- Markets expect revenues of approximately $2.26 billion (+25% YoY) and EPS of around $0.72.

- The AI Networking segment and hyperscale data centers remain the main growth drivers, accounting for ~65% of sales.

- Investors will closely watch management commentary on demand, cost pressures, and margins in the coming quarters.

- Markets expect revenues of approximately $2.26 billion (+25% YoY) and EPS of around $0.72.

- The AI Networking segment and hyperscale data centers remain the main growth drivers, accounting for ~65% of sales.

- Investors will closely watch management commentary on demand, cost pressures, and margins in the coming quarters.

Arista Networks is publishing its third-quarter 2025 results after today’s session, and expectations for the report are high. Strong demand for networking solutions for artificial intelligence (AI) infrastructure and hyperscale data centers is driving the company’s dynamic revenue growth. Arista is recognized as a key player in delivering advanced networking technologies, which allows it to maintain a leading position in the AI Networking sector.

Key Financial Data

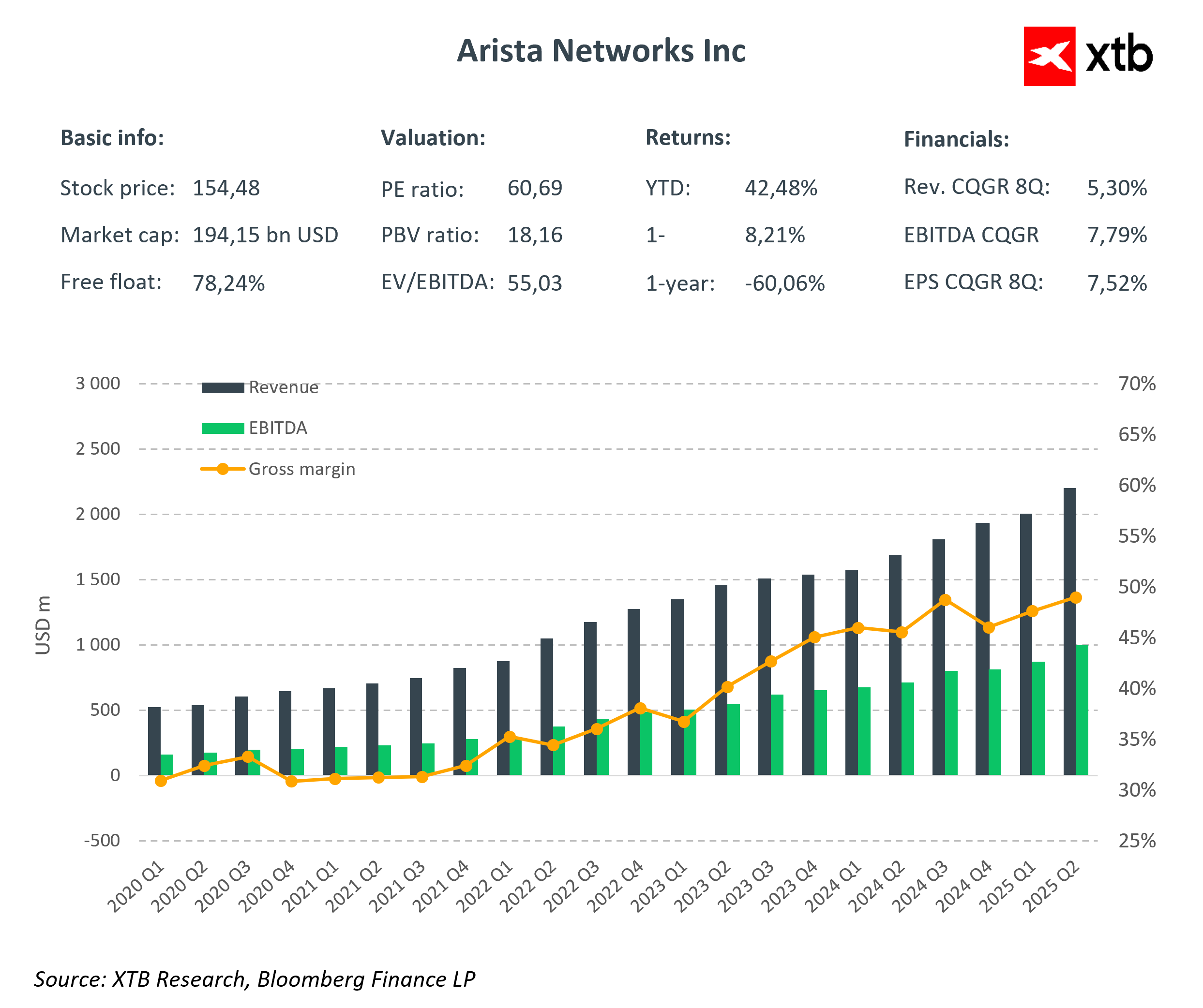

The market consensus indicates that Arista Networks’ Q3 2025 results should show continued solid revenue growth and sustained high profitability.

-

Q3 2025 revenues: $2.26–2.3 billion, representing approximately 25% year-over-year growth.

-

Product revenues: around $1.9 billion.

-

Service revenues: approximately $347 million.

-

Earnings per share (EPS): approximately $0.72, up more than 13% year-over-year.

-

Gross margin: estimated at 64.2%, slightly lower than the previous quarter.

-

Operating margin: around 47.5%, confirming continued strong profitability.

Q4 2025 forecasts:

-

Revenues: $2.33 billion

-

Gross margin: 63.2%

AI and Data Centers as the Main Growth Driver

The AI Networking segment and hyperscale data centers are currently Arista’s most important revenue sources, accounting for roughly 65% of total sales. Demand for ultra-high-speed Ethernet switches, including 100G, 400G, and 800G, continues to grow. Arista’s solutions support key clients such as Amazon, Google, Microsoft, Meta, and Oracle, providing reliable large-scale AI infrastructure. Estimates suggest that Arista’s AI-related revenues could reach $1.5 billion in 2025, and the further development of new scale-up networking technologies could become a significant revenue source from 2027 onwards.

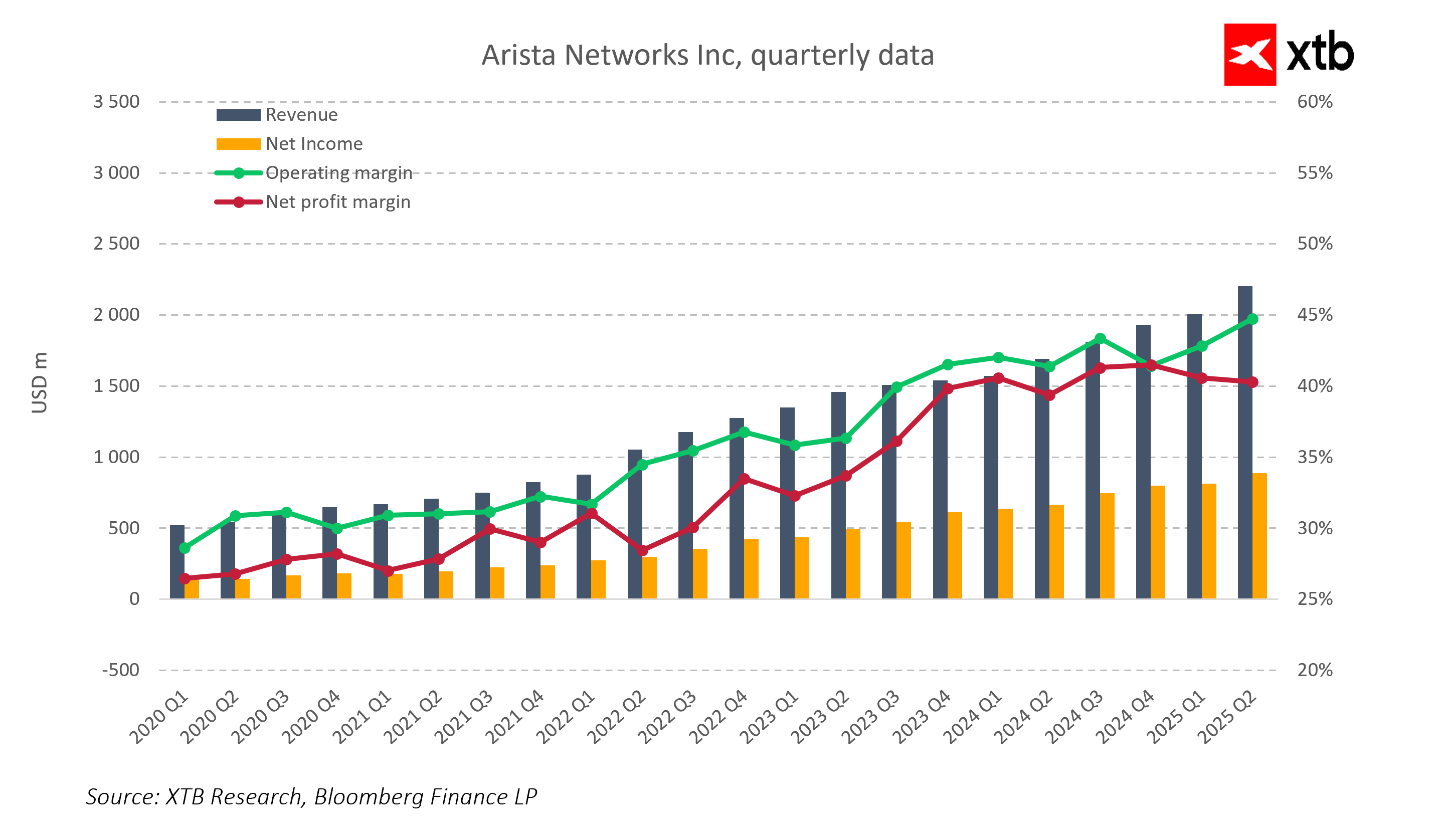

Strong Profitability and Operational Stability

Despite cost pressures and supply chain challenges, Arista maintains one of the highest profitabilities in the industry. Operating margins remain near 47%, and cash flows from operations are strong. Service revenues provide additional financial stability and strengthen customer relationships, allowing the company to remain flexible in a competitive environment.

Outlook and Risks

Despite strong demand, Arista’s management has not raised its 2026 guidance following the September Investor Day. Market participants will closely monitor management’s commentary on optical component costs, pricing pressure from hyperscalers, and the potential for further margin expansion in a competitive environment. Key risks also include revenue concentration among a few large clients and the cyclical nature of investments in the data center sector.

Market Assessment

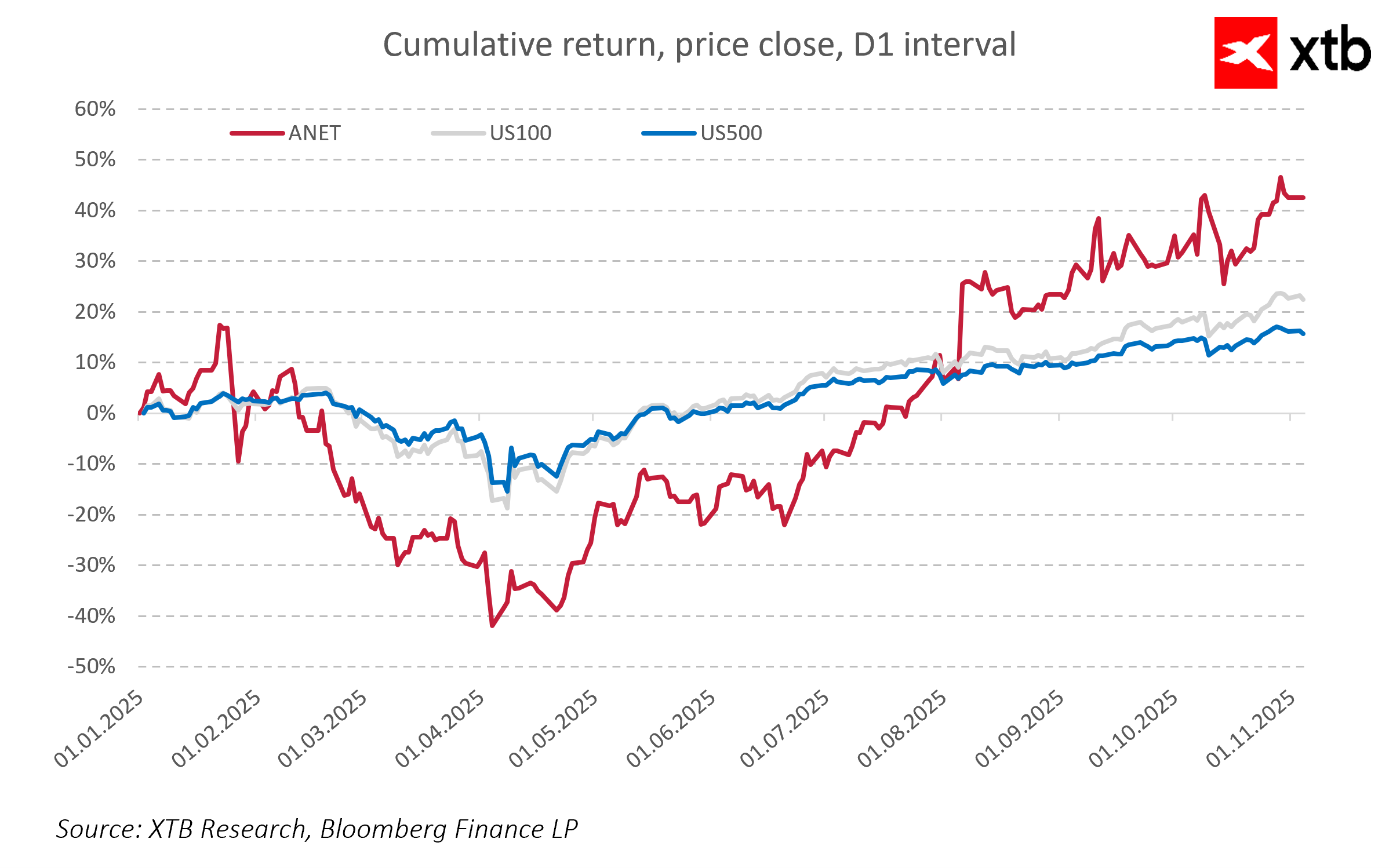

Over the past 12 months, Arista Networks’ share price has increased by approximately 40%, reflecting high market expectations for continued expansion in the AI segment. A key factor influencing investor reactions following the results will be the tone of guidance for upcoming quarters and the demand trends in AI Networking.

Summary

Arista Networks enters the year-end with a strong financial position, stable margins, and a growing presence in the AI market. The company continues to build a competitive advantage through innovative networking technologies, advanced software, and partnerships with major hyperscalers. Today’s quarterly report is expected to confirm that Arista remains one of the main beneficiaries of AI and cloud infrastructure growth, maintaining solid potential for further revenue and margin expansion in the coming quarters.

Daily summary: Markets recover optimism at the end of the week

Three Markets to Watch Next Week (09.01.2026)

US OPEN: Investors exercise caution in the face of uncertainty.

Oklo shares surged in a true “atomic open” on today’s session

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.