- Inflation in US below expectations

- Inflation in US below expectations

14:30 - USA CPI (Consumer inflation) for September:

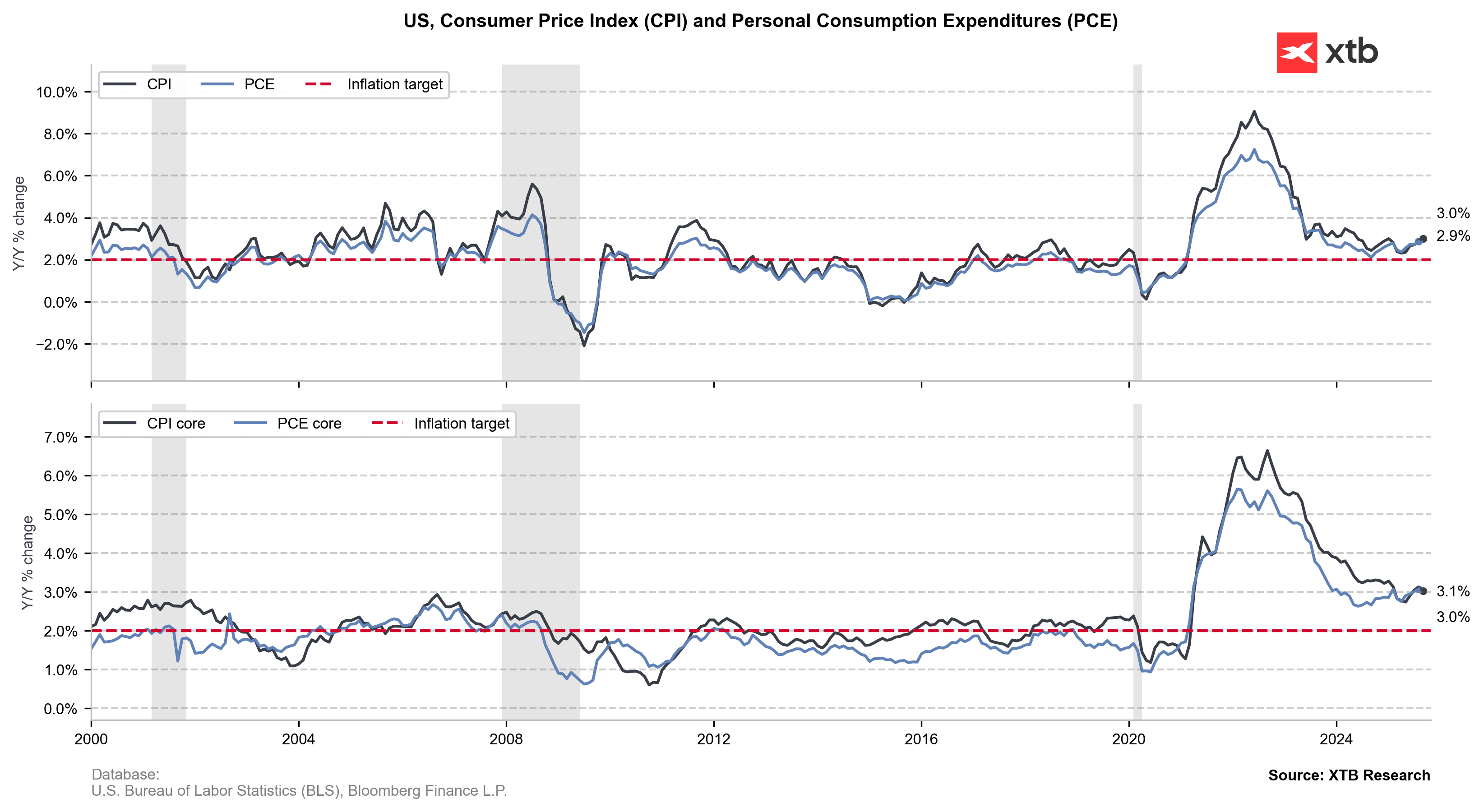

Core CPI YoY: 3% (Expected: 3.1%, Previous 3.1%)

Core CPI MoM: 0.2% (Expected: 0.3%, Previous: 0.3%)

CPI YoY: 3% (Expected: 3.1%, Previous 2.9%)

CPI Mom: 0.3% (Expected: 0.4%, Previous 0.4%)

The CPI reading from the USA presented lower than expected, signaling disinflation in the US economy. Both the annual and monthly indicators fell 0.1% percentage points below consensus. Structure of changes is ambiguous is as follows:

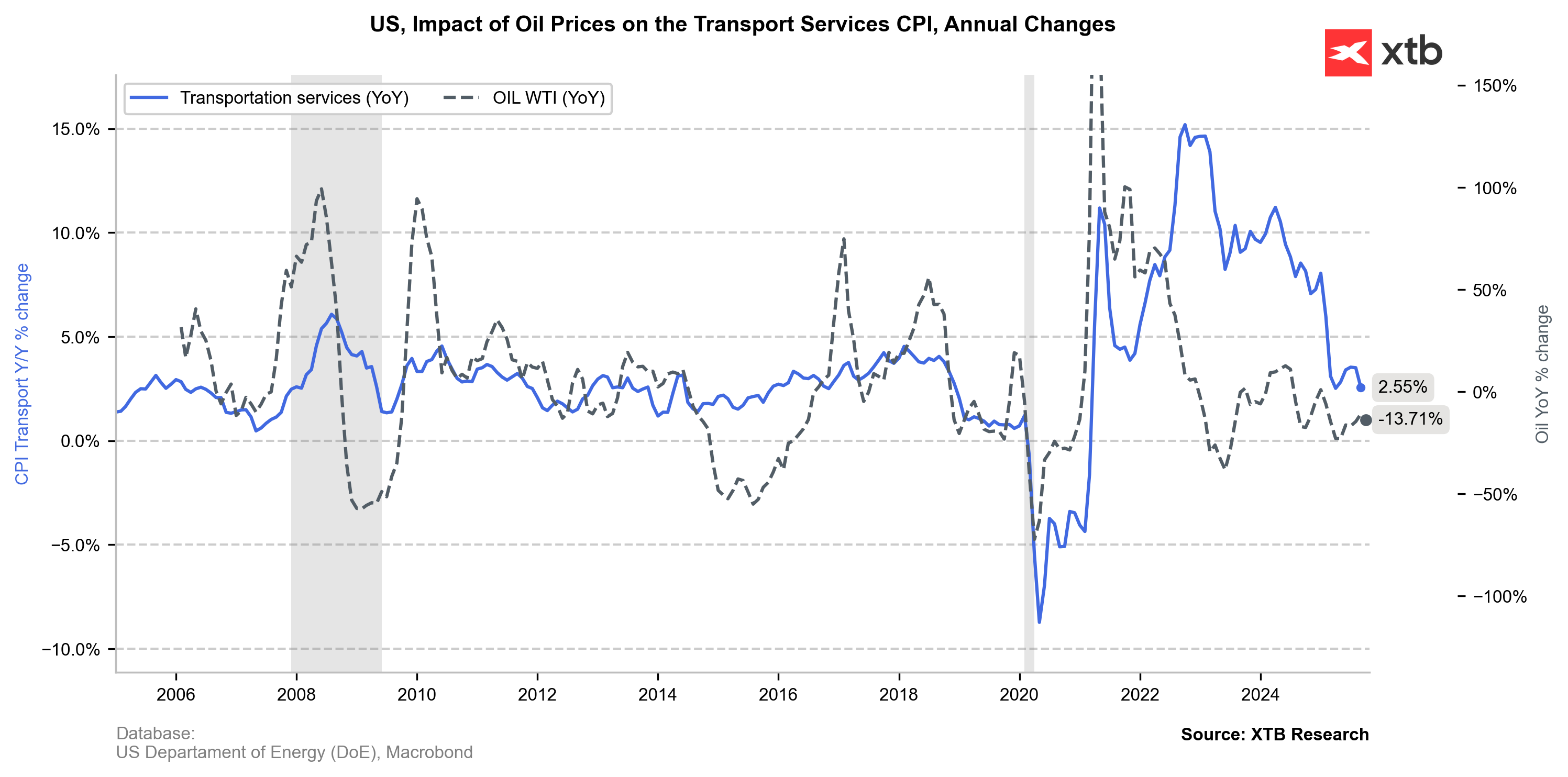

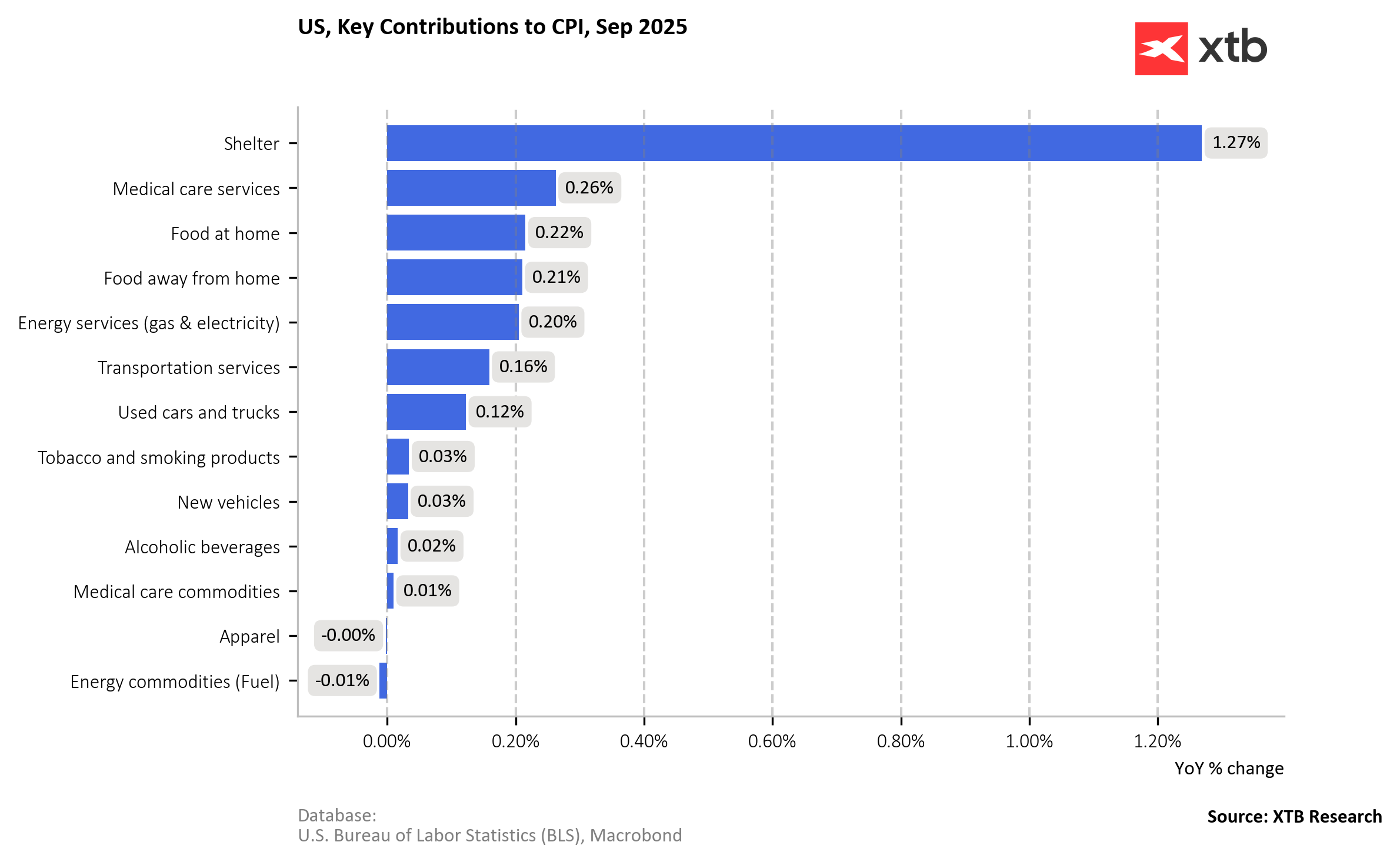

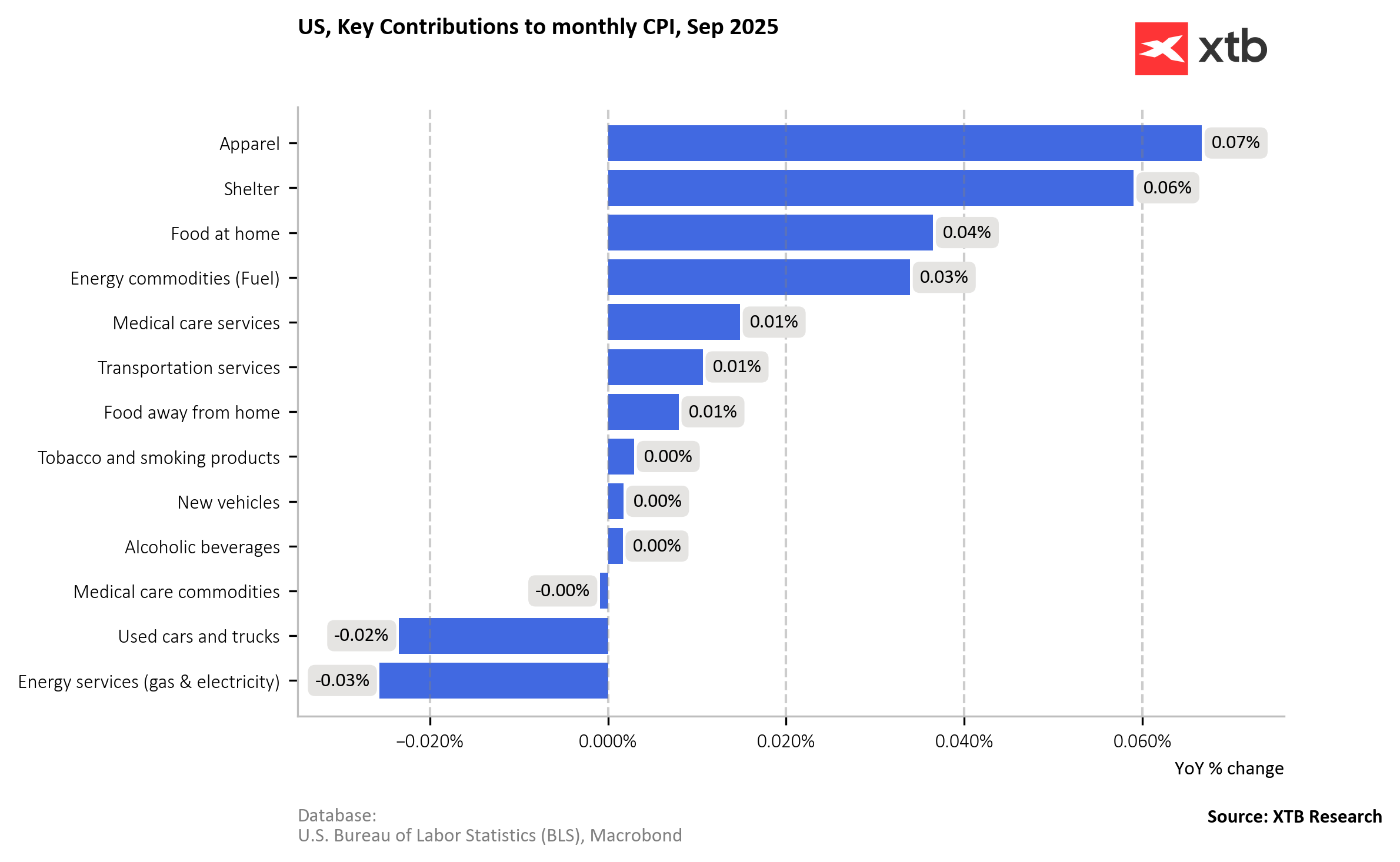

Despite the drop in oil prices, fuels contributed to September's dynamics. This is possibly due to factors such as refinery margins and seasonally higher prices at stations.

At the same time, the apparel category came out surprisingly high.

On the other hand, electricity decreased month-on-month and acted in a disinflationary manner. This is interesting in the context of ongoing debate in the US related to the electricity prices rising due to high usage by data centers.

Finally, housing, or "shelter" inflation, remains the largest and most persistent contributor to CPI, although the growth rate in this category is gradually slowing.

This mix suggests further flattening of price pressure in most goods, while inertia persists in housing related services. The power market, fuel and tariffs may still react with a delay, but for now, CPI shows relief subcomponent in this regard.

This has far-reaching implications for monetary policy. Lower than expected means increased expectations that FED will resume QE policy sooner than expected. Pricing in further rate cuts and repurchase of the debt by the Fed is crucial for the current market.

Even more so now due to "heightened concerns about shutdown" pressure on the economy.

Markets reacted swiftly, Euro appreciated to the dollar after the CPI reading by approximately 0.3%, although market quickly corrected substantial part of this gain.

Source: xStation5

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.