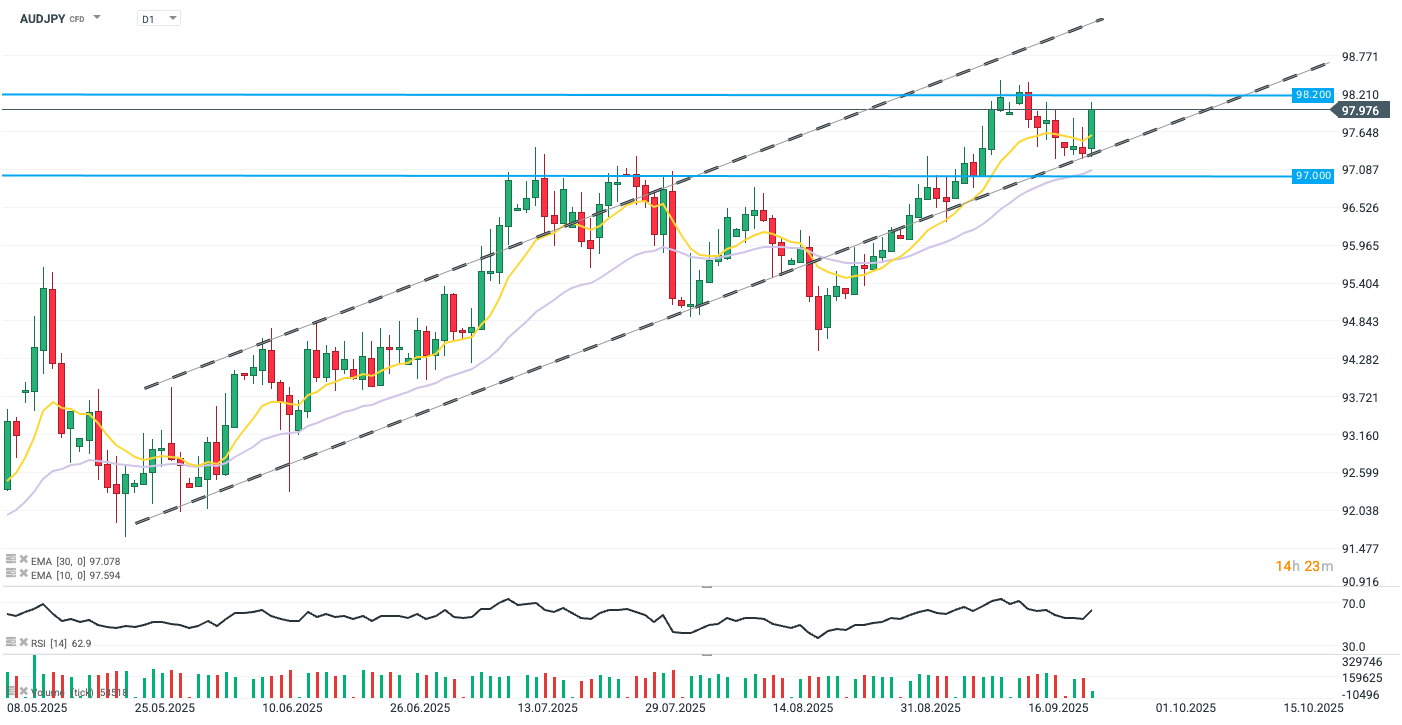

AUDJPY rebounds bullishly by 0.7%, with yen giving up the most against the Australian dollar among all G10 currencies. Dynamic appreciation of AUDJPY has been motivated by trend-supporting data from both economies, particularly higher monthly inflation reading in Australia that caps expectations for further monetary easing in the country.

AUDUSD rebounds from the lower bound of the well pronounced increasing channel. Today’s gains erase the recent correction which pushed the pair off of its highest levels since the start of 2025. Source: xStation5

What is shaping AUDJPY today?

-

Australia’s consumer price index rose 3.0% in August from a year earlier, up from 2.8% in July and slightly above forecasts. The increase was partly due to base effects but highlighted persistent pressures, particularly in services such as restaurant meals, takeaway food, andf audiovisual services. Core inflation was mixed: the trimmed mean eased to 2.6%, while the measure excluding volatile items climbed to 3.4%. Housing costs also ticked higher, suggesting upside risks for third-quarter inflation after months of moderation.

-

Markets quickly adjusted rate expectations after the inflation surprise, with major banks and financial institutions abandoning calls for a November cut. Odds of a move dropped to 50% from nearly 70% before the data, with investors now expecting rates to stay at 3.6% until at least May 2026. Analysts flagged the labour market as the key variable for policy direction, though its volatility makes a near-term cut less likely. The RBA continues to emphasize quarterly CPI as its preferred guide.

-

On the JPY side, Japan’s private sector activity is visibly slowing, as indicated by September’s flash PMIs. The composite index hit the lowest in four months, with manufacturing falling more than expected from 49.7 to 48.4, the lowest since March, due to sharp order declines and weaker exports. Services’ expansion helped to offset the downturn in manufacturing with solid activity and sales, reflecting robust domestic demand. Cost pressures persisted, selling prices rose, and employment growth slowed to a two-year low.

BREAKING: Oil prices plummet amid rumors of further OPEC production increases 🚨

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.