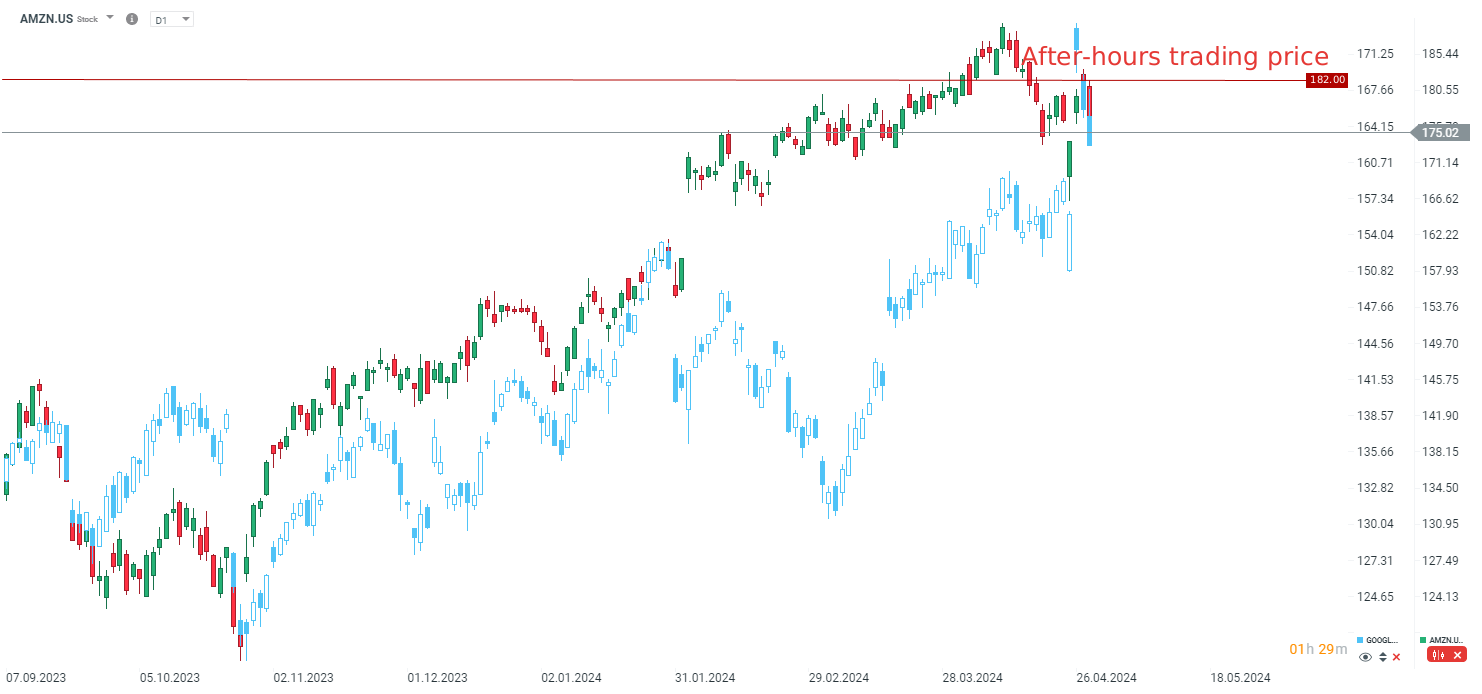

Amazon has shown very solid Q1 2024 results, once again surpassing analysts' expectations, both in terms of revenue and earnings per share (EPS). The company reported very good results for AWS cloud sales, but on the other hand, the company provided fairly conservative guidance for the next quarter. Despite this, the company's strong performance is leading to an increase in stock prices after the session, reminiscent of the situation with Microsoft and Alphabet's earnings releases. Both of these companies have (at least partially) similar businesses. Here is a summary of the key points and their impact on stock prices:

Positive aspects:

- Revenue: $143.3 billion, surpassing expectations of $142.6 billion. This is a significant year-over-year increase compared to $127.4 billion in Q1 2023.

- EPS: $0.98, surpassing expectations of $0.84. This is a significant jump compared to $0.31 in Q1 2023.

- Strong growth in all sectors: Online sales revenue increased as expected. AWS revenue also exceeded expectations, showing even stronger growth of 17% compared to the expected 14.7%. AWS revenue reached $25 billion. Advertising revenue is also on a growth trajectory, which may begin to generate a significant portion of revenue in the future.

- North American sales increased by 12% YoY to $86.3 billion.

- International sales increased by 10% to $31.9 billion, up 11% excluding currency impact.

- The company also plans to invest $750 million to ensure the security of its services.

Mixed signals:

- Q2 sales forecast: Amazon's sales forecast for Q2 of $144 to $149 billion falls short of analysts' expectations of $150.13 billion. However, mixed sales expectations take into account the negative currency impact.

- Operating income: Expected operating income range of $10 to $14 billion, when market expected $12.56 billion.

Amazon's Q1 2024 results were positive, indicating continued growth in all key areas of business. The company shows solid growth in the cloud segment and in the key sales segment. Of course, the company did not meet expectations for guidance, but it is worth noting that it cites currency exchange as the reason. Furthermore, in previous quarters, the company usually significantly exceeded its initial expectations. The company's stock gained 4.5% in after-hours trading.

The price has jumped in after-hours session. Source: xStation5

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.