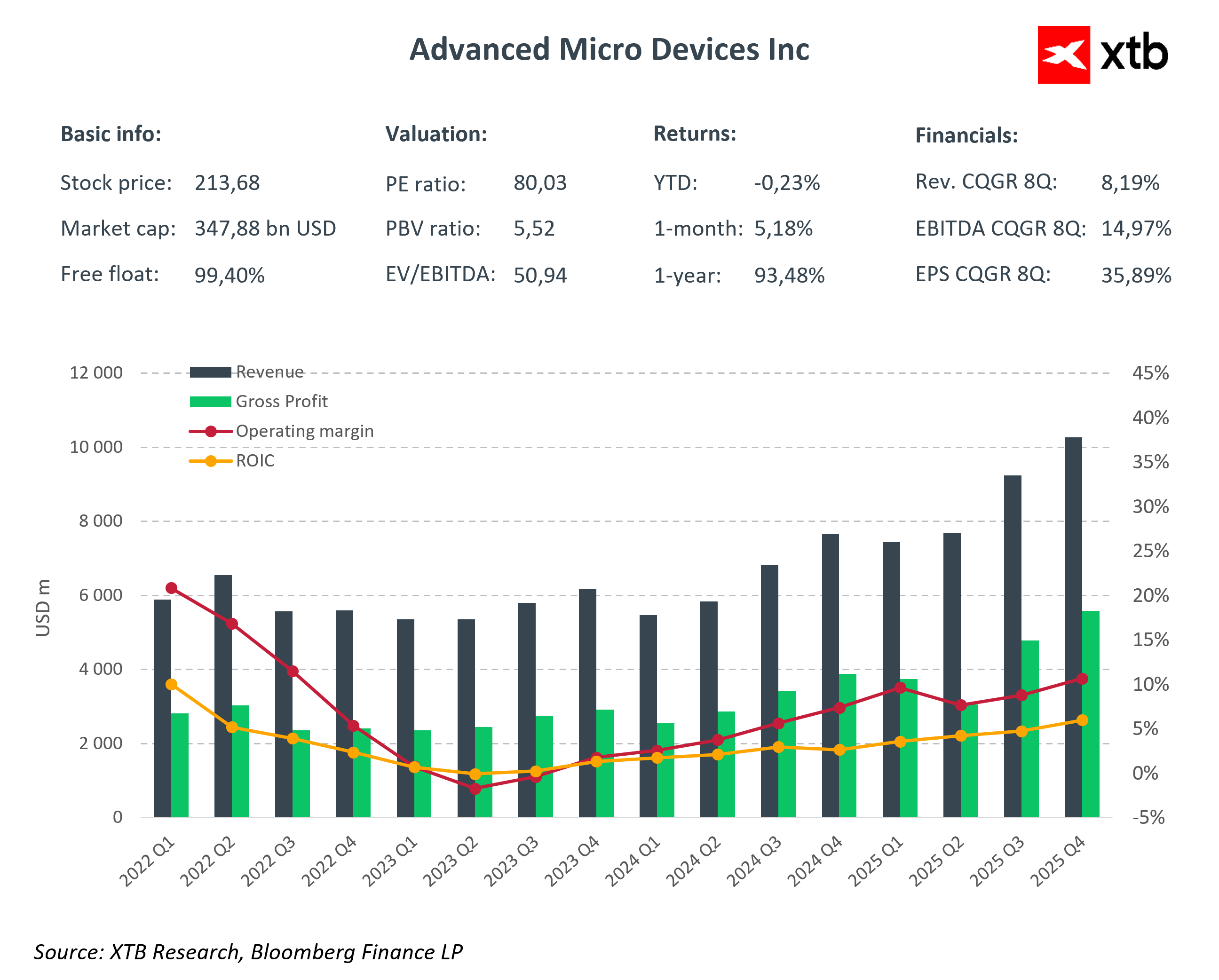

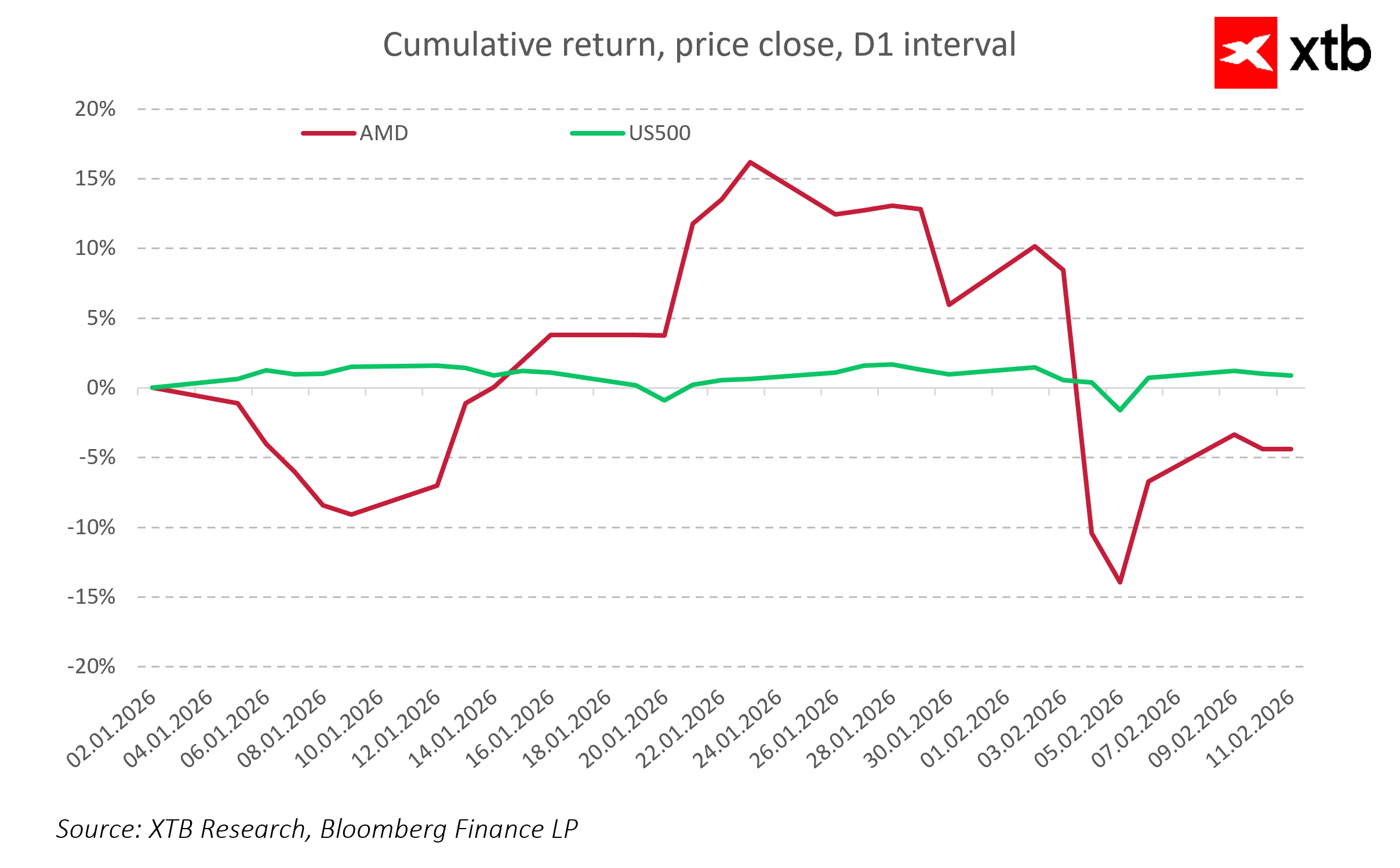

Advanced Micro Devices is increasing its involvement in India by partnering with Tata Consultancy Services to compete with Nvidia in the artificial intelligence infrastructure segment. The Helios project aims to support large AI workloads in enterprises and data centers by offering scalable infrastructure ready for large-scale operation. From a market perspective, AMD shares may react both to the potential benefits of expansion in the growing AI segment and to the risks associated with implementation costs and uncertainty about customer acceptance of the platform.

The new infrastructure allows companies to deploy advanced AI systems faster, but the success of the project depends not only on technology, but on the ability of TCS and AMD to effectively integrate and launch the systems in real-world conditions. The costs of building and maintaining such data centers are high, and competitors in India, most notably Nvidia, already have a strong position in this segment. As a result, markets may react cautiously, especially if the pace of implementation proves slower than expected or if there are difficulties in customer adoption of the technology.

In addition, AMD's expansion is taking place in the context of India's growing importance on the global AI scene. The country is attracting the attention of global technology leaders and politicians, and growing investment in local data centers and AI infrastructure shows that India is becoming a key strategic market. This means potentially greater opportunities for companies ready to quickly implement their solutions, but also risks associated with strong competition and growing market expectations.

For investors, the Helios project is an example of how leadership in the AI segment does not come solely from chips themselves, but from a comprehensive approach to large-scale technology implementation. In the coming quarters, it will be worth watching the pace of the project's implementation, customer response, and competition from Nvidia, as these factors will largely determine whether AMD's expansion will bring measurable financial results or become a costly experiment in the growing but demanding AI market segment.

US OPEN: Market under pressure from AI

Hollywood on Edge: Another Round in the Battle for Warner Bros.

Norwegian Cruise Line surges 7% amid disclosed Elliott Management 10% stake 📈

BHP Results, the Copper Market, and the KGHM Correction. What You Need to Know

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.