Microsoft, Nvidia, and Anthropic have entered a strategic agreement that could significantly impact the artificial intelligence and cloud services market. Anthropic has committed to purchasing $30 billion worth of computing power from Microsoft Azure to develop its Claude models. Initially, the company will utilize up to one gigawatt of computing power based on Nvidia’s latest Grace Blackwell and Vera Rubin systems. Despite this substantial engagement with Azure, Anthropic remains an Amazon Web Services customer, providing greater flexibility and reducing operational risk. Previously, Amazon had invested around $8 billion in Anthropic.

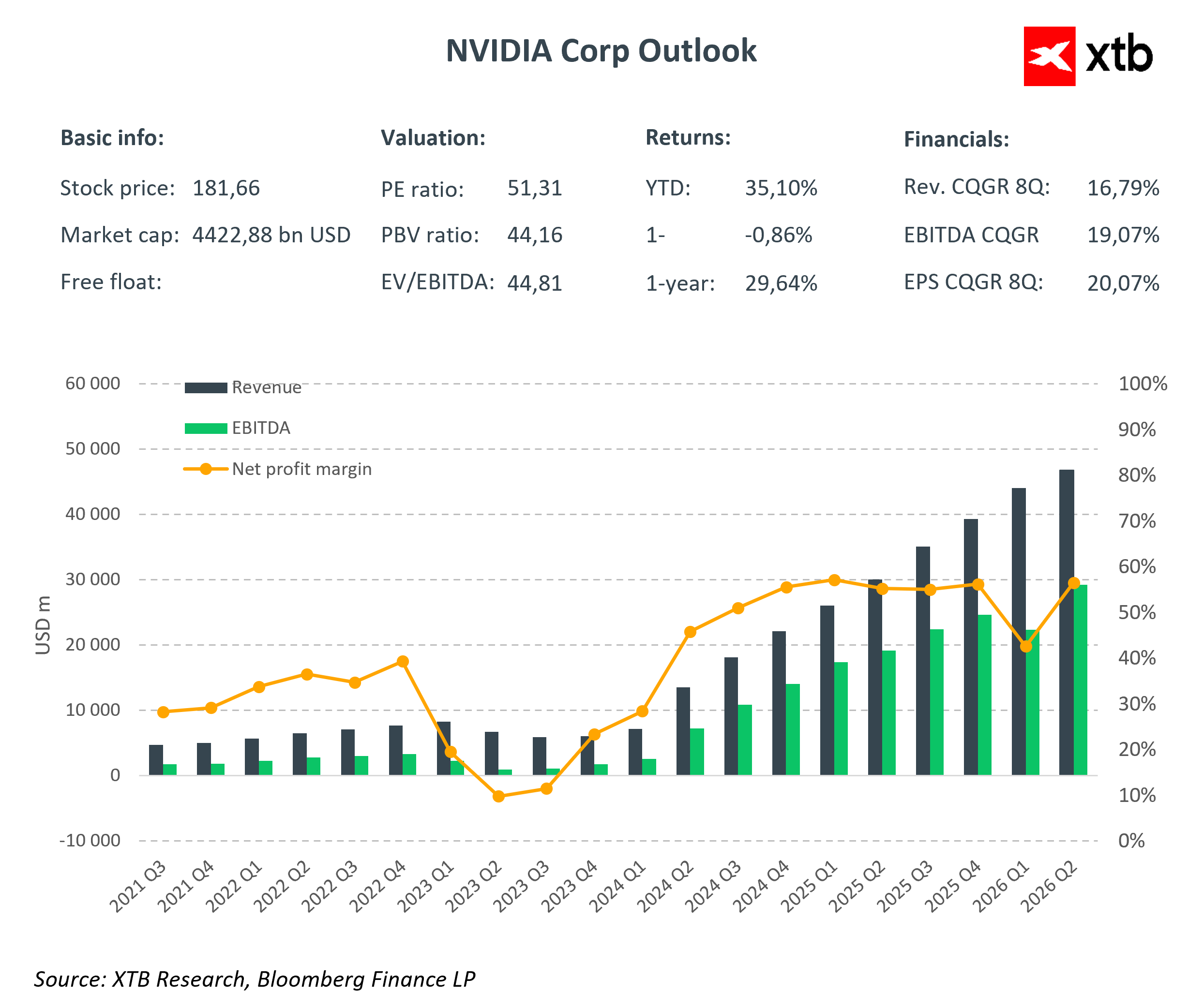

Under the agreement, Nvidia will invest up to $10 billion in Anthropic, while Microsoft will contribute up to $5 billion. The partnership also includes technological collaboration aimed at jointly designing and optimizing AI architecture. This ensures that Claude’s development is supported both financially and technologically, while simultaneously strengthening Nvidia’s and Microsoft’s positions in the rapidly growing generative AI sector.

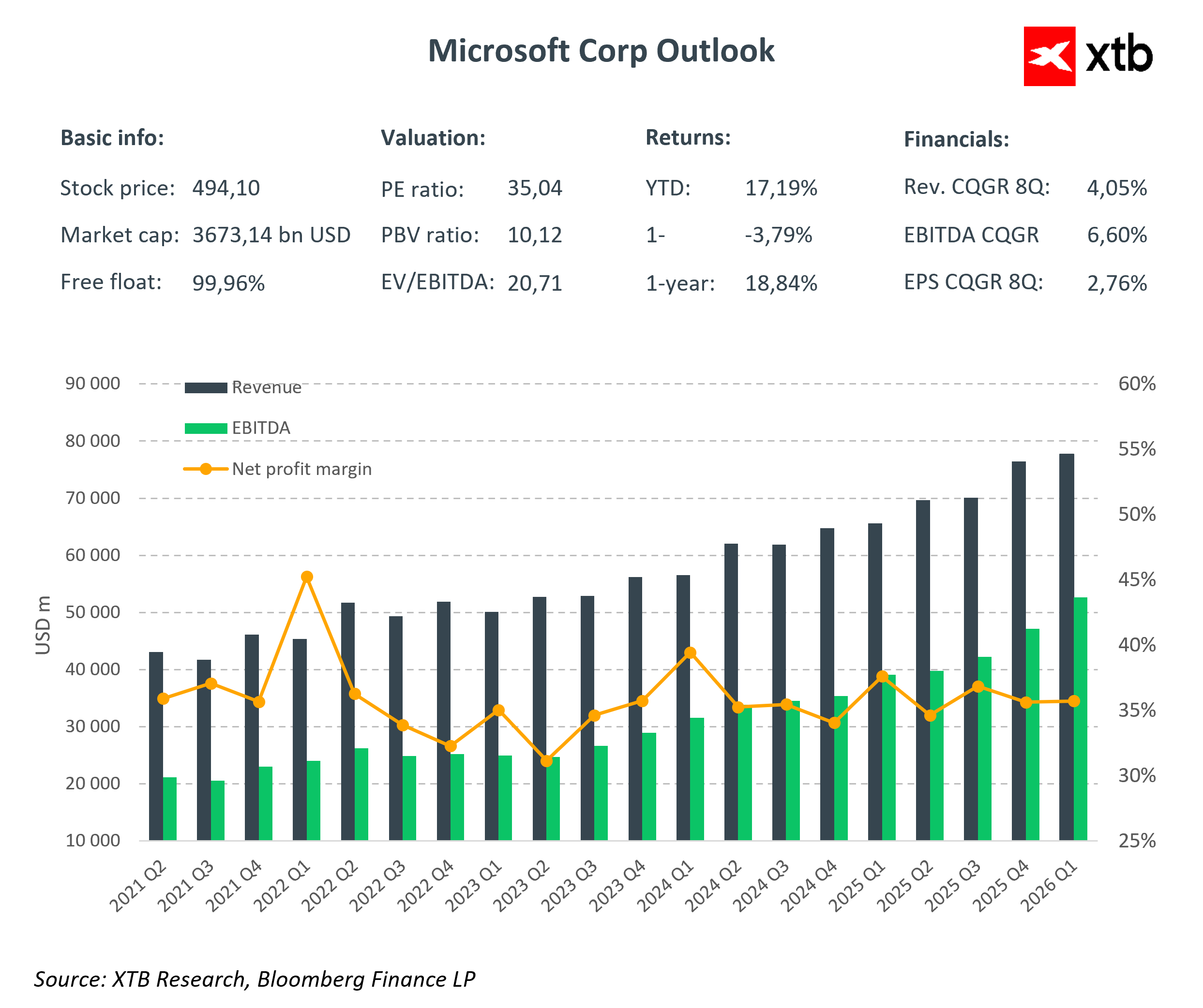

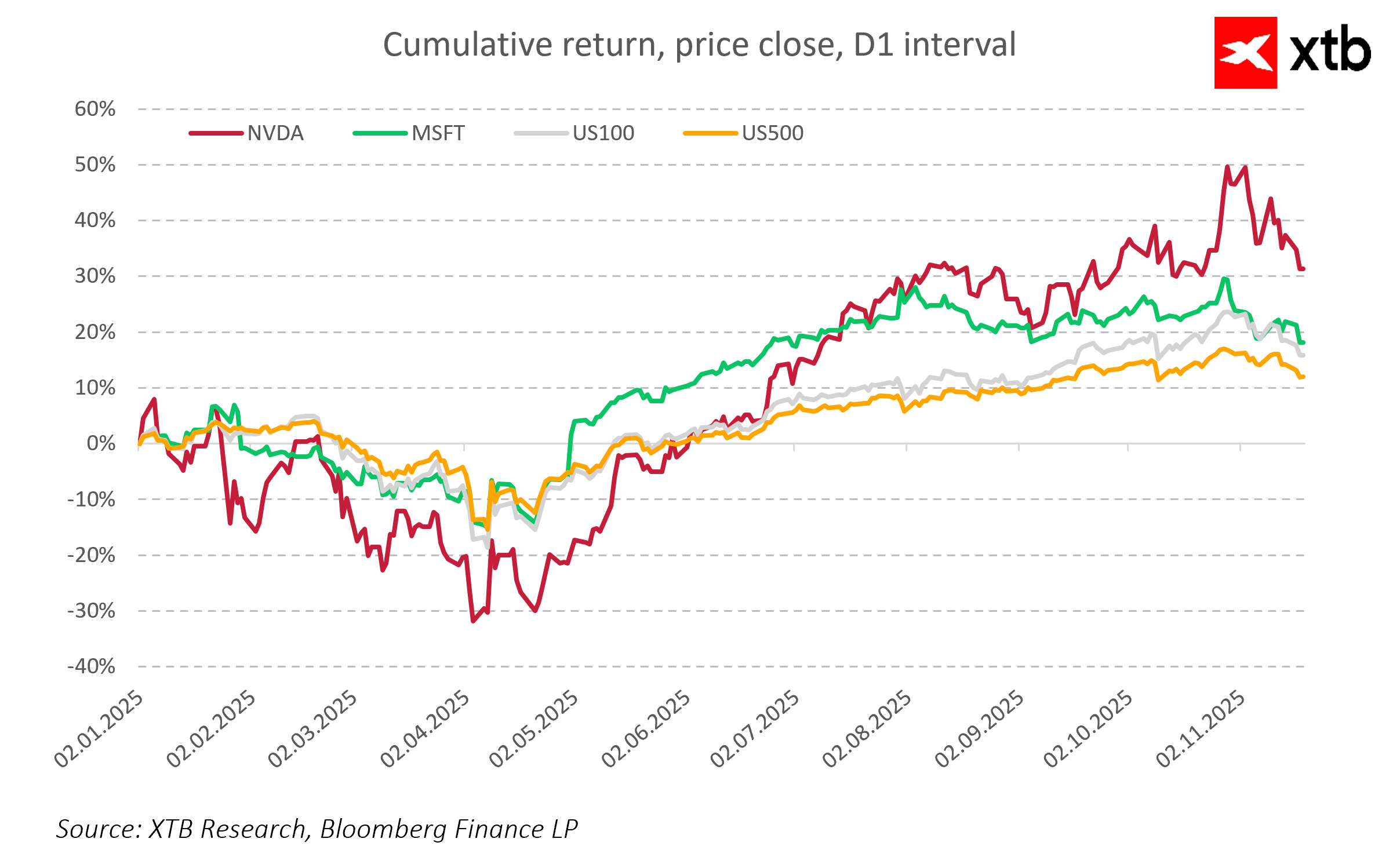

The scale of the initiative is enormous. AI infrastructure spending is expected to exceed $400 billion in 2025, with forecasts suggesting global expenditures could reach $3–4 trillion by 2030. Microsoft Azure is currently growing at a year-over-year rate of 39 percent, outpacing AWS’s growth of 17.5 percent. This underscores Microsoft’s increasing role as a key player in cloud computing and AI infrastructure.

For Microsoft and Nvidia, the deal secures access to cutting-edge technologies and a stable demand for their services and hardware. For Anthropic, it guarantees access to critical infrastructure and financing, enabling intensive development of Claude while maintaining its partnership with AWS, which enhances operational security. However, the company does not expect to achieve profitability before 2028, representing a significant financial risk.

Markets are also watching the move for signs of potential overexpansion in the AI sector. Experts point out that rising infrastructure investments could pressure financial performance if AI revenue growth does not keep pace with spending. The trend of mutual investments among companies may support short-term development but raises questions about the stability of the sector’s financial foundations.

In summary, the partnership between Microsoft, Nvidia, and Anthropic is reshaping the generative AI landscape. Markets may interpret it as a strengthening of Microsoft’s and Nvidia’s positions in cloud and infrastructure, while offering Anthropic an opportunity for faster technological advancement, albeit with ongoing financial and operational challenges.

Daily summary: Dollar loses ground after NFP; OIL.WTI at its lowest since 2021 💡

OIL.WTI loses 2.5% 📉

From Euphoria to Correction: CoreWeave and the Future of AI Infrastructure

EU Fines for Tech Giants — Their Role in EU/USA Competition

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.