The final session of a turbulent week is opening on Wall Street in an uncertain mood. Investors received important inflation data today, but it still does not appear to be affecting valuations. Earnings season is still ongoing; however, shareholders seem to be placing greater weight on sentiment than on the data. The main U.S. indices are limiting moves to below 0.5%.

BlackRock data indicates that despite recent concerns about the quality and condition of companies benefiting from the AI revolution, retail investor inflows into funds investing in the technology sector are at record levels.

Donald Trump stresses the need for negotiations with Iran, but his actions suggest otherwise. The U.S. government will send another aircraft carrier to the Middle East along with an escort.

Macroeconomic data:

In the U.S., inflation data for January 2026 was published.

- Year-on-year inflation came in at 2.4% versus expectations of 2.5%. On a monthly basis, the reading was 0.2% versus expectations of 0.3%.

- Core inflation was in line with expectations at 2.5% year-on-year and 0.3% month-on-month.

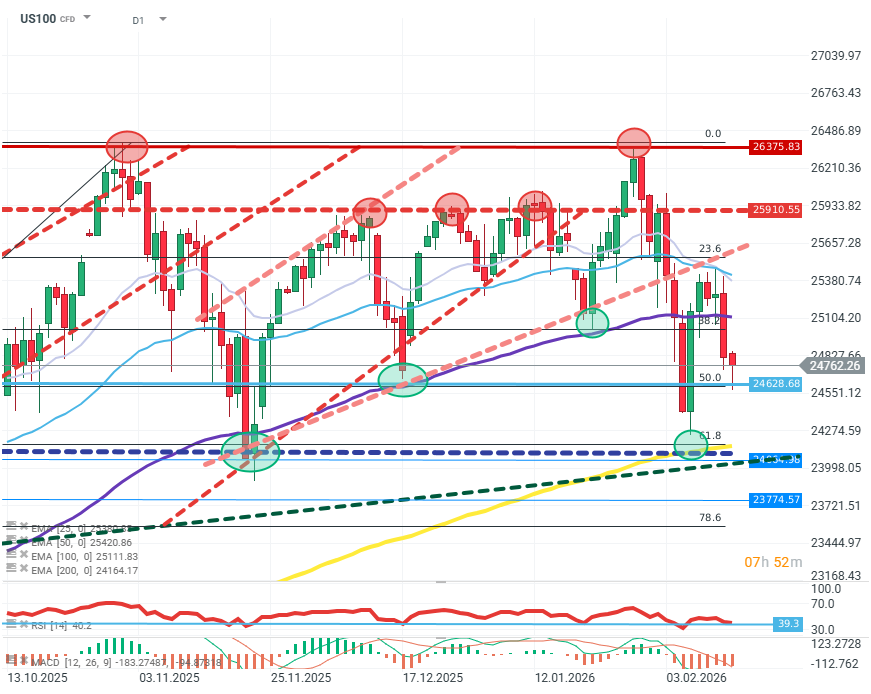

US100 (D1)

Buyers failed to reclaim levels above the 23.6% Fibonacci level, signaling weak demand and a gradual loss of momentum. For sellers, the main target is resistance at the 61.8% Fibonacci level, a break of which could open the way for a deeper correction. Before that happens, the 50% Fibonacci level must be overcome. Some support for price comes from the RSI, which has fallen close to overbought territory. Source: xStation5

Company news:

- Arista Network (ANET.US): The electronics manufacturer is up more than 6% after strong results. The company beat expectations on both earnings and revenue. Management stated that despite cost pressure from memory components, profit margins in the coming quarters remain unthreatened.

- Applied Materials (AMAT.US): The stock is up more than 10% after a clear beat versus market expectations during the earnings call and optimistic sales forecasts for the coming quarters.

- Pinterest (PINS.US): Shares of the social platform are down as much as 20% after disappointing results. Q4 results showed both EPS and revenue slightly below expectations, but it was pessimistic forward revenue guidance that weighed on valuations.

- Alibaba (BABA.US): The U.S. administration is considering adding Alibaba to the list of entities subject to export restrictions (1260H); the stock is down about 2%.

- Rivian (RIVN.US): The electric vehicle maker is up more than 20% after announcing sales forecasts for the company’s new car model.

IBM Goes Against the Tide: Three Times More Entry-Level Employees

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Amazon shares tumble 10% as investors recoil at the price of AI dominance

Daily summary: Red dominates on both sides of Atlantic

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.