Nvidia (NVDA.US) fiscal Q1 2026 earnings report topped Wall Street estimates. Nvidia shares rise more than 3% in the first reaction to a strong quarterly report, signalling still rising AI demand.

Fiscal Q1 2026 earnings report

- Revenue came in at $44.1 billion, up 12% from Q4, 69% from a year ago and above $43.3 billion anticipated on Wall Street

- Earnings per share (EPS) non-GAAP came in at $0.81 well above $0.73 awaited by consensus on Wall Street

- Data Center segment revenue came in at $39.1 billion, up 10% from Q4 and up 73% from a year ago but slightly below $39.2 billion expected on Wall Street

- NVIDIA will pay the next quarterly cash dividend of $0.01 per share on July 3, 2025 (record date: June 11, 2025)

- Nvidia forecasts Q2 2025 revenue below estimates, however, the market didn't react to that fact.

The company reported that its GAAP and non-GAAP gross margins were 60.5% and 61.0%, respectively. However, if the $4.5 billion charge (less than $5.5 billion anticipated before by the company) were excluded, the first quarter non-GAAP gross margin would have been 71.3%.

As for earnings per diluted share, GAAP and non-GAAP figures were $0.76 and $0.81, respectively. Without the charge and related tax impact, first quarter non-GAAP diluted earnings per share would have been $0.96.

Nvidia business segments (ex-Data center)

- Gaming and AI PC: revenue was a record $3.8 billion, up 48% from the previous quarter and up 42% from a year ago.

- Professional Visualization: revenue was $509 million, flat with the previous quarter and up 19% from a year ago.

- Automotive and Robotics: revenue was $567 million, down 1% from the previous quarter and up 72% from a year ago.

The outlook

Nvidia expects Q2 2025 revenue of $45 billion, plus or minus 2% vs $45.90 billion estimated by LSEG analysts consensus. The forecast includes a loss in H20 revenue of about $8 billion (much higher than $4.5 billion in Fiscal Q1 2026) due to the recent export curbs. As for now, Nvidia expects a major hit to sales from tighter U.S. curbs on exports of its AI chips to key semiconductor market China.

- Q2 non-GAAP gross margins are expected to be at 72.0% level, respectively, plus or minus 50 basis points. The company is continuing to work toward achieving gross margins in the mid-70% range late this year.

- Q2 non-GAAP operating expenses are expected to be at approximately $4.0 billion. Full year fiscal 2026 operating expense growth is expected to be in the mid-30% range.

- Q2 non-GAAP other income and expense are expected to be an income of approximately $450 million, excluding gains and losses from non-marketable and publicly-held equity securities.

- Q2 non-GAAP tax rates are expected to be 16.5%, plus or minus 1%, excluding any discrete items

Source: Nvidia Fiscal Q1 2026 earnings report Non-GAAP

Jensen Huang commentary on Q1 earnings

“Our breakthrough Blackwell NVL72 AI supercomputer — a ‘thinking machine’ designed for reasoning— is now in full-scale production across system makers and cloud service providers (...) Global demand for NVIDIA’s AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate. Countries around the world are recognizing AI as essential infrastructure — just like electricity and the internet — and NVIDIA stands at the center of this profound transformation.”

Nvidia (D1 interval)

Shares rise above $140 in US after-market, signalling a potential of a breakout pattern, with a major resistance zone at ATH zone (February 2025). On the other hand, for the final reaction on Wall Street we have to wait until tomorrow session opening, as fiscal Q2 2026 revenue guidance missed estimates.

Source: xStation5

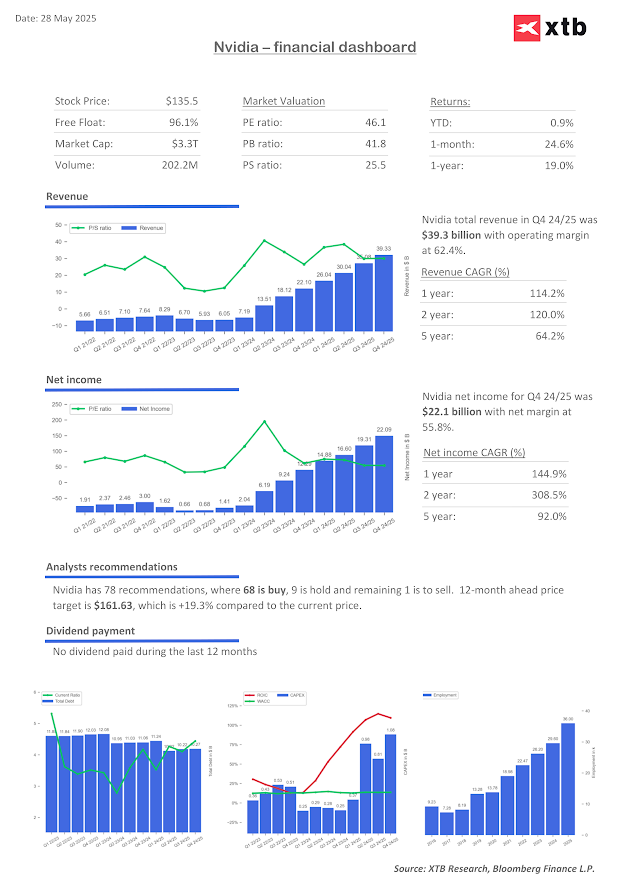

Nvidia financial dashboard

Source: XTB Research, Bloomberg Finance

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.