Nvidia is introducing a breakthrough feature in its Blackwell chips, a location verification system that allows the company to determine in which country its processors are operating and helps prevent illegal exports to restricted nations. The feature is available as an optional software update and uses GPU telemetry and confidential computing mechanisms, enabling data center operators to monitor the status of their chips. This solution aligns with growing expectations from the US administration following uncovered attempts to smuggle H100 and H200 chips worth more than 160 million dollars into China in violation of existing export restrictions.

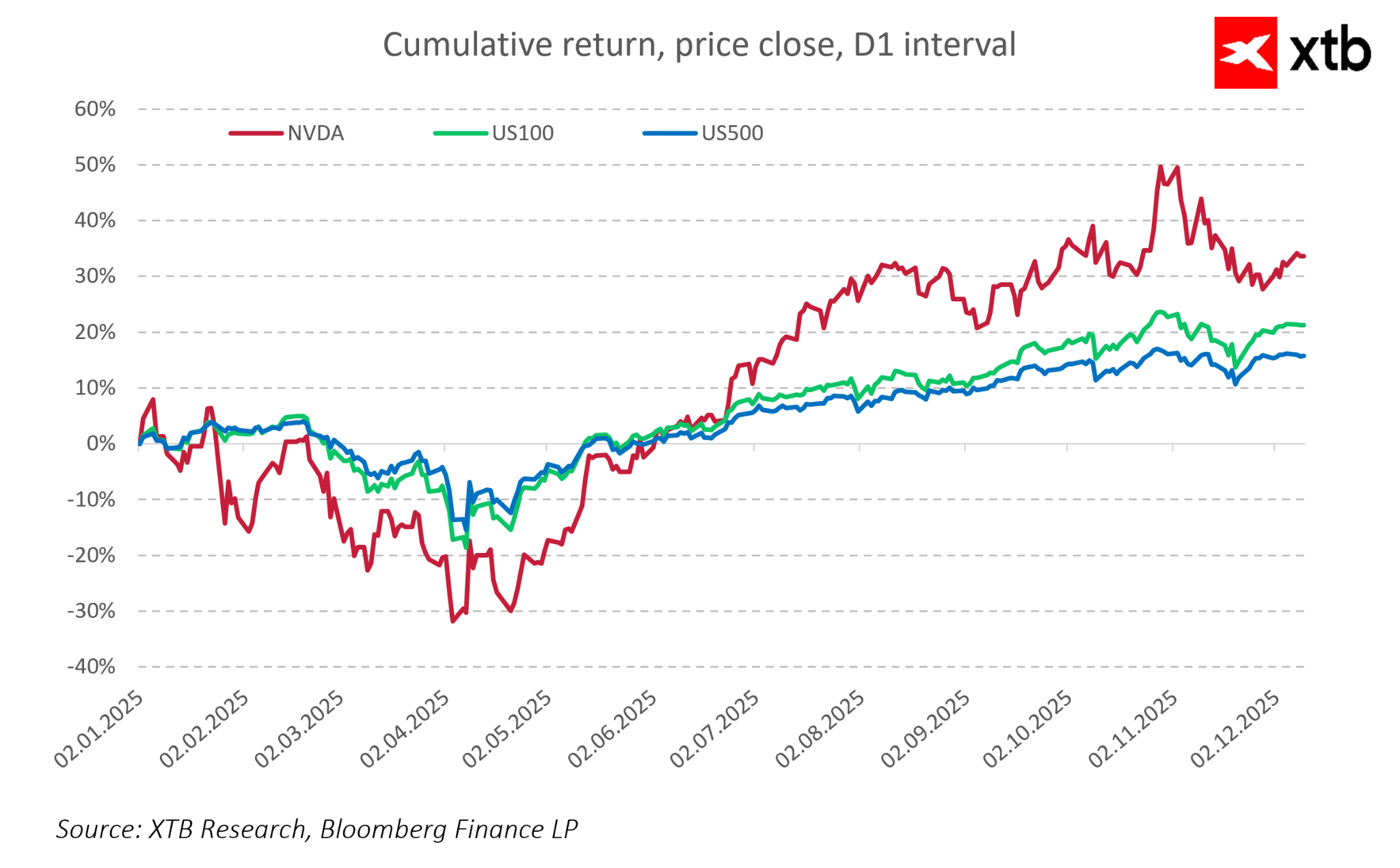

From a market perspective, the decision to implement location verification appears logical and desirable. It increases the transparency of high-end hardware distribution, strengthens oversight of exports and reduces the risk of uncontrolled movement of advanced processors. Markets may view this as a stabilizing factor for the supply chain and a measure that limits potential regulatory risks.

At the same time, countries such as China have long expressed objections to such mechanisms. Authorities in Beijing argue that monitoring features could potentially create opportunities for American government institutions to collect data, and that elements enabling external control of devices could, in their view, be embedded deep within the software code. These claims are not confirmed, but they remain a persistent part of China’s narrative regarding American technologies and influence the caution of local regulators and companies. This tension between security requirements and geopolitical suspicion may shape purchasing decisions and the level of acceptance for Nvidia’s technology in the Chinese market.

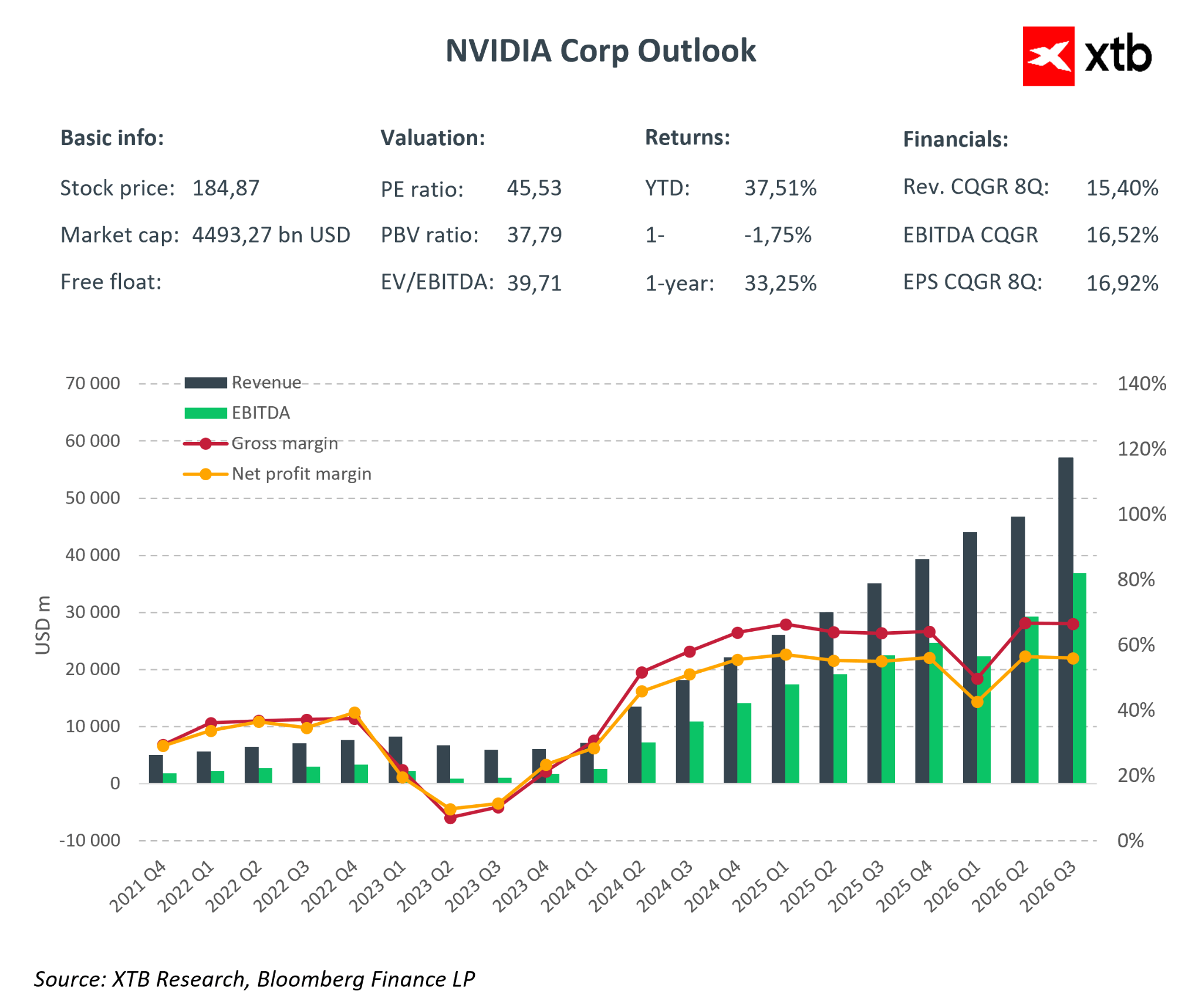

Meanwhile, the US administration has allowed Nvidia to sell older H200 chips to China, potentially reopening access to one of the largest markets for AI and data center technologies. For NVDA, this represents a visible catalyst that may strengthen revenues in the short and medium term and reduce some of the geopolitical pressures that have weighed on the company’s valuation in recent years. Nvidia gains an opportunity to regain parts of the market it previously lost due to export restrictions.

However, the situation is more complex than it appears. China may not be fully satisfied with access only to older chips and could limit or entirely block purchases of Nvidia’s most advanced products by local companies. In addition, the very introduction of monitoring features in the new chips may provoke further political pressure from Chinese regulators. In the longer term, the way the Chinese market responds to these new safeguards and to the restricted access to next-generation chips will be a critical factor shaping Nvidia’s sales potential in the region.

As a result, the market views the new verification system as a step toward greater stability and security in the export of advanced technology, while some recipient countries, particularly China, see it as a potential tool for external oversight. This growing tension between regulatory demands and geopolitical sensitivity creates an environment that may influence future demand dynamics and decisions on the use of Nvidia’s chips in the most sensitive parts of the market.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.