- European equity markets ended the session higher — Germany’s DAX gained nearly 1%. Sentiment around the European stocks improved on hopes of a potential end to the war in Ukraine. Earlier, NBC News reported — citing sources within the U.S. administration — that the Ukrainian delegation had agreed to the terms of a U.S.-backed peace proposal. Meanwhile, shares of German defense manufacturer Rheinmetall fell to their lowest levels since April, reflecting weakening momentum across the defense sector.

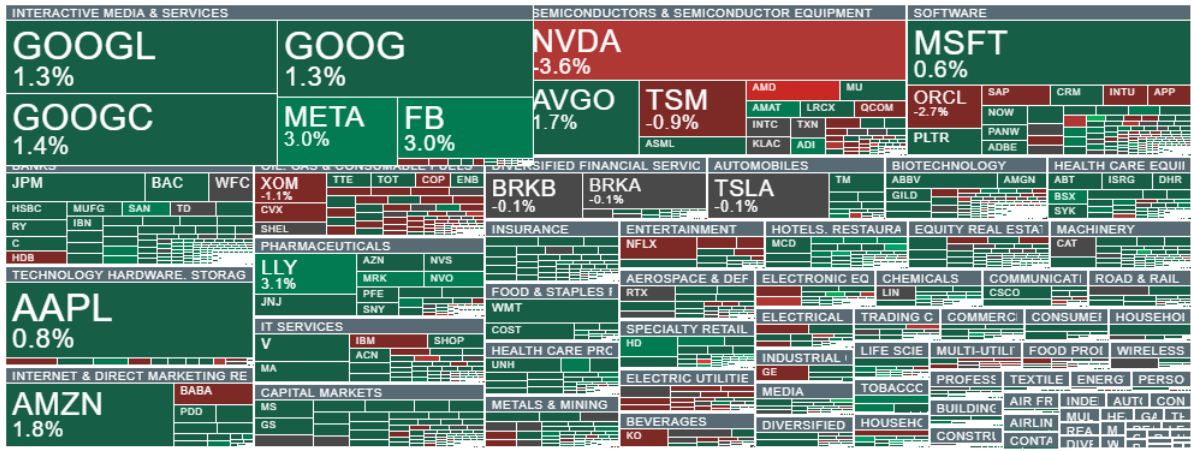

- Market sentiment on Wall Street continues to show a strong appetite for gains, despite Nvidia’s shares initially plunging nearly 7%. The decline in NVDA has now eased to around 3%, and the tech sector is rebounding; losses in Taiwan Semiconductor, AMD and Oracle have also slowed. Meta Platforms and Eli Lilly are trading higher, while Alphabet has reached new all-time highs. Nearly all equity sectors are in the green.

- Semiconductor stocks reacted negatively to reports that Meta is considering using Google’s TPU chips instead of Nvidia’s GPUs. This narrative struck at Nvidia’s perceived “monopolistic” market position and boosted optimism around Alphabet, which, alongside Broadcom, is increasingly viewed as a major challenger to Jensen Huang’s company.

The U.S. dollar is weakening today following soft retail sales data and a drop in consumer sentiment in the Conference Board survey. Wall Street is increasing its bets on a December rate cut, and EURUSD is up 0.4%, rebounding from key support at the 200-day EMA and testing the 1.158 area. Below is today’s U.S. macro data:

-

Conference Board Consumer Confidence: 88.7 (Forecast: 93.3, Previous: 94.6, Revised: 95.5)

-

Pending Home Sales Index: 76.3 (Forecast: –, Previous: 74.8, Revised: 71.8)

-

Retail Sales YoY: 4.3% (Forecast: –, Previous: 5.0%)

-

PPI YoY: 2.7% (Forecast: 2.6%, Previous: 2.6%)

-

Core PPI MoM: 0.1% (Forecast: 0.2%, Previous: -0.1%)

-

Core PPI YoY: 2.6% (Forecast: 2.7%, Previous: 2.8%)

-

PPI MoM: 0.3% (Forecast: 0.3%, Previous: -0.1%)

-

Core Retail Sales MoM: 0.3% (Forecast: 0.3%, Previous: 0.7%, Revised: 0.6%)

-

Retail Sales MoM: 0.2% (Forecast: 0.4%, Previous: 0.6%)

-

Business Inventories MoM: 0% (Forecast: 0%, Previous: 0.2%)

-

Pending Home Sales Change MoM: 1.9% (Forecast: 0.2%, Previous: 0.0%, Revised: -0.1%)

-

Richmond Fed Manufacturing Index: -15 (Forecast: -5, Previous: -4)

-

House Price Index YoY: 1.7% (Forecast: –, Previous: 2.3%)

-

House Price Index MoM: 0% (Forecast: 0.2%, Previous: 0.4%)

-

Case-Shiller 20-City Index YoY: 1.36% (Forecast: 1.4%, Previous: 1.6%)

-

Redbook YoY: 5.9% (Previous: 6.1%)

- ICE coffee futures are rising for the third consecutive session, rebounding after the recent sell-off. The main driver behind the rally is drought in Brazil’s key growing region, Minas Gerais, where rainfall is only around 50% of the historical average.

- Natural gas futures are down more than 2.5% as forecasts for cold weather across many U.S. states have eased, though they are recovering part of earlier losses after dropping over 4.5% in the afternoon.

- Cryptocurrency prices are falling despite improving sentiment in equity markets. Bitcoin is holding around $87,000 and has failed to climb back above $90,000 despite a solid stock market rebound. Ethereum is trading just below $2,900.

- Scott Bessent noted that hearings for Federal Reserve chair candidates are still underway; the White House intends to complete them before the holidays. According to anonymous sources, Kevin Hassett—considered loyal to Donald Trump—has recently gained the upper hand.

- Trump stated that a peace agreement between Russia and Ukraine is “close,” while Ukraine’s President Zelensky expressed his willingness to meet with the U.S. President as soon as possible.

- FedEx shares are up nearly 3% today; the company will invest $200 million to modernize its logistics hub in Anchorage, Alaska — including a new sorting facility and additional aircraft parking capacity.

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.