- Macroeconomic data shapes the market movements

- CPI and PMI data send market to its new All-time-high

- University of Michigan consumer sentiment below expectations

- Ford recovers some of the lost capacity

- Macroeconomic data shapes the market movements

- CPI and PMI data send market to its new All-time-high

- University of Michigan consumer sentiment below expectations

- Ford recovers some of the lost capacity

The session on Wall Street opens on a positive note following the accumulation of key macroeconomic data. The compilation of the latest PMI and CPI readings creates a mixed, yet still optimistic picture for the markets regarding the economic situation in the United States. This is sufficient to push the main indices towards new historical levels right at the start of trading. US100 contracts are up by approximately 0.8%, US500 is up by 0.6%. Contracts on the Russel2000 index are performing better, rising by 1.3%.

Today's session remains under the influence of macroeconomic readings. Consumer inflation turned out to be lower than expected, which strengthens the narrative of the Federal Reserve's progress in combating price pressure and increases the likelihood of faster and potentially deeper monetary policy easing.

At the same time, a very good PMI signals a solid condition of the economy, which may prompt the Fed to adopt a more cautious schedule for rate cuts, especially if economic activity maintains its pace without further deterioration in the labor market.

An additional piece of the puzzle is the University of Michigan consumer sentiment reading, noticeably weaker than forecasts, but still above the neutral threshold of fifty points, which can be interpreted as sustained, albeit cautious, optimism among households.

In such an environment, investors will closely monitor bond yields, the dollar, and sector rotation, as these indicators may point the market towards the final conclusion from today's data.

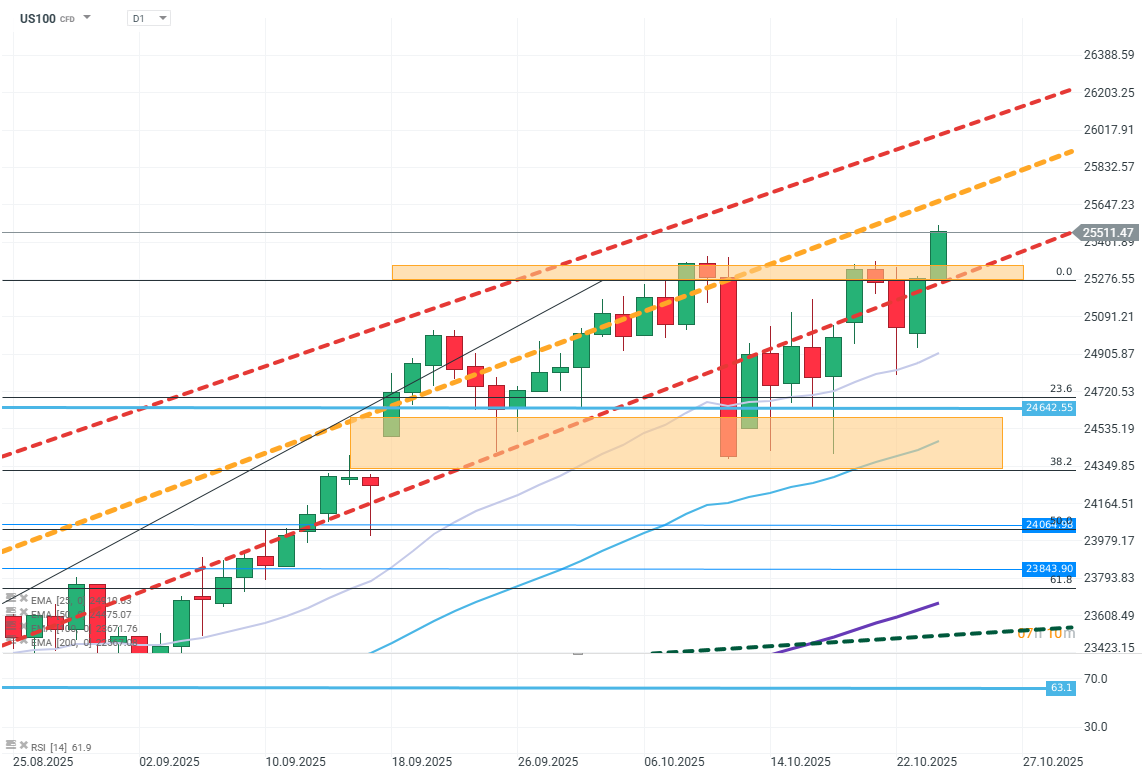

US100 (D1)

Source: xStation5

On the chart, a successful breakout of the peak can be observed after many attempts over the past week. The price defended the lower boundary of the upward trend, and the EMA averages indicate the continuation of the upward price direction. In the event of a temporary loss of initiative by buyers, the nearest support is at the level of 25270, determined by the last peak. Below, support can be observed at around 24720 where EMA25 runs and the FIBO level 23.6.

Company News:

Ford (F.US) — The automotive company is experiencing a huge increase, by as much as 9%. This is due to news from the company's management that the damage caused by the production halt at one of the company's plants will not be as deep and lasting as initially thought. The CEO assures that losses from this year will be recovered next year.

Alphabet (GOOGL.US) - Google and Anthropic have announced an expansion of their collaboration in cloud services. The new agreement is expected to provide AI access to approximately one million "Tensor" processors. Google shares are rising by about 3%.

Deckers Outdoor (DECK.US) — The footwear manufacturer is losing about 12% at the opening. This follows announcements by subsidiaries UGG and Hoka that net sales will be below market consensus.

Newmont (NEM.US) — The gold mining company announced that production will remain unchanged next year. This disappointed the market, which expected the company to take advantage of high commodity prices. As a result, the company is down by 6%.

Target (TGT.US) — The large US retailer announced a significant reduction in positions. Over 1800 positions, which constitutes 8% of the company's workforce. The stock remains unresponsive.

Kodiak Sciences (KOD.US) — The pharmaceutical company is up by as much as 15% at the session's opening, following a recommendation from JP Morgan. However, as trading continues, the stock erases most of the gains.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.