US100 extends losses by another 2%, dipping below 25,000 for the first time since December 2025.

The tech sector is currently facing a sharp decline, primarily driven by a "buy everything" fatigue as the market transitions into a phase where not every artificial intelligence player is guaranteed to win. This sector-wide pressure was intensified by underwhelming first-quarter forecasts from Advanced Micro Devices (AMD), which saw its shares plunge 16%.

The weakness extended across the semiconductor and software landscapes, with Micron Technology falling 9%, Broadcom shedding 5%, and Oracle dropping 4%. Even leading infrastructure names like Nvidia and CrowdStrike have faced recent selling pressure. While Microsoft found some stability, the broader tech sector remains the S&P 500’s worst performer, down over 2% as investors await pivotal earnings from Alphabet and Amazon to determine the next trend.

Jobs data also weighs on the overall sentiment. The private payrolls rose only by 22,000 according to the newest ADP report, missing by a huge margin the expected 45,000. Moreover, the reading would be negative if it wasn’t for a surge in hiring in education and health services, with the previous month's downward revision further contributing to the shaky labour market outlook.

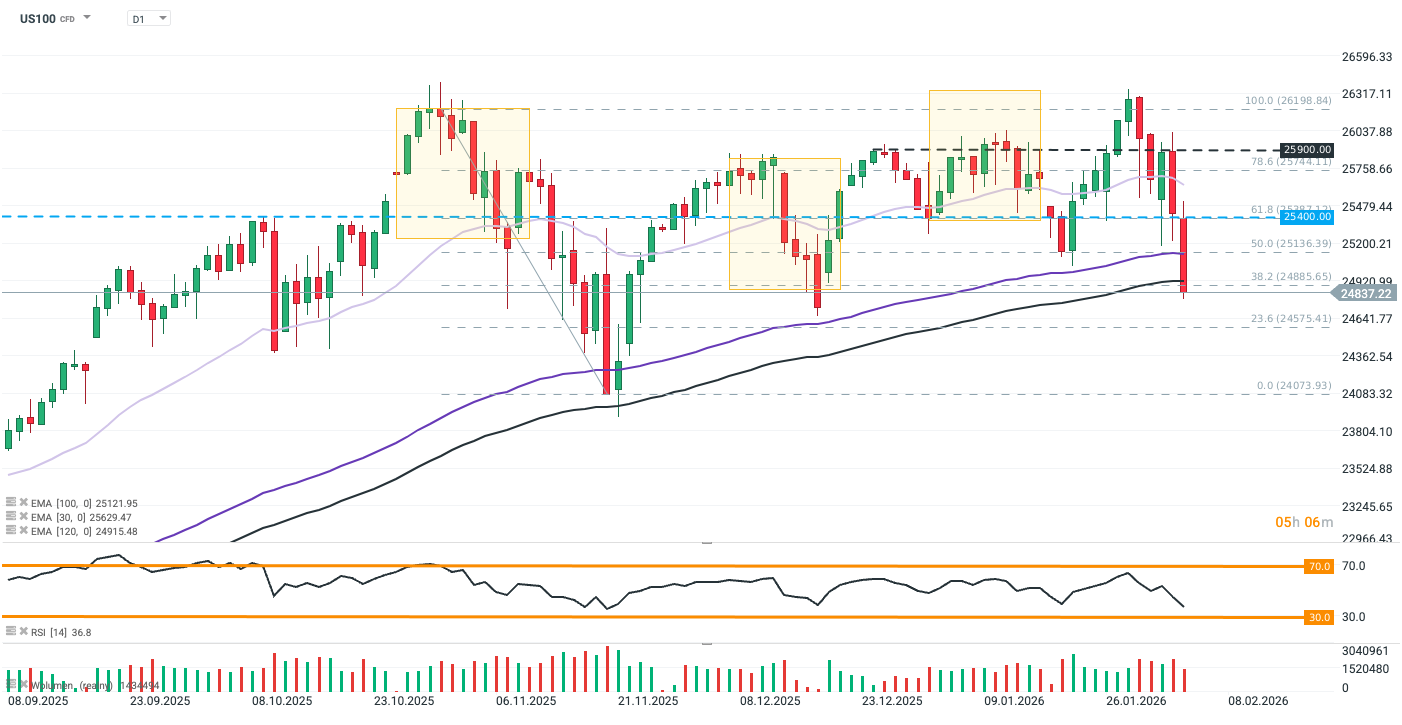

US100 (D1)

The US100 has entered a deeper corrective phase, suffering a sharp 2.3% drop. The index has decisively broken below the 50% Fibonacci retracement (25,136), which acted as support earlier in the day. Current price action is testing the 38.2% Fibonacci level (~24,885) and the long-term 120-period EMA (dark purple line), which now serves as a critical line in the sand for bulls.

A failure to hold 24,800 would likely trigger a slide toward the 23.6% Fibo (24,575) or even the psychological floor at 24,000. Recovery hinges on reclaiming the 25,130 level (100-day EMA). A failure to do so could confirm this breakdown as a structural trend change.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.