The first US session this week falls on Tuesday due to yesterday’s holiday. Investors seem at least slightly concerned. Valuation pressure stems mainly from worries about the condition of technology companies. Part of the market sees a serious threat to traditional business models, while others point to systemic risks related to excessive CAPEX. The situation is not helped by tensions remaining between Iran and the US, despite negotiations.

Futures on the main indices are down before the market open and shortly after the open. The biggest decliner is US100, down more than 0.6%, while the DOW futures are holding up best, with declines of around 0.3%.

Macroeconomic data:

- Canada’s January inflation was released. The reading came in below expectations, and the slowdown in price growth continues to deepen. Year-over-year CPI fell to 2.3%.

- ADP published the weekly change in employment in the US. The private reading suggests job growth of 10,300. This is an increase versus the turn of January and February, but the figure remains below average.

- The NY Empire State Index for the manufacturing sector beat expectations and fell to 7.1 from 7.7, versus an expected 6.4.

- The CB Employment Trends Index for January came in at 105 versus the previous reading of 104.27.

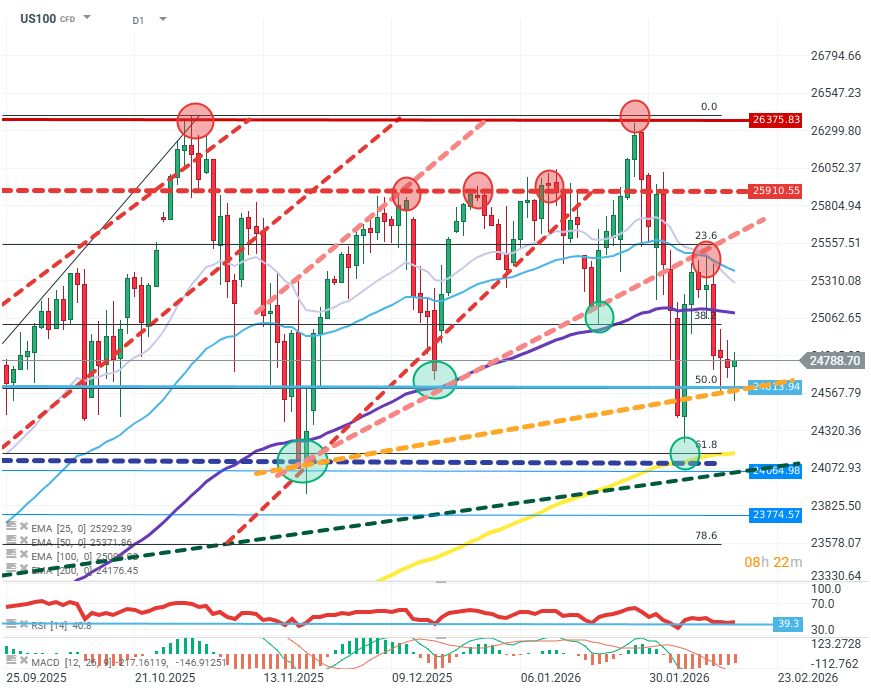

US100 (D1)

Source: xStation5

Buyers are struggling to regain the initiative in the index. The rebound from the 61.8% Fibonacci level was quickly pushed back down. Price remains below the 50 and 100 EMAs. The key level to defend is the 50% Fibonacci. If supply pushes the price noticeably below ~24,500, further correction can be expected, with a move toward the 200 EMA and the 61.8% Fibonacci level.

Company news:

- Norwegian Cruise (NCLH.US): The cruise ship operator is up about 6% following WSJ reports that Elliott Investments bought a significant stake.

- Zim Integrated Shipping (ZIM.US): The stock is up 35% after confirmation of the company’s acquisition by Hapag-Lloyd AG.

- Warner Bros (WBD.US): Shares are up 2% on reports that acquisition talks with Paramount and Skydance have reopened.

- Palo Alto (PANW.US): One of the cybersecurity leaders will publish its results today. The market expects Q4 EPS of USD 9.3–9.4 and at least USD 2.5 billion in revenue.

NZDUSD: sharp declines after a dovish RBNZ stance 🎙️📄

Daily summary: The market looks for direction, oil and metals under pressure

Gold loses 2.5% amid US - Iran trade negotiations and dollar strength 📉ANZ lifts outlook

Oil drops over 2% on possible Iran Deal 🛢️🔥

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.