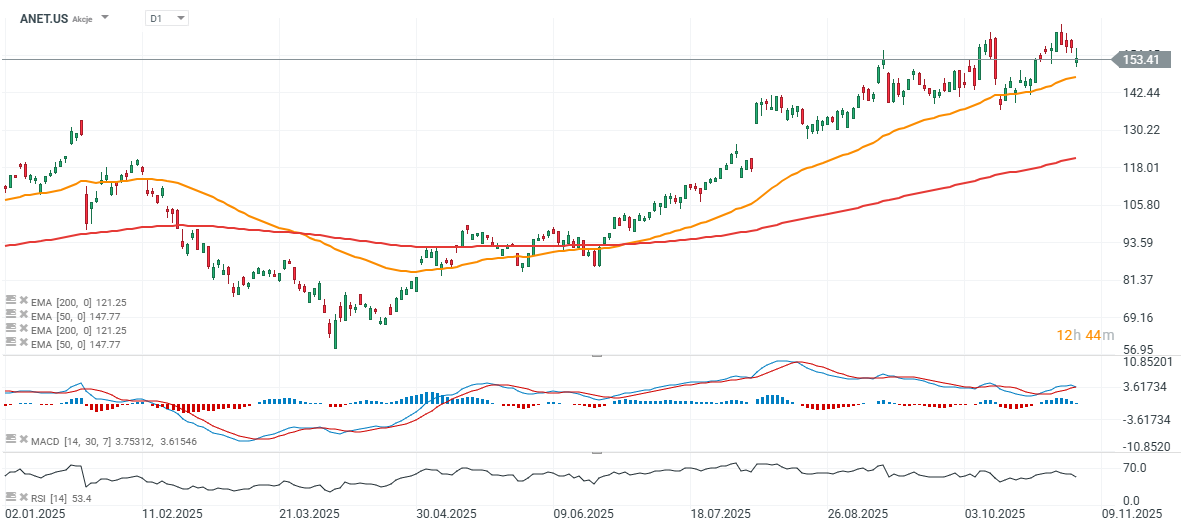

Despite stronger-than-expected revenue and profit in Q3 2025, shares of Arista Networks (ANET.US) — a leader in network switches and software for data centers — fell roughly 12% in the initial market reaction. Below are the key highlights from Arista’s third-quarter 2025 report. Year-to-date, the stock remains up over 40%, having rebounded nearly 60% since its April low. The decline reflects the company’s cautious and broadly in-line guidance for the current quarter and slightly lower margin outlook.

Strong Quarterly Results

-

Adjusted EPS: $0.75 vs. $0.71 expected (+25% YoY).

-

Revenue: $2.31 billion vs. $2.27 billion consensus, up 27.5% YoY.

Margins and Profitability

-

Non-GAAP gross margin: 65.2%, about 1 percentage point above forecasts.

-

Net income: $962 million, roughly 42% of revenue.

-

Cash and investments: $10.1 billion.

Business Momentum

-

Continued strength in cloud and AI networking, supported by partnerships with NVIDIA and OpenAI.

-

New product launches and geographic expansion reinforce Arista’s position as a key player in high-performance data-center infrastructure.

Outlook

-

Q4 revenue: $2.3–$2.4 billion (midpoint $2.35B vs. $2.33B expected).

-

Gross margin: 62–63%, slightly below the previous quarter.

-

FY 2025 revenue: around $8.87 billion (+26–27% YoY);

long-term target of $10.65 billion by 2026.

Management Commentary

-

CEO Jayshree Ullal highlighted strong execution and growing adoption of Arista’s “center-to-cloud” and AI-driven networking vision.

-

CTO Ken Duda emphasized the performance edge of Arista’s hardware in handling AI workloads.

Risks and Watchpoints

-

Component supply volatility could delay shipments.

-

Rising competition in AI and cloud networking segments.

-

Margins sensitive to product mix and broader macroeconomic softness.

Arista once again delivered a strong quarter, beating expectations on both the top and bottom lines. However, a softer margin outlook, in-line revenue guidance, and a broader tech-sector pullback prompted short-term profit-taking. Long term, Arista remains well positioned to capitalize on growing demand for AI-driven and cloud-based networking solutions.

Source: xStation5

Analyst Call Summary

Demand vs. Supply

-

Demand far exceeds supply, with shipments constrained by component availability (38–52 weeks lead time). This created temporary bottlenecks in quarterly results and led to a cautious tone in guidance.

Blue Box

-

A hybrid solution positioned between commodity whitebox systems and full Arista EOS platforms.

-

Lower margins than EOS products; expected to remain niche in 2026 (single-digit number of customers) but strategically vital for scale-up use cases.

Front-End ↔ Back-End

-

Ongoing convergence (currently 800G, moving toward 1.6T).

-

Arista stresses that servicing both layers represents a unique competitive advantage that is hard to replicate.

Product, Technology & Partnerships

-

EtherLink / ESUN / UEC: development of Ethernet Scale-Up Networking standards for AI workloads.

-

AVA (Autonomous Virtual Assist) and NetDL: leveraging AI to design, operate, and optimize networks.

-

Broad ecosystem partnerships with NVIDIA, AMD, Broadcom, OpenAI, Anthropic, Oracle Accelerate, and others.

Financial Highlights & Guidance

-

Q3: non-GAAP gross margin 65.2% (favorable mix + inventory);

net income 41.7% of sales; operating expenses 16.6% of revenue. -

Cash/investments: $10.1B; strong cash flow of ~$1.3B.

-

Purchase commitments: increased to $7B (from $5.7B) to support longer lead times and new products.

-

Deferred revenue: $4.7B; volatile due to acceptance clauses in AI contracts.

-

Q4 guidance: revenue $2.3–$2.4B; GM 62–63%; OM 47–48%; ETR ~21.5%.

-

FY 2025: growth 26–27% (~$8.87B); GM ~64%; campus $750–800M; AI ≥ $1.5B.

-

FY 2026: revenue ~$10.65B (+20% YoY); GM 62–64%; OM 43–45% (lower due to strategic investments).

Management Narrative & Takeaways

-

The company rejects the “deceleration” label, attributing fluctuations to shipment timing, not demand.

-

Product margins dip below 60% amid a heavier cloud/AI mix; software/services less profitable than some analysts expected.

-

Arista maintains a partner-led model (cabling, power, cooling, XPU integration); some sales may use JDM/Blue Box arrangements.

-

Management expects scaling to become easier after 2026–2027.

-

No visible threat from NVIDIA’s networking division in Arista’s core markets.

Bottom line: Demand driven by AI remains at record highs, but longer lead times and the AI/cloud mix are slightly compressing margins. The Blue Box strategy represents a calculated trade-off with strong long-term scale-up potential. The front/back convergence trend continues to play in Arista’s favor thanks to its comprehensive stack (hardware + EOS + software tools).

Guidance for 2025–2026 remains solid though cautious, reflecting deferred customer acceptances in AI-driven projects.

Daily summary: Markets recover optimism at the end of the week

US OPEN: Investors exercise caution in the face of uncertainty.

Oklo shares surged in a true “atomic open” on today’s session

Rio Tinto and Glencore shake up the mining market🚨 Giants negotiate merger 🤝

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.