-

Start of U.S. bank earnings season: Major U.S. banks are reporting results at a crucial moment marked by the government shutdown and limited recent economic data. Analysts are expected to seek clues about the outlook for the U.S. economy.

-

Pressure on Net Interest Margin: The Federal Reserve’s rate cuts (-75 bps since last September) have reduced profitability in traditional lending and deposit activities. However, resilient economic growth and stronger home sales provide some support.

-

Rebound in Investment Banking and Trading: Investment banking revenues could exceed $9 billion, up 13% year-over-year, driven by a recovery in debt issuance and M&A activity. Trading divisions are expected to generate around $31 billion, roughly 8% higher than last year thanks to elevated market volatility.

-

Supportive environment from deregulation: The planned relaxation of capital rules could free up as much as $2.6 trillion in lending capacity, strengthening large Wall Street banks, enabling greater investment in AI and data centers, and allowing higher shareholder returns through dividends and buybacks.

-

Start of U.S. bank earnings season: Major U.S. banks are reporting results at a crucial moment marked by the government shutdown and limited recent economic data. Analysts are expected to seek clues about the outlook for the U.S. economy.

-

Pressure on Net Interest Margin: The Federal Reserve’s rate cuts (-75 bps since last September) have reduced profitability in traditional lending and deposit activities. However, resilient economic growth and stronger home sales provide some support.

-

Rebound in Investment Banking and Trading: Investment banking revenues could exceed $9 billion, up 13% year-over-year, driven by a recovery in debt issuance and M&A activity. Trading divisions are expected to generate around $31 billion, roughly 8% higher than last year thanks to elevated market volatility.

-

Supportive environment from deregulation: The planned relaxation of capital rules could free up as much as $2.6 trillion in lending capacity, strengthening large Wall Street banks, enabling greater investment in AI and data centers, and allowing higher shareholder returns through dividends and buybacks.

Today marks the start of earnings presentations for the U.S. banking sector, at a crucial moment, now more important than ever due to the government shutdown. Given the lack of published economic data in recent weeks, analysts are expected to take this opportunity to ask about forecasts and possible clues regarding the U.S. economy. What can we expect from banks this quarter?

Net Interest Margin

This is the classic source of income for banking institutions and the most important item on their income statements: the bank earns interest on the loans it grants (mortgages, consumer loans, corporate loans) and pays interest on the funds it raises (deposits, debt, other liabilities). The difference between what it receives from interest-bearing assets and what it pays for its liabilities is the net interest margin. This line item tends to be the most stable, and often the largest, in commercial banks.

The difference between the 2-year and 10-year U.S.Treasury yields. Source: XTB

In last quarter’s earnings presentations, net interest income raised some concerns, falling short of market estimates in most cases. Particularly worrying were the figures from Wells Fargo, an institution less tied to other sources of income such as fees or investment banking, and more dependent on traditional commercial banking activities. We do not rule out that this trend may continue. The Federal Reserve already cut interest rates by 50 basis points in September of last year and by another 25 basis points just a few weeks ago, leaving less room to generate higher income in this category.

Even so, the U.S. economy continues to show resilience, and both economic growth and home sales have surprised to the upside in recent weeks, offering some hope of improvement in this area.

Investment Banking

Revenues from the investment banking divisions of Wall Street’s largest banks are expected to surpass $9 billion in the third quarter for the first time since 2021. Corporate transactions have shown signs of growth under the Trump administration after months of subdued activity caused by the trade war.

Analysts expect that the quarterly revenues reported this week from advisory and equity/debt underwriting activities at JPMorgan, Bank of America, Citigroup, Goldman Sachs, and Morgan Stanley will total around $9 billion.

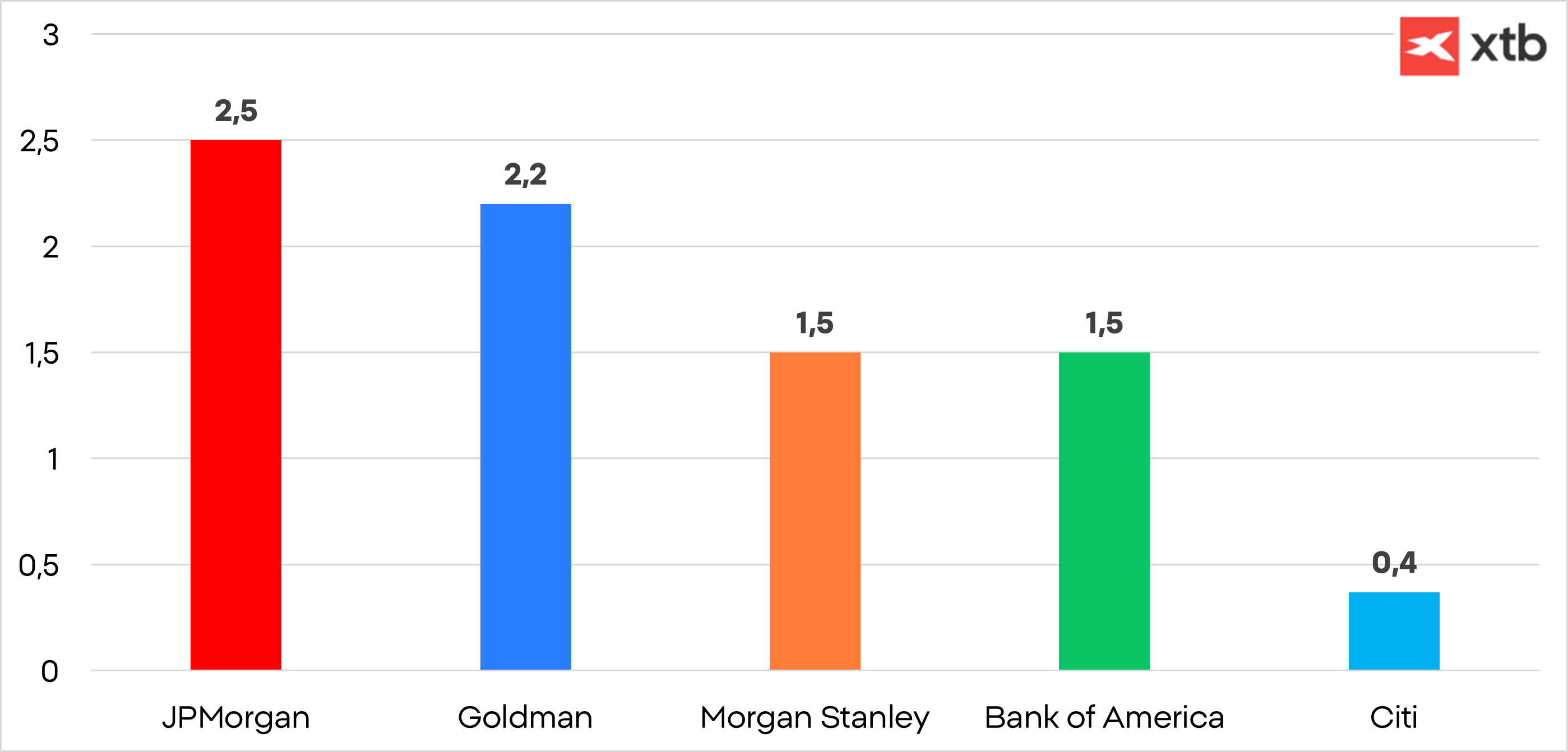

Investment banking results for the second quarter of the year. Source: XTB.

That would represent a 13% increase compared to last year, with Goldman Sachs and JPMorgan expected to lead this growth. In fact, in the previous quarter, these two were the biggest positive surprises, beating the most optimistic estimates. Debt issuance rose 12%, and M&A advisory fees climbed 8%, both defying analysts’ expectations of a year-over-year decline. Equity underwriting revenues fell 6%, while analysts had forecast a 29% drop The outlook for the third quarter reflects growing optimism on Wall Street that the surge in new corporate acquisitions, leveraged buyouts, and stock listings predicted after Donald Trump’s return to the White House may now be materializing..

Trading

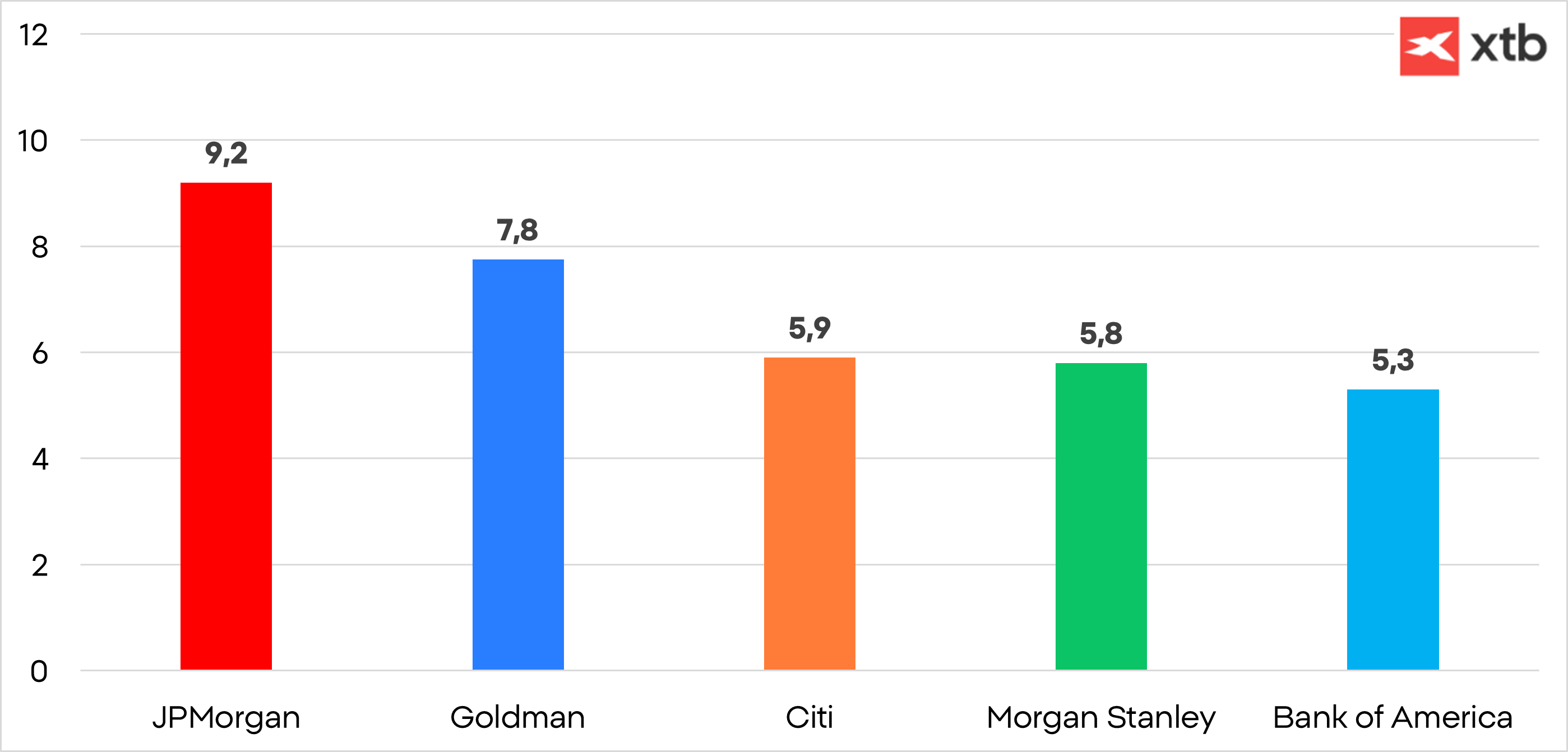

Trading divisions have generated higher-than-expected revenues over the past few years, particularly in the last quarter, thanks to the high market volatility resulting from Donald Trump’s trade policies However, forecasts suggest that equities and fixed-income trading operations in the five major banks will be about 8% higher than a year earlier, totaling around $31 billion.

Earnings generated from trading activities in U.S. financial institutions. Source: XTB

Deregulation

U.S. banks are preparing for unprecedented capital rule relaxation, which, according to new research, could free up $2.6 trillion in lending capacity.

The reduction in capital requirements will reinforce the dominant position of the large Wall Street groups, increase their ability to finance massive investments in artificial intelligence and data centers, and allow them to return more capital to shareholders through buyback programs and dividends.

It will also help finance new U.S. government debt issuances, at a crucial time when demand from foreign buyers has fallen — a factor that has been used as leverage in the ongoing trade negotiations.

With all these factors combined, we expect a positive earnings season, especially for those institutions with greater exposure to investment banking and trading activities.

How to Invest in the Sector

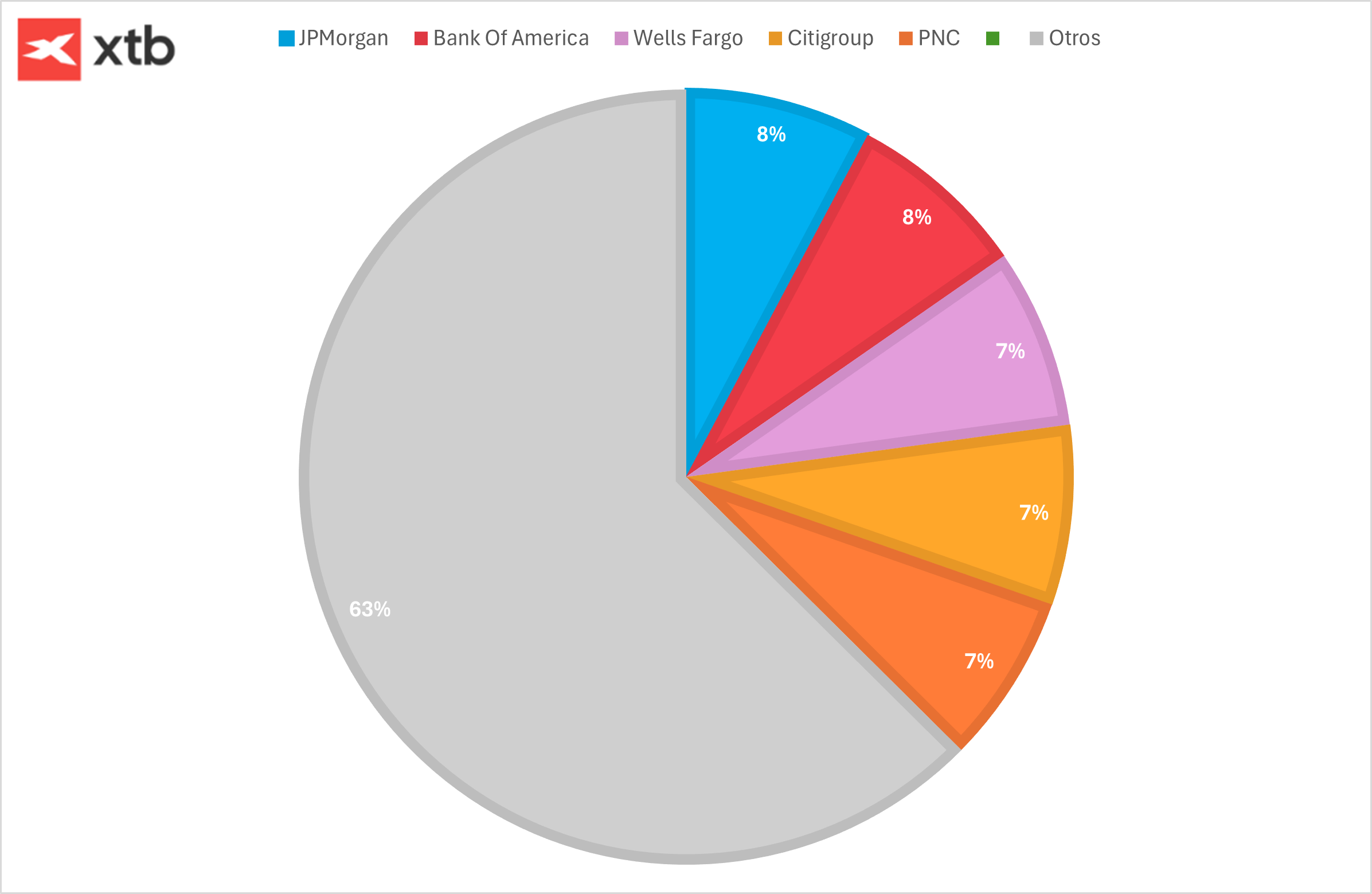

Clients can invest in individual stocks like the ones mentioned above, or alternatively through an ETF that replicates the overall performance of the sector.

In this case, one option is the S&P U.S. Banks ETF (ticker: IUS2.DE), whose main holdings include Citigroup, Bank of America, JPMorgan, and PNC.

BREAKING: Ifo business expectations drop unexpectedly 📉 🇩🇪 DE40 ticks down

Economic calendar: Ifo survey, Eurozone inflation and FOMC speaks (17.12.2025)

BREAKING: UK inflation drops more than expected 🇬🇧 📉 GBPUSD dips 0.2%

BREAKING: October U.S. Retail Sales: Strong Core Growth, Overall Flat. EURUSD rises!

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.