US biopharmaceutical company, Biogen (BIIB.US), will report its results tomorrow; before Wall Street opens. Value-oriented fund Patient Capital Management on "Opportunity Equity Strategy" shared its observations with investors. In Q1, the commenting company said, the fund provided its investors with an 11.8% return net of fees, compared to a 10.6% gain from the S&P 500 index. The firm indicated that one of its biggest investment choices in Q1 was the stock of US pharmaceutical company Biogen (BIIB.US). Biogen discovers, develops, manufactures and delivers therapies for the treatment of neurological and neurodegenerative diseases. The company's shares have been underselling pressure for many months and have lost more than 30% since April 2023. The stock is trading flat today.

Alzhaimer's drug - an opportunity for Biogen?

- Biogen focuses on treating multiple sclerosis, spinal muscular atrophy and Alzheimer's disease. The company has been under pressure since the FDA's approval of Aduhelm, a drug to inhibit Alzheimer's (June 2021).

- The approval process has been criticized due to the limited effectiveness of the drug's therapy. Patient Capital believes that the company now has a new, highly regarded CEO, Christopher Viehbacher, a rationalized cost structure and more disciplined investment management;

- Patient Capital assessed that the company already has another Alzheimer's drug, Leqembi, which is more effective than Aduhelm and fully approved. The fund assessed that while progress in the use of Leqembi has been slow so far, it still creates great long-term potential for a higher patient population. Analysts pointed out that this potential may be 'dramatically underestimated' at present.

- As a result, the fund maintained that Biogen now offers an opportunity to buy forward-looking, high-performing healthcare assets with a strong track record of delivering great products. The fund summarized Legembi's outlook and stressed that "it's not often that you see such a risk/reward ratio in the market, and we opportunistically took advantage of that."

- Analysts at Oppenheimer 2 days ago lowered their target price, for Biogen shares from $290 to $270 which would still imply approx. 40% upside potential from current valuation levels. Wedbush, on the other hand, lowered its recommendation significantly, from $245 to $213 per share.

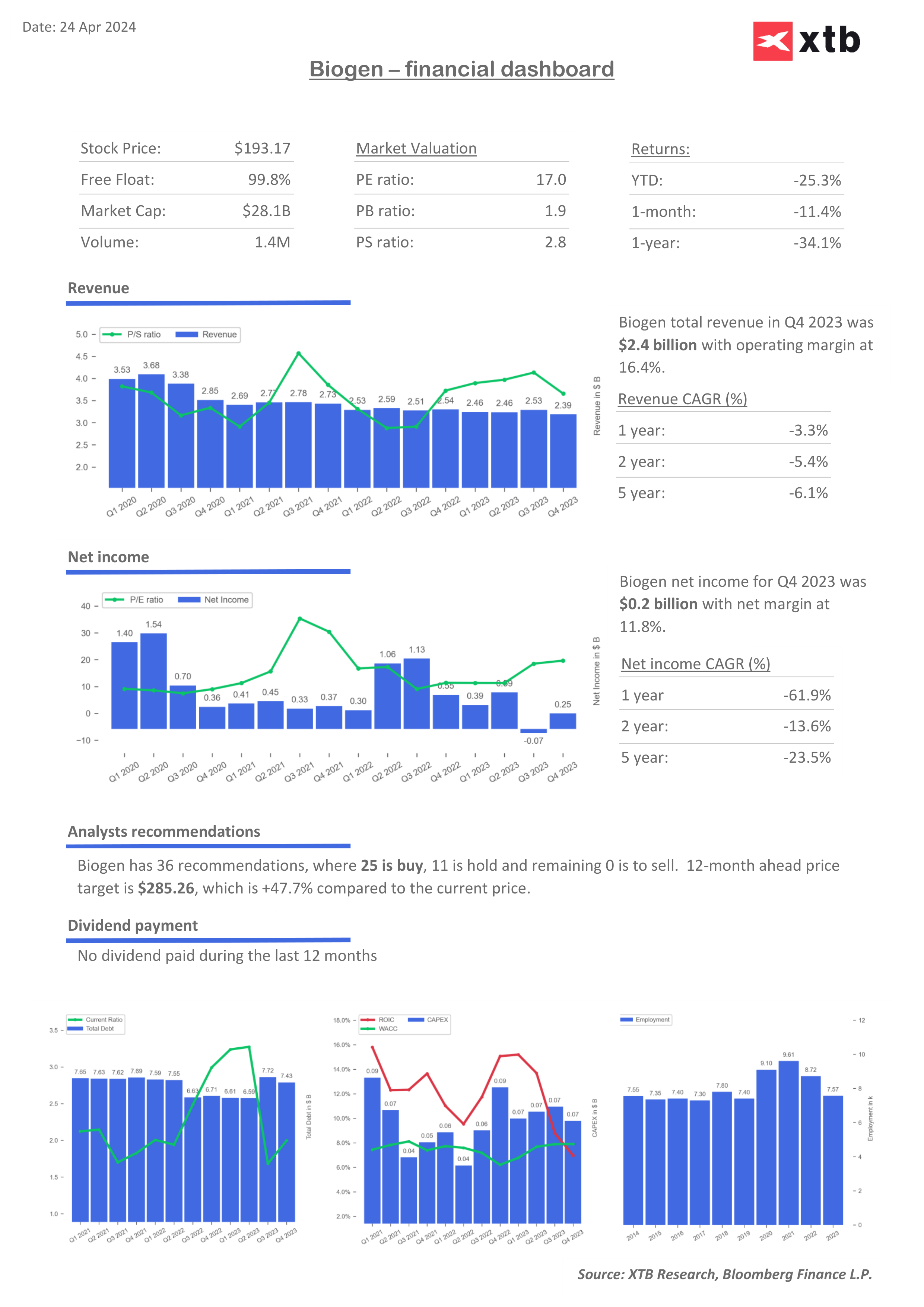

- The value (Equity) generated by Biogen as of 2021 has increased by $4 billion, to $14 billion, against an unchanged long-term debt level of about $6 billion. In February, the company said it expected $15 to $16 in earnings per share for the full year 2024 (about 5% y/y growth). A possible upward revision of these forecasts could help the company's stock. Wall Street still seems skeptical looking ahead to tomorrow's report; looking at recent analyst revisions.

...But the world is still skeptical

- Today's Reuters report suggests that Biogen's partner Japanese Eisai (as well as the company itself) launch faces a fundamental problem, because physicians still see Alzheimer's disease as untreatable. Alzheimer's drug adoption in US slowed by doctors' skepticism 9 months after the drug debut.

- Eisai has recently outlined a range of ways to kick-start Leqembi’s lackluster launch, from increasing the number of neurology account specialists to adding a subcutaneous option. Spherix report found few of the 75 surveyed U.S. neurologists “Consider Leqembi to be a significant medical advance over other historical AD treatments.” Less than half of the neurologists were actively recommending the drug to patients.

Biogen shares (BIIB.US)

Biogen shares have been outperforming companies like Eli Lilly (LLY.US) for years. The current, D1-based RSI indicates levels near oversold levels, near 30 points. Levels of $190 appear key to hold in the medium term, as they reflect the 'local lows' of 2013 and 2022. On February 13, the company reported results that disappointed Wall Street expectations.

Source: xStation5

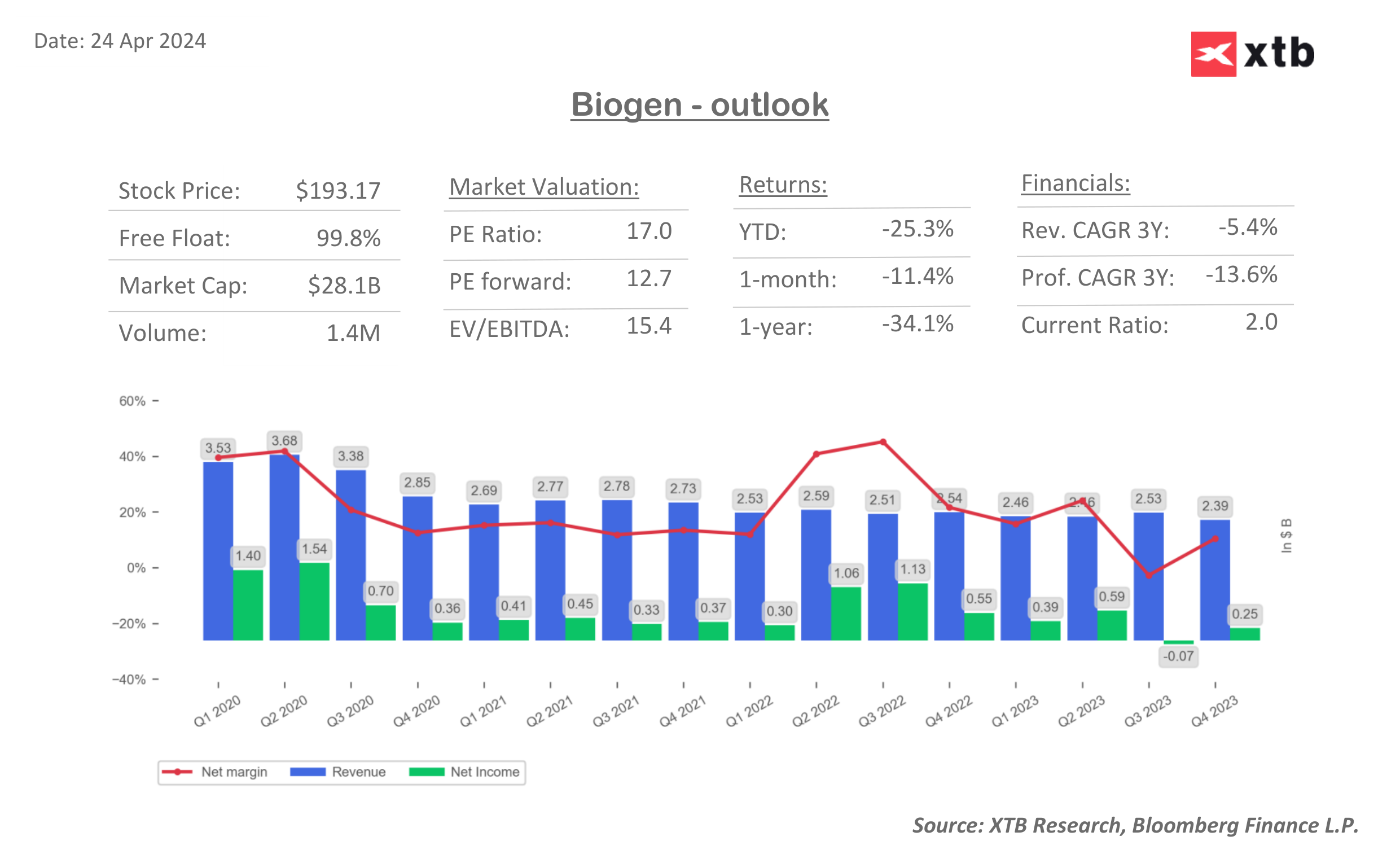

Source: Bloomberg Financial LP, XTB Research

Source: Bloomberg Financial LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.