses.

The main factors driving silver’s rally this year include another year of severe deficit caused by strong demand from the photovoltaic sector, stimulation from ETFs, and ongoing problems on the silver mining side, as it is often a byproduct of copper, gold, or zinc extraction. Additionally, monetary factors and concerns related to the appointment of a new Fed Chair are increasing demand for precious metals.

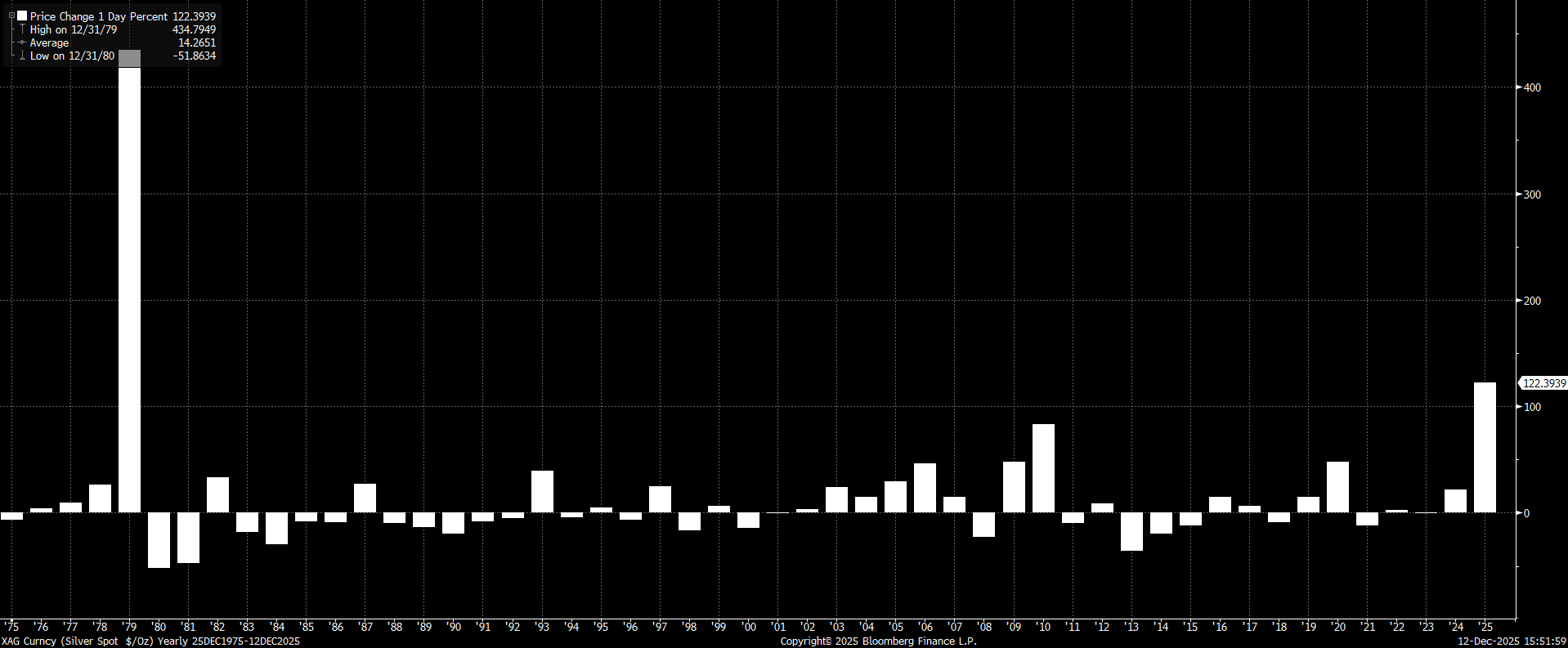

The price increase for silver this year already amounts to 120%, with this week alone contributing over 10%. There is now growing talk that the demand for silver is primarily speculative. Source: Bloomberg Finance LP, XTB

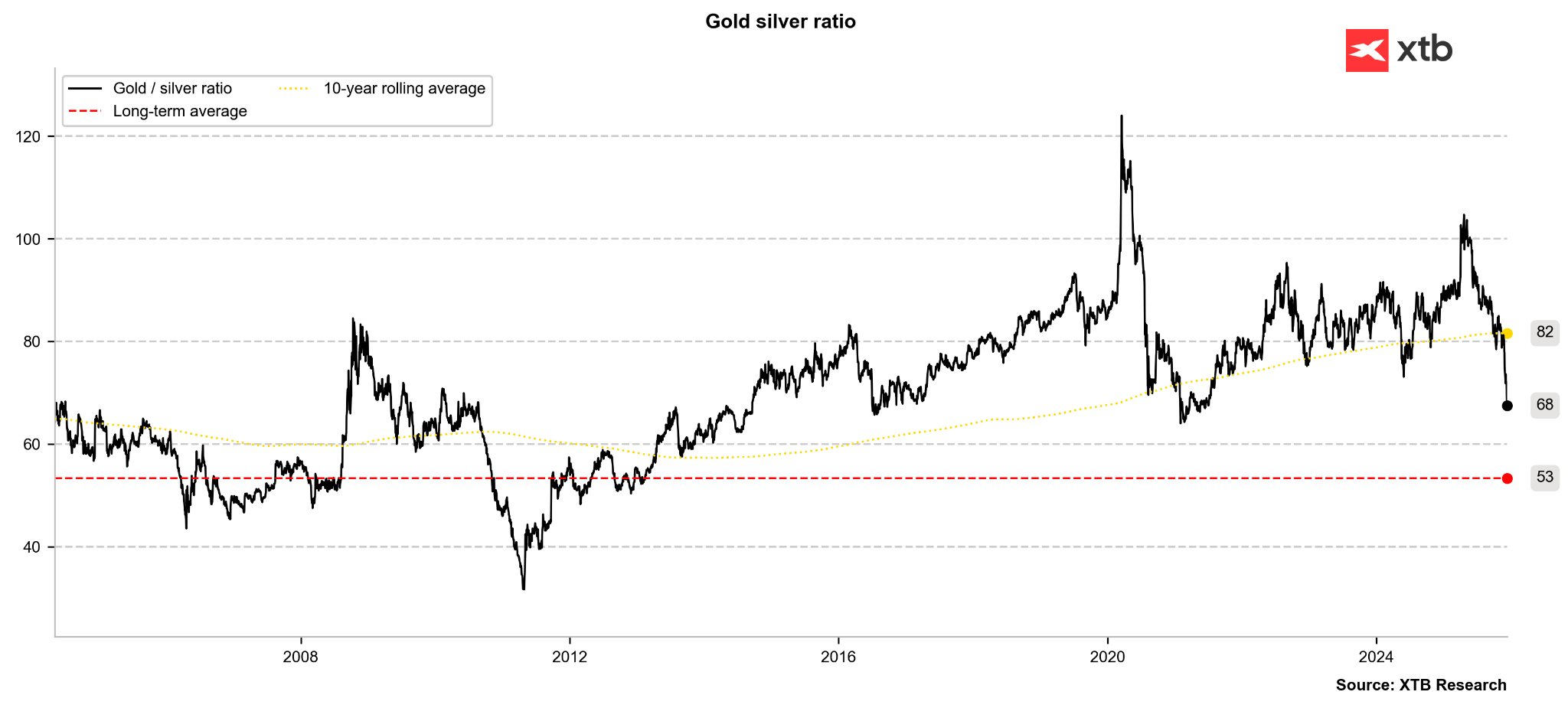

The gold-to-silver price ratio is experiencing a similar dynamic decline to that seen in 2020. The ratio itself is at its lowest level since 2021. If it were to fall to the long-term average of 53, it would imply a breakthrough above the $80 per ounce level. Source: Bloomberg Finance LP, XTB

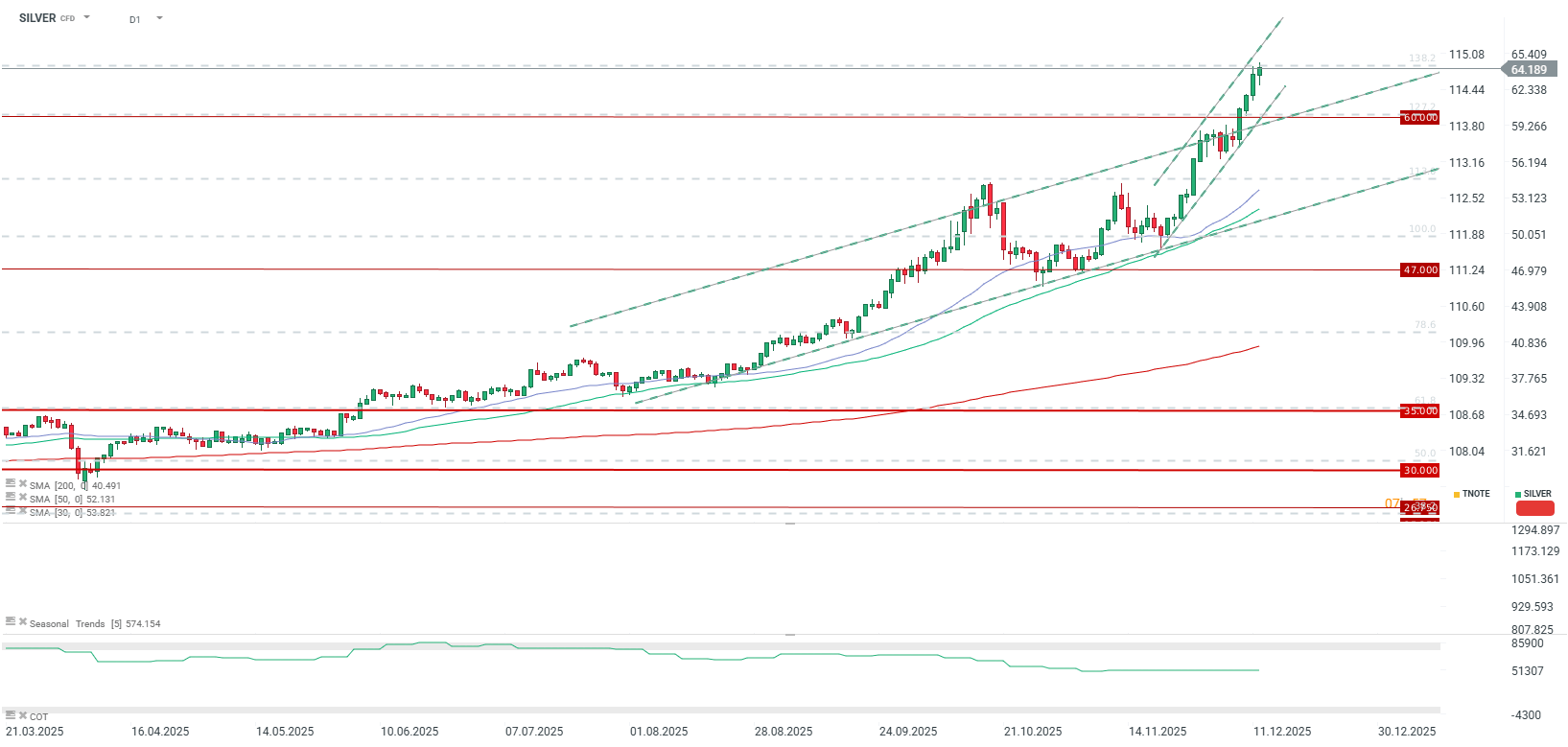

Silver marks its fourth consecutive day of gains, reaching the vicinity of potential technical resistance. Nevertheless, the $60 per ounce level could currently serve as strong support for the price. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.