The problem with the commercial real estate market by some institutions like Wells Fargo and Morgan Stanley is seen as a systemic threat although it is not yet clear whether it is really escalating to such a scale. According to Green Street data, the value of commercial real estate in the U.S. has already fallen by 25% year-on-year, and vacancy rates are also rising:

- Brookfield (BN.US) and Blackstone (BX.US) funds have significant exposure to the commercial real estate situation. Blackstone will report results tomorrow, before the market open;

- Brookfield has already defaulted on nearly $161 million in obligations for office buildings in Washington (DC), due to vacancy but is still pursuing a deal;

- Previously valued at about $784 million, the fund's problems involved properties in Los Angeles (777 Tower, Gas Company Tower), but now it is also affecting a dozen other office buildings;

- According to Bloomberg, Columbia Property Trust, Pacific Investment Management, as well as WeWork and Rhone Group are also having trouble paying off debt and meeting obligations.

Brookfield points out that 95% of its real estate portfolio is high quality properties and demand persists. At the same time, in the Washington metropolitan area, commercial real estate prices are down 36% y/y, and compared to the pre-pandemic period, only 43% of the region's workers need to go to the office at least once a week according to Kastle Systems. Remote work is also popular in other US states. Among the 12 largest office properties in the Brookfield portfolio, occupancy real estate rate in 2022 was 52% compared to 79% in 2018. At the same time, its monthly variable mortgage interest rate rose to about $880,000 in April from just over $300,000 in 2021.

Will CRE affect banks?

- OakTree estimates that banks in the U.S. hold about $1.8 trillion of the $4.5 trillion in outstanding mortgages (about 40 percent), and commercial real estate (CRE) loans account for about 8 to 9 percent of the average bank's assets (not counting any share of commercial mortgage-backed securities);

- Given the leverage of the banking industry, its approximate equity is about $2.2 trillion so a 9% share of assets would mean up to 100% equity which could herald the 'undercapitalization' of many banks;

- According to the BofA report, the average large bank has almost 50% of risky capital in CRE loans, a much larger exposure to smaller banks - up to 167%. According to OakTree, the average CRE exposure is 4.5% of assets for banks over $250 billion and over 11% for banks under $250 billion;

It is still unclear to what extent the problem may affect the financial system - under each mortgage there may have been sufficiently high borrower collateral (LTV) to absorb the losses - it would be crucial to know the terms on which the loans were made. Additionally, defaulted loans could be negotiated and restructured.

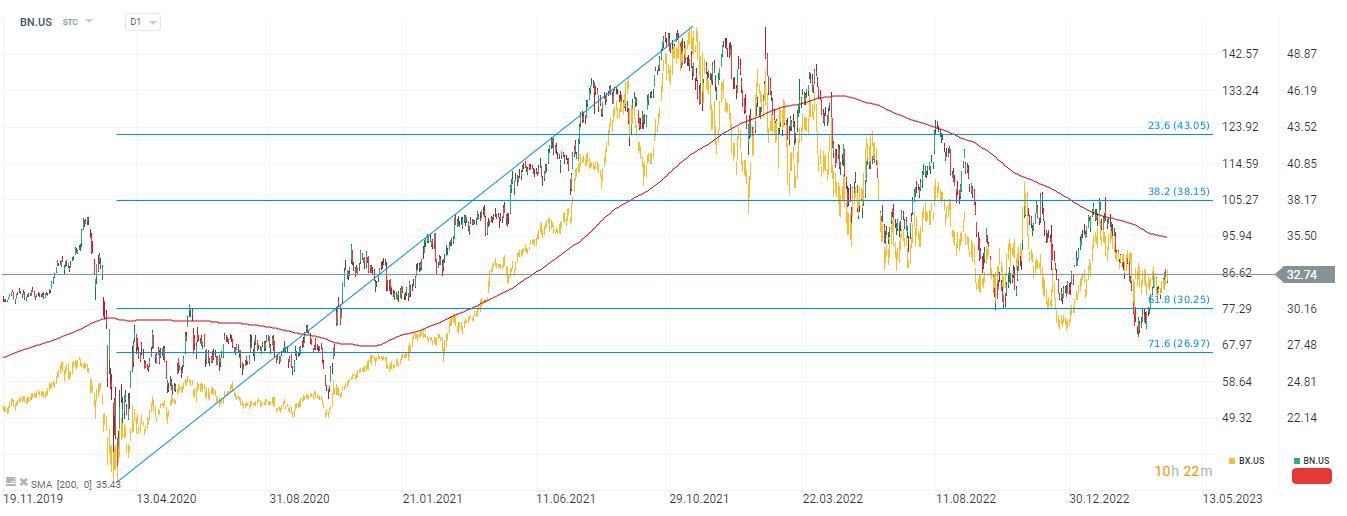

Shares of Brookfield Corp (BN.US) and Blackstone (BX.US), yellow chart. The shares of both companies are moving in a very simmiliar price pattern. Source: xStation5

Shares of Brookfield Corp (BN.US) and Blackstone (BX.US), yellow chart. The shares of both companies are moving in a very simmiliar price pattern. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.