-

AMD has signed an agreement with OpenAI to supply Instinct MI450 chips, increasing its share in the AI market.

-

OpenAI can purchase up to 160 million AMD shares, highlighting the strategic nature of the partnership.

-

AMD has signed an agreement with OpenAI to supply Instinct MI450 chips, increasing its share in the AI market.

-

OpenAI can purchase up to 160 million AMD shares, highlighting the strategic nature of the partnership.

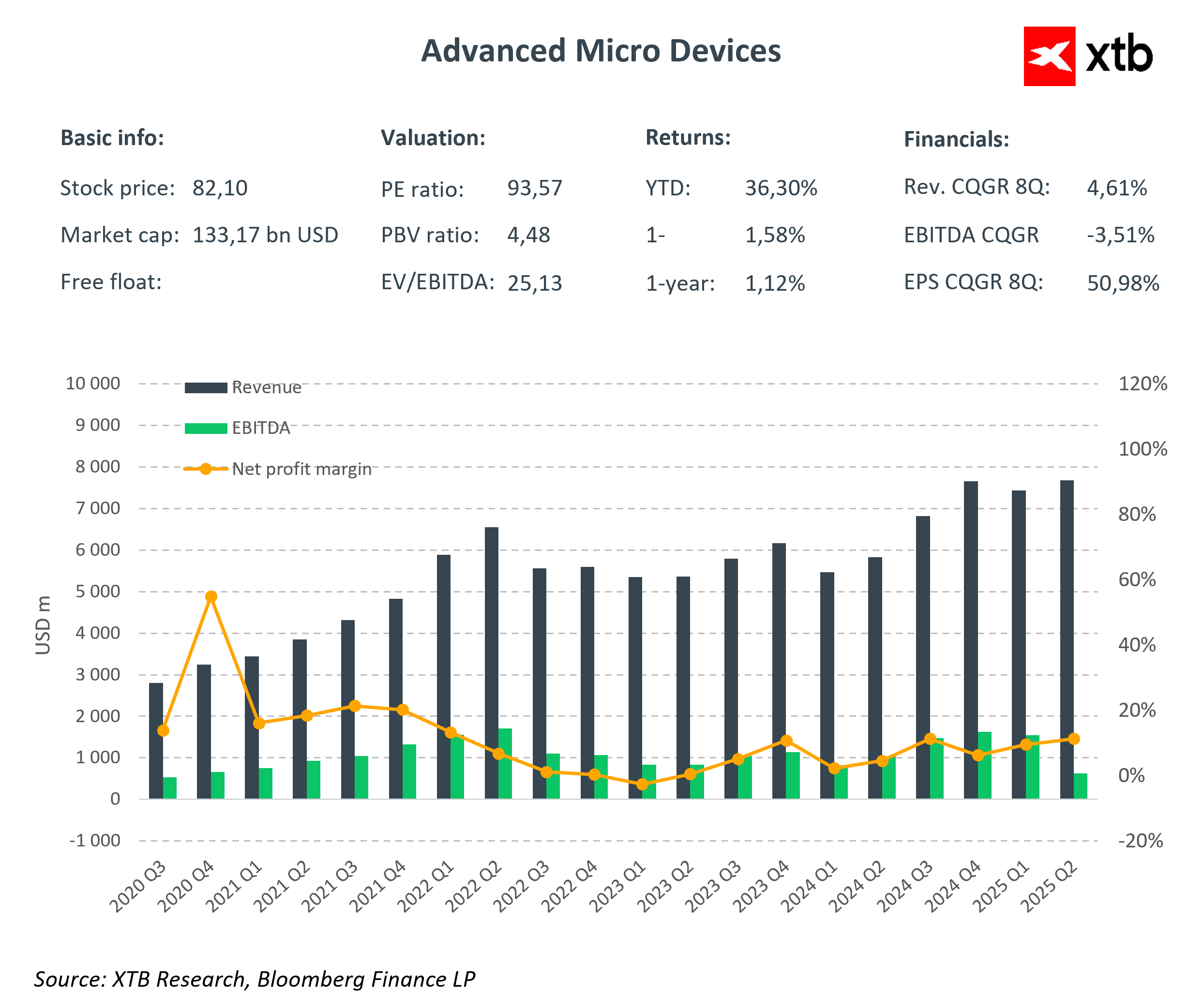

The agreement between AMD and OpenAI is a pivotal moment not only for the company itself but also for the entire artificial intelligence market. By supplying powerful Instinct MI450 chips with a total capacity of 6 gigawatts, AMD demonstrates that it is ready to compete with Nvidia, the current leader in the AI chip industry. This collaboration will allow AMD to significantly increase its share in the rapidly growing AI infrastructure segment while accelerating the development of advanced AI solutions worldwide.

Additionally, AMD has issued OpenAI warrants for up to 160 million shares, which will be activated upon achieving specific technical and financial milestones.

The possibility for OpenAI to purchase shares on preferential terms clearly indicates that this partnership has a long-term and strategic nature, with potential mutual benefits. For AMD, this means the prospect of substantial revenue growth, especially since the deal's value could reach tens of billions of dollars annually. Collaboration with a leader in the AI field also confirms that AMD is not only developing advanced technologies but is also capable of building high-level strategic business relationships effectively.

Sam Altman, co-founder and CEO of OpenAI, emphasized that the partnership with AMD is crucial for increasing the computing power needed to fully unlock the potential of artificial intelligence. This agreement fits into the broader trend of expanding AI infrastructure worldwide, where companies are investing heavily in the development of generative AI technologies. For example, Nvidia recently announced plans to invest up to $100 billion in OpenAI to jointly develop data centers based on their systems.

In the context of the semiconductor market, this deal could change the balance of power, especially given the growing demand for AI chips driven by the development of generative artificial intelligence and the widespread application of these technologies across various economic sectors. For investors, this is a clear sign that AMD is dynamically expanding its portfolio and has the potential to compete effectively in the global market, which should positively impact the company’s financial results in the coming years.

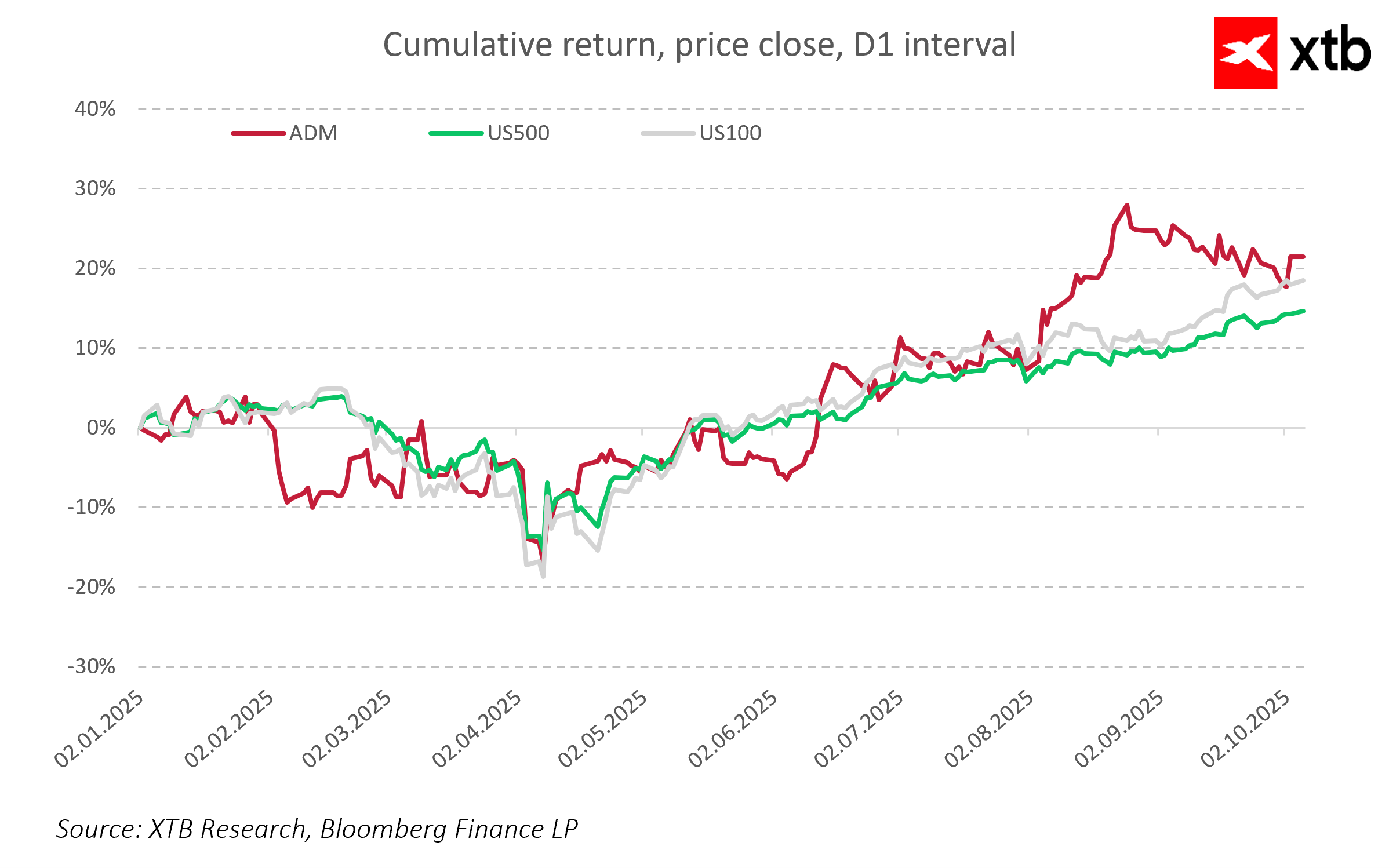

Moreover, since the beginning of the year, AMD shares have gained approximately 20% in value, outperforming benchmarks such as the S&P 500 and NASDAQ. The company’s stock price remains in a strong upward trend, further confirming growing investor interest and optimism about the company’s future.

This agreement is not only a success for AMD but also an important step toward a more competitive and innovative semiconductor market, where strategic partnerships play a key role. It will be worth following the development of this collaboration and how it will influence the future of the AI sector.

US OPEN: Wall Street not afraid of Shutdown 📈💲

Chart of the day: EURUSD (08.10.2025)

NZDUSD at 6-month lows after unexpected RBNZ rate cut ✂️

FOMC officials see structural shifts driven by AI; Kashkari and Miran back two rate cuts this year 🔎

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.