- Tech stocks are leading gains at the start of the week.

- Alphabet is lifting the indices again with the launch of Gemini 3 and its new NATO contract.

- Rising risk appetite isn’t hurting defensive sectors such as healthcare and pharmaceuticals.

- Tech stocks are leading gains at the start of the week.

- Alphabet is lifting the indices again with the launch of Gemini 3 and its new NATO contract.

- Rising risk appetite isn’t hurting defensive sectors such as healthcare and pharmaceuticals.

US equities are extending Friday’s rebound, attempting to erase the recent sell-off that even strong Nvidia earnings failed to stop. Tech leads the move higher (US100: +2%, US30: +0.3%) as risk appetite is boosted by renewed hopes for a December Fed rate cut.

Rate-cut expectations jumped above 70% on Friday after comments from the New York Fed’s John Williams, who said monetary policy remains somewhat restrictive. Another dovish signal came today from Christopher Waller — considered a contender for Fed Chair — who cited labour-market concerns and voiced support for a December cut.

The return of dovish rhetoric is giving Wall Street fresh momentum, supported further by upbeat news from key tech names, including the release of Gemini 3, Alphabet’s latest AI model. The company also announced a multimillion-dollar cloud-services contract with NATO.

Big Tech is driving the rally, including the Magnificent 7 (Alphabet: +5.4%, Amazon: +2.5%, Tesla: +6.5%, Meta: +3.4%). Nearly the entire semiconductor sector is also in the green (Broadcom: +9%, AMD: +4%, Micron: +6.7%). Interestingly, today’s tech euphoria isn’t weighing on more defensive sectors like pharmaceuticals and healthcare (Pfizer: +1.1%, Merck: +3.5%). Source: xStation5

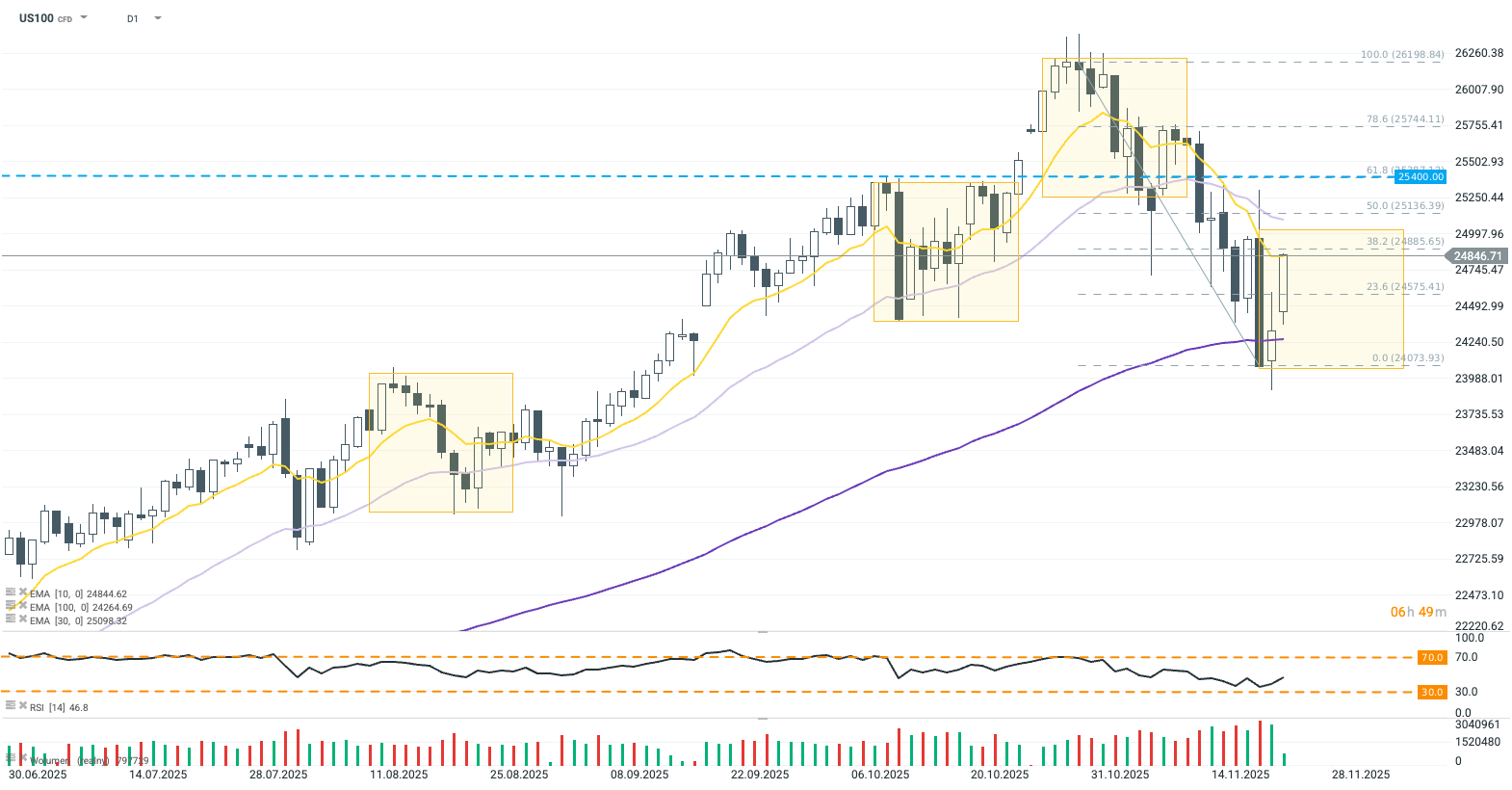

The US100 contract continues to climb despite already bullish opening. The index has broken above the 23.6% Fibonacci retracement and is pushing toward a test of the 10-day EMA (yellow), which roughly aligns with the 38.2% Fibo level and the upper geometry boundary. Erasing Thursday’s sell-off would open the door to a broader recovery on Wall Street, supported by neutral RSI. A rejection at the 10-day EMA, however, would signal growing investor caution ahead of the Fed decision. Source: xStation5

DE40: European tech and defence stocks sell-off

Constellation Energy and Three Mile Island — Nuclear Past and Future

US100 gains 1% before Nvidia earnings📈

US OPEN: All Eyes on Nvidia

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.