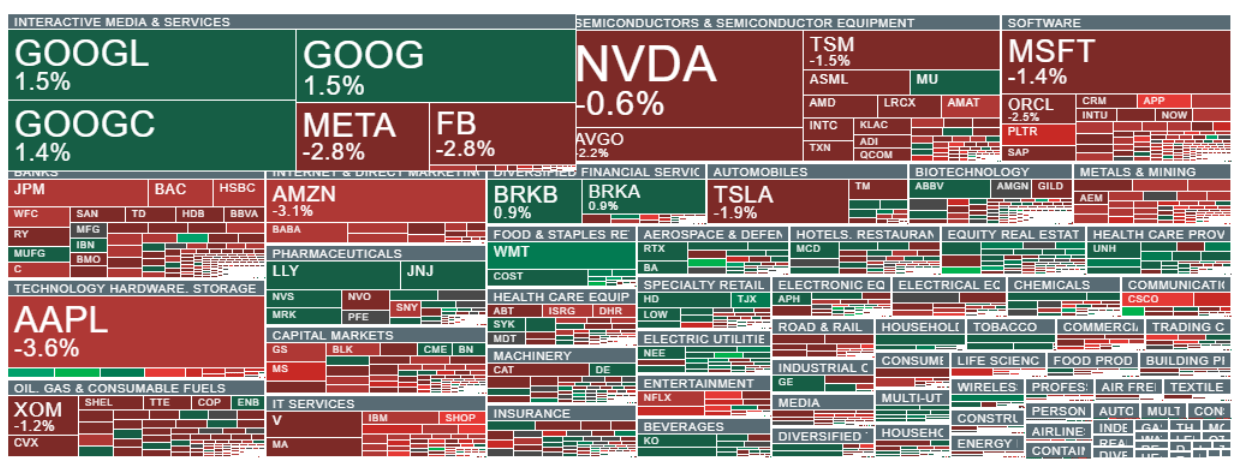

The mixed open in US indices has turned into a broader sell-off, with Nasdaq 100 (US100) futures down nearly 1.5%. While there is no single clear catalyst behind the move, several factors stand out.

- First, Google (GOOGL.US) is expected to release an updated Gemini 3 Deep Think model (Alphabet is also the only “Big Tech” name not falling today). A potential “success” of the release may amplify what markets have dubbed the “Anthropic effect”—a narrative that in recent days has driven selling across parts of the tech complex, particularly software. The market appears to be shifting from “what good can AI do for companies?” to “which companies can AI realistically disrupt?”, and price action suggests a “sell first, ask questions later” phase—especially across IT and SaaS-style business models.

- Second, Cisco delivered guidance for the current fiscal year that came in below expectations, overshadowing a solid quarter and partially undermining the idea that hardware names are automatic AI winners regardless of valuation. The move has also pressured peers, with Arista Networks (ANET.US) pulling back ahead of its quarterly report due after the US close today.

- Third, the latest US labor-market data have eased recession and slowdown fears, but at the same time they may reduce any urgency for rate cuts—potentially pushing the first meaningful easing window out to at least May. That is not necessarily supportive for Wall Street, which not long ago was positioned for a relatively aggressive easing cycle this year.

Finally, Goldman Sachs data published over the weekend suggested that CTA funds (systematic, trend-following strategies) are likely to be net sellers of US equities this week in virtually all scenarios (regardless of whether the S&P 500 rises or falls). In a continued downside scenario, their selling could accelerate further, adding a mechanical flow-driven headwind.

US100 (D1)

US100 has recently found support around the 200-day EMA. A renewed move toward 24,350 could point to a deeper correction and greater selling pressure. The 24,850 area remains a key support zone, defined by two prior price reactions—one in early December 2025 and the latest in early February 2026.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.