-

WTI crude rose over 2% toward $59 per barrel, driven by expectations that a potential US-India deal will restrict Russian oil imports, increasing demand for other sources.

-

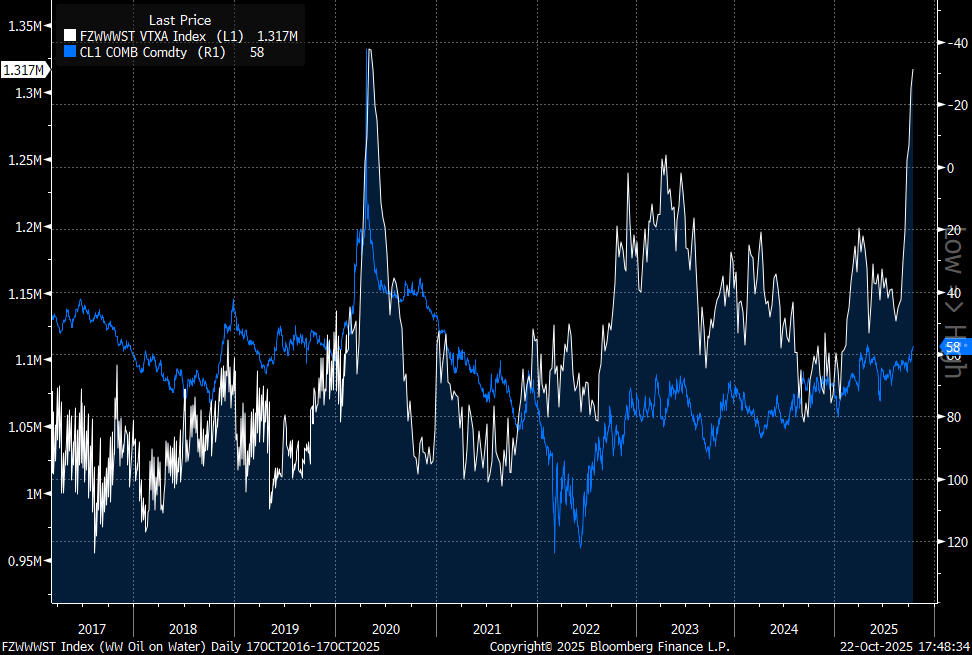

The market continues to face an oversupply: $1.3 billion barrels of oil are currently at sea (the highest level since 2020). Banks expect the surplus to persist into next year.

-

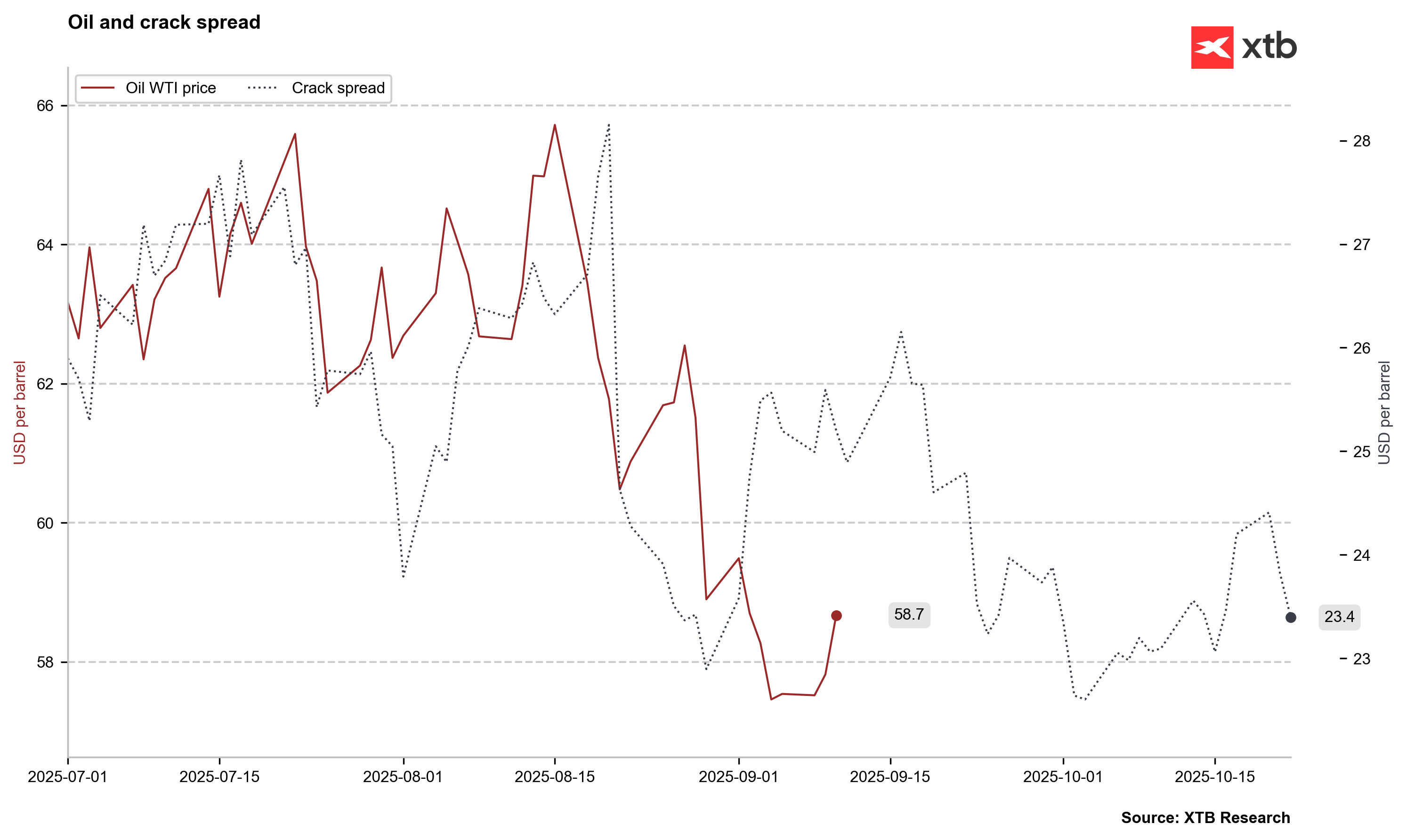

$59 is the key technical resistance, while the crack spread indicator suggests no demand surge should be expected in the US in the coming month.

-

WTI crude rose over 2% toward $59 per barrel, driven by expectations that a potential US-India deal will restrict Russian oil imports, increasing demand for other sources.

-

The market continues to face an oversupply: $1.3 billion barrels of oil are currently at sea (the highest level since 2020). Banks expect the surplus to persist into next year.

-

$59 is the key technical resistance, while the crack spread indicator suggests no demand surge should be expected in the US in the coming month.

Oil prices are rallying by over $2\%$ today, pushing West Texas Intermediate (WTI) crude towards the $59 per barrel level. This surge is linked to a potential agreement between the United States and India aimed at reducing Indian imports of Russian oil. Such a scenario would create a challenge for Russian crude in finding a market outlet, thereby increasing demand for oil from alternative destinations, specifically OPEC nations and the US.

Nonetheless, the market is facing a significant potential supply glut, evidenced by the largest volume of oil on the water since 2020. Currently, an estimated $1.3 billion barrels of crude are held in tankers, either moving or at anchor. According to projections from major institutions like JP Morgan and Goldman Sachs, the oil market should anticipate sustained oversupply into the coming year. JP Morgan suggests that maintaining a price floor of $48 per barrel will be crucial, as this level currently represents the break-even point for cash flow from oil extraction.

The leading indicator for oil, the crack spread (the differential between crude and petroleum product prices), remains at a relatively low level compared to recent months but is concurrently very high against historical standards. However, the 30 day forward spread suggests that a significant increase in US demand is unlikely in the immediate future.

The volume of oil at sea is currently the highest since 2020, indicating a persistent, massive oversupply. Source: Bloomberg Finance LP, XTB

The crack spread suggests no excessive demand rebound should be expected in the US over the next month. Source: Bloomberg Finance LP, XTB

The crack spread suggests no excessive demand rebound should be expected in the US over the next month. Source: Bloomberg Finance LP, XTB

The price of crude oil is rebounding by more than 2% today, continuing the recovery observed since the beginning of the week. Ahead of the current price lies resistance in the form of the upper boundary of the descending trend channel, alongside the 23.6 Fibonacci retracement of the last decline. A decisive breach of the $59 per barrel level could potentially see the price rally toward the $61.5 per barrel area. Conversely, a close today below $58.5 could prompt crude to retreat and attempt to continue its downtrend. Source: xStation5

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.