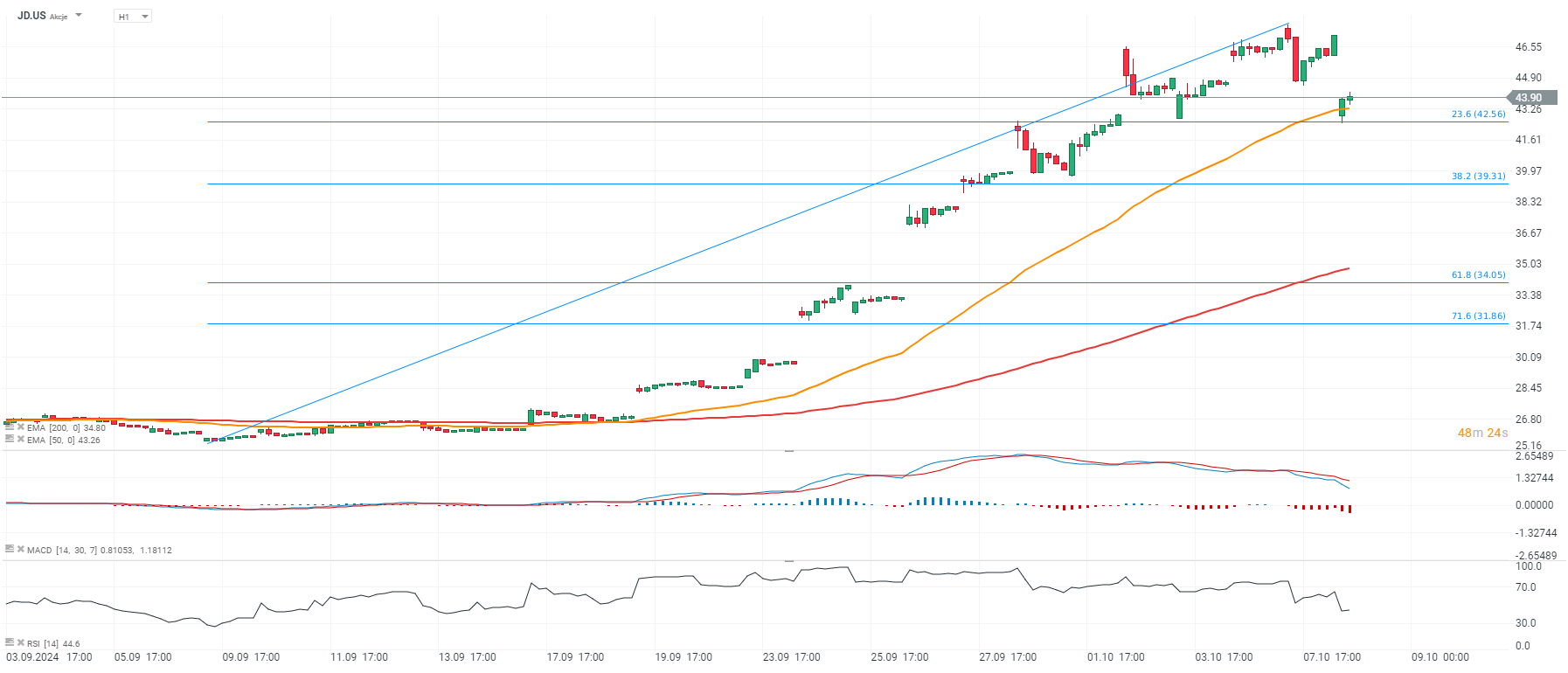

Shares of Chinese giants like JD.com (JD.US), Alibaba (BABA.US), Tencent (TME.US), and Yum!China (YUM.US) are trading in the 6 to 8% range today. A number of companies are even posting double-digit declines, driven by massive profit-taking in China, which has been on an unprecedented upswing. The Hang Seng Index retreated nearly 9.5% today, the strongest since 2008, after an announcement by Chinese authorities on expectations for further steps to stimulate the economy 'disappointed' exorbitant expectations.

It seems, however, that fundamentals may still be in favor of Chinese equities; as long as incoming macro data for September and October show at least a noticeable improvement, relative to recent months. However, this is not a foregone conclusion. Chinese authorities still expect this year's growth to 'meet current forecasts,' which seemed an insufficiently optimistic statement for 'Wall Street,' excited by the prospect of a strong rebound in Chinese demand. As a result, the mass of investors decided to realize profits, after the Hang Seng Index rallied more than 30%. China's Commerce Minister Wang Wentao spoke with US Commerce Secretary Gina Raimondo today and 'urged the US' to improve the business environment, for Chinese businesses operating in the United States.

Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.