BlackRock Inc. (BLK.US) reported strong fourth quarter 2024 results Wednesday, with shares climbing as much as 2.7% in premarket trading as adjusted earnings surpassed analyst estimates. The world's largest asset manager demonstrated robust growth across its platforms, particularly in ETFs and private markets, though assets under management slightly missed expectations. The implied earnings surprise was positive with EPS beating estimates by 4.1%.

BlackRock delivered exceptional Q4 performance with notable strength in ETF flows and private market expansion, while its technology services segment showed continued momentum. The company benefited from increased client engagement and significant growth in alternative investments.

BlackRock Q4 2024 results:

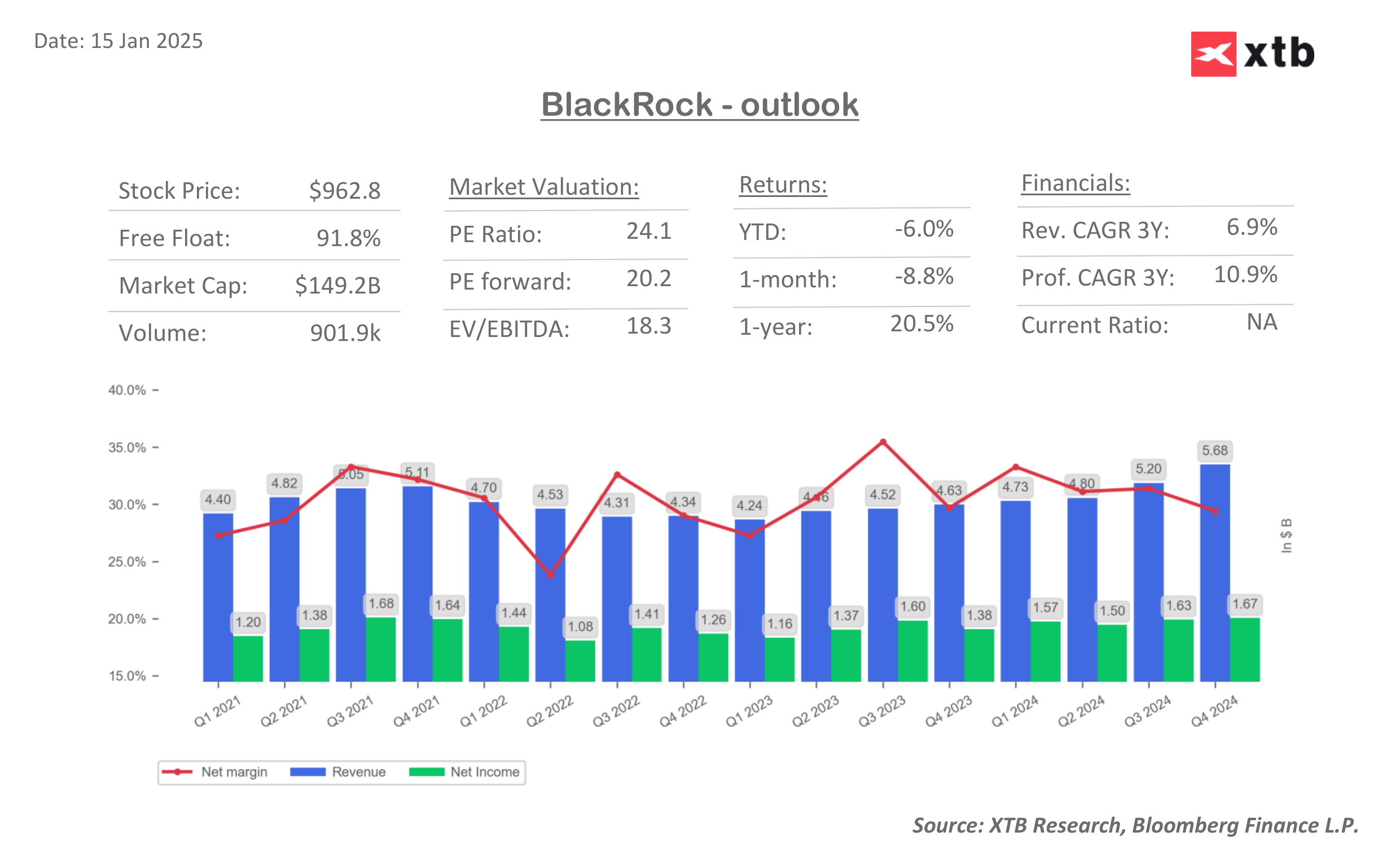

- Revenue: $5.68 billion vs $5.59 billion expected (+23% YoY)

- Adjusted EPS: $11.93 vs $11.46 expected ($9.66 YoY)

- Assets under management: $11.55 trillion vs $11.66 trillion expected (+15% YoY)

- Net inflows: $281.42 billion vs $198.41 billion expected (+194% YoY)

- Base fees and securities lending revenue: $4.42 billion vs $4.38 billion expected

- Technology services revenue: $428 million vs $417.5 million expected

- Adjusted operating margin: 45.5% vs 44.8% expected

Segment Performance:

- Long-term inflows: $200.67 billion (vs $159.93 billion expected)

- Equity net inflows: $126.57 billion (vs $73.47 billion expected)

- Fixed Income net inflows: $23.78 billion

- Institutional net inflows: $53.38 billion

- Retail net inflows: $4.65 billion

- Investment advisory performance fees: $451 million (vs $369.5 million expected)

Strategic Developments and 2025 Outlook:

- Completed $12.5 billion acquisition of Global Infrastructure Partners

- Pending closures of HPS Investment Partners ($12 billion) and Preqin Ltd. ($3.1 billion) acquisitions

- Bitcoin ETF launch showing strong growth with over $50 billion in assets

- Annual ETF business attracted $390 billion in total flows for 2024

- Record total annual inflows of $641 billion across all products

CEO Larry Fink expressed strong confidence in the firm's trajectory, stating "BlackRock enters 2025 with more growth and upside potential than ever. This is just the beginning." The company's strategic expansion into private markets through recent acquisitions positions it to compete with industry leaders like Blackstone, KKR, and Apollo Global Management.

The company announced several leadership changes, including Joe DeVico becoming head of the Americas client business and the establishment of a new global partners office to oversee relationships with major investors, following the departure of Mark Wiedman, a 20-year veteran of the firm.

The stock gains 2.7% in premarket trading to $989. Source: xStation

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.