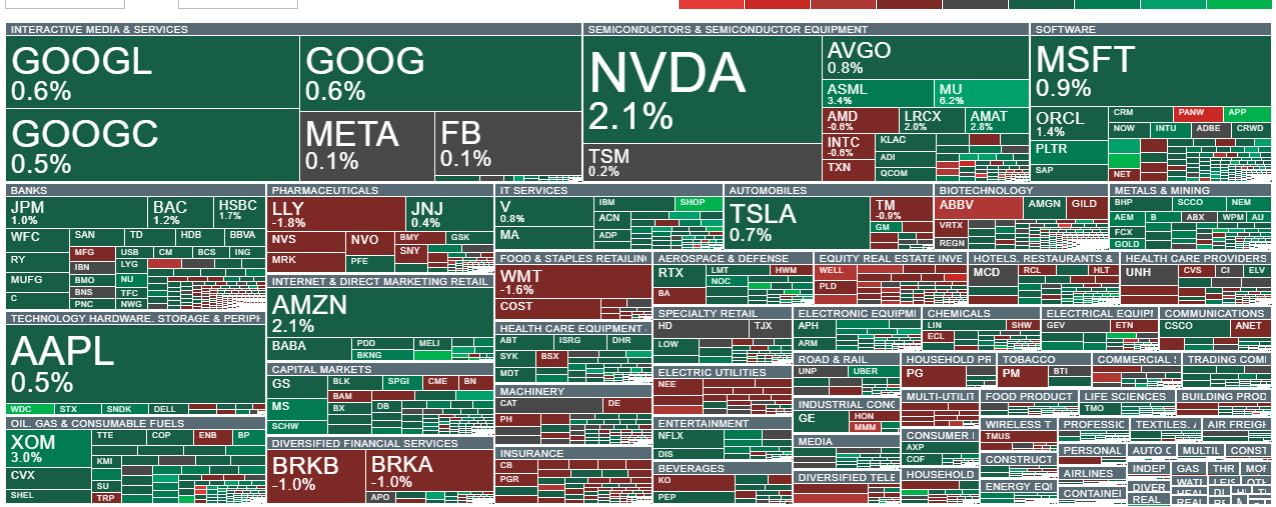

US100 is up more than 1%, with US indices regaining ground after Wednesday’s sell-off. US data — from building permits to industrial production and durable goods orders — beat expectations, supporting the US dollar.

According to Citadel Securities, retail investors have been buying software stocks at a record pace on Citadel’s platform (data tracked since 2017). As the firm put it: “Net notional on our platform has reached levels we have never observed before.”

Citadel added that the scale, persistence and breadth of the buying have materially exceeded prior peaks, highlighting retail as a key source of incremental demand in early 2026. Average daily dollar demand for US equities on the platform (Jan 2–Feb 13) was roughly 25% above the previous record set in 2021 and about twice the 2020–2025 average.

The momentum has also spilled into options. Retail participation in 2026 is already running at historically high levels. Average daily options volume year-to-date is nearly 50% above the 2020–2025 average and more than 15% above last year’s pace. Retail options investors have been net buyers in 41 of the past 42 weeks, pointing to sustained risk appetite rather than sporadic positioning.

Interestingly, despite a stronger USD index (USDIDX) today and EURUSD down nearly 0.5%, precious metals are rising. Gold is up almost 2.5%, attempting to break decisively above the psychological $5,000/oz level, while silver is jumping as much as 5%. This move may also have a meaningful retail-flow component.

US data

-

Industrial production (m/m): 0.7% (Exp: 0.4%; Prev: 0.4%; Rev: 0.2%)

-

Industrial production (y/y): 2.3% (Prev: 1.99%)

-

Manufacturing output (m/m): 0.6% (Exp: 0.4%; Prev: 0.2%)

-

Capacity utilization: 76.2% (Exp: 76.6%; Prev: 77.3%; Rev: 75.7%)

-

Durable goods orders (m/m): -1.4% (Exp: -1.8%; Prev: 5.4%)

-

Core durable goods (m/m): 0.9% (Exp: 0.3%; Prev: 0.4%)

-

Durable goods ex-defense (m/m): -2.5% (Prev: 6.6%)

-

Durable goods ex-transportation (m/m): 0.9% (Exp: 0.3%; Prev: 0.4%)

-

Building permits: 1.448m (Exp: 1.400m; Prev: 1.411m)

-

Housing starts: 1.404m (Exp: 1.310m; Prev: 1.272m)

Cocoa is sharply lower, down more than 6%. Year-to-date, prices are down over 45%. Ghana (the second-largest producer) cut its farmgate prices by nearly 30% last week. Ivory Coast (the largest producer) says it will keep farmgate prices unchanged through the end of the current main season (March 31), though reports suggest it is considering a cut.

Markets are also pricing a higher risk of military escalation in the Middle East after the US moved additional military equipment into the region. Oil is gaining more than 3.5% on these concerns.

(summary in progress)

Source: xStation5

Fed minutes released 🗽Key takeaways

Western Digital shares gains 8% reaching new all-time high 📈

Gold surges 2.5% nearing $5000 per ounce 📈

Strong Quarter for Analog Devices and Record Outlook

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.