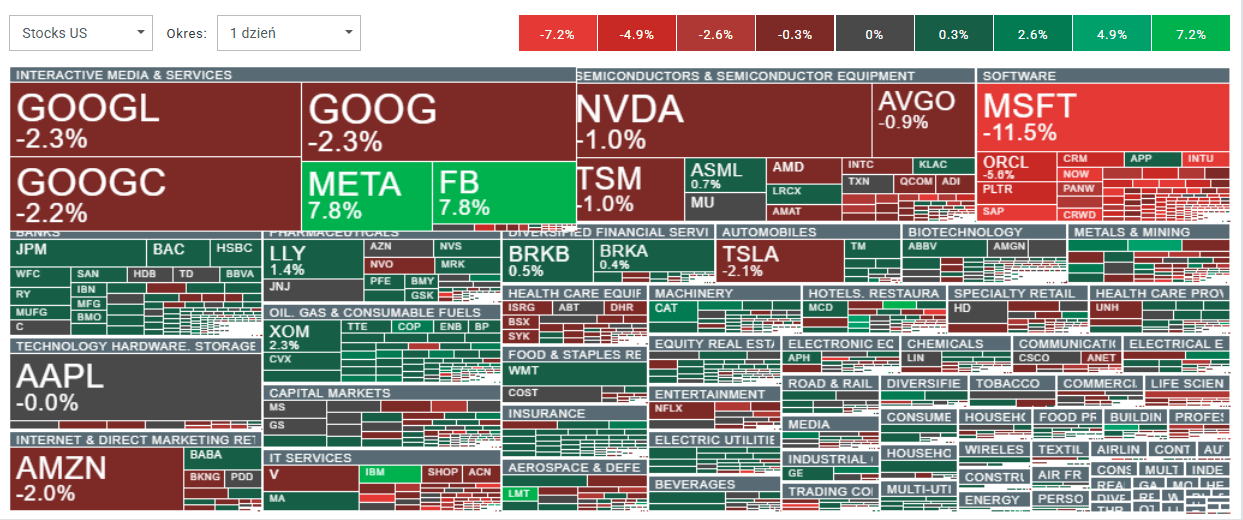

U.S. index futures opened the session in a sharply risk-off mood. A drop of more than 10% in Microsoft (MSFT.US) following its earnings is weighing heavily on sentiment and dragging major benchmarks lower — especially the US100, which is down close to 2%.

- Declines in the U.S. equity market are also weighing on cryptocurrencies. Bitcoin has fallen to around $86,000, while Strategy shares are down more than 6%.

- Analysts at Switzerland’s UBS raised their price target for Meta Platforms to $872 per share, up from $830 previously. Meanwhile, JPMorgan lowered its price target for Tesla to $145 per share, from $150 previously.

- Large losses are also visible across the software sector, where Microsoft’s sell-off is putting pressure on names such as Oracle, Palantir, Intuit, Salesforce, and ServiceNow. Big Tech is broadly weaker as well, with the exception of Meta Platforms: Amazon, Alphabet, and Tesla are down nearly 2%, while Nvidia is off about 1%. Apple (AAPL.US) is scheduled to report after today’s U.S. close; its shares are trading flat ahead of the release.

- On the macro side, U.S. factory orders rose 2.7% m/m, beating expectations of 1.3% and rebounding from -1.3% previously. December 2025 wholesale sales also increased by 1.3%, versus expectations for just a 0.1% rebound after -0.4% previously.

US100 (H1 interval)

Source: xStation5

The only notable gainers today are essentially Meta Platforms (META.US), IBM (IBM.US), and Lockheed Martin (LMT.US).

Source: xStation5

Microsoft plunges on AI CAPEX?

Microsoft shares slid 11% on 29 January 2026, wiping out several billion dollars of market value as investors fixated on two things: sky-high AI capex and signs of cooling cloud momentum.

-

The headline numbers were actually strong:

-

Revenue: $81.3B, up 17% YoY (ahead of expectations)

-

Adjusted EPS: $4.14 vs $3.93 expected

-

-

The cloud engine is still growing, but the market is picky about the “rate of change”:

-

Microsoft Cloud revenue: $51.5B, up 26% YoY

-

Azure growth: +39% (called out as a key driver)

-

-

The real shocker was the spending:

-

Capex jumped 66% to $37.5B

-

Roughly two-thirds of that went into AI GPUs and infrastructure

-

Result: operating margins compressed versus last year

-

Satya Nadella’s message was essentially: we’re early in the AI cycle, and Microsoft’s AI business is already big enough to rival some of its legacy franchises — and the company plans to keep pushing across the full AI stack. So this wasn’t a “bad quarter,” it was a valuation / patience test, so the numbers beat, but the bill for AI build-out is arriving now. Microsoft didn’t pretend the AI story is finished but it made a believable case that today’s spending has a clear path to payback. The bolatility can persist as long as capex stays elevated and margins are pressured. It's not only about the Microsoft but about the broader, software stocks sector. However, the long-term perspective is: if AI features become deeply embedded across Azure and Microsoft’s enterprise software, these investments can translate into durable growth and eventually rebuild investor confidence.

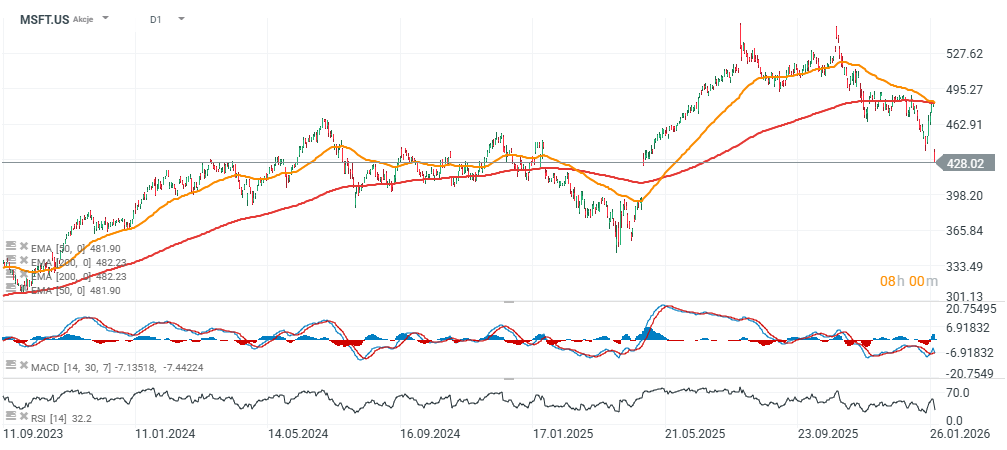

MSFT.US (D1)

Microsoft shares - the third-largest U.S.-listed company by market capitalization are down more than 10%. The current discount versus the EMA200 (red line) is now close to 15%.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.