Western Digital (WDC.US) has moved into the market spotlight on the back of two key developments: the company has already sold out its entire 2026 hard-disk-drive (HDD) production capacity, while simultaneously accelerating the sale of its remaining SanDisk (SNDK.US) stake worth roughly $3 billion. Together, these headlines form a coherent narrative of benefiting from the AI boom while completing a broader structural transformation. The stock is up more than 8% today.

AI is absorbing HDD capacity

Western Digital said its 2026 HDD production capacity is now fully booked. This reflects rising demand from data-center operators and hyperscalers building out infrastructure for artificial intelligence.

Key takeaways:

-

Fully booked 2026 production implies strong revenue visibility over the coming quarters.

-

Long-term agreements (LTAs) are expected to extend into 2027–2028, which could help stabilize volumes and margins.

-

The revenue mix is heavily tilted toward the cloud/hyperscale segment, while the consumer contribution remains relatively small.

-

AI is driving substantial demand for “low-cost capacity.” Despite competition from SSDs, HDDs remain critical for archiving and storing very large data sets.

For investors, this supports the view that Western Digital is increasingly an AI infrastructure play rather than a traditional consumer-hardware name. Valuation has moved accordingly: the company’s forward P/E (price-to-next-12-months expected earnings) is now around 34.

Sale of the SanDisk stake

In parallel, the company is moving quickly to monetize its remaining stake in SanDisk, valued at about $3.09 billion. The secondary offering covers Western Digital’s entire remaining position.

Key elements of the transaction:

-

The offering price implies a discount to the latest market close.

-

The deal is structured: it involves exchanging SanDisk shares for debt held by banks (including JPMorgan and Bank of America), followed by distribution to the underwriting syndicate.

-

Timing matters—exiting the stake around the one-year anniversary of the SanDisk separation may have meaningful tax implications.

-

Proceeds go to Western Digital, not to SanDisk—this is asset monetization, not a capital raise for the spun-off company.

For the market, the transaction points to a potential improvement in balance-sheet structure and greater financial flexibility for Western Digital.

How the market may interpret it

Taken together, the headlines reinforce a clear message:

-

Operationally: WDC is benefiting from the AI capex cycle and holds a strong position in the data infrastructure supply chain.

-

Financially: the company is simplifying its post-spinoff structure and may reduce leverage or strengthen liquidity.

-

Strategically: Western Digital is increasingly positioning itself as a beneficiary of the AI data-center investment cycle.

Risks to keep in mind

-

“Sold out” does not automatically translate into margin expansion; that depends on contract terms and production costs.

-

The AI boom is cyclical—any slowdown in hyperscaler investment could quickly change the outlook.

-

A large SanDisk block sale could create near-term supply pressure on SanDisk shares.

-

Valuations across AI infrastructure plays remain elevated, increasing sensitivity to shifts in sentiment.

Western Digital is taking advantage of supportive AI-driven tailwinds by securing multi-year demand for its products, while also closing the chapter on its SanDisk separation—strengthening the balance sheet ahead of the next phase of the capex cycle. For investors, it’s a blend of a growth narrative (AI storage demand) and a restructuring narrative (deleveraging and simplification), which could shape the stock’s trajectory over the coming quarters.

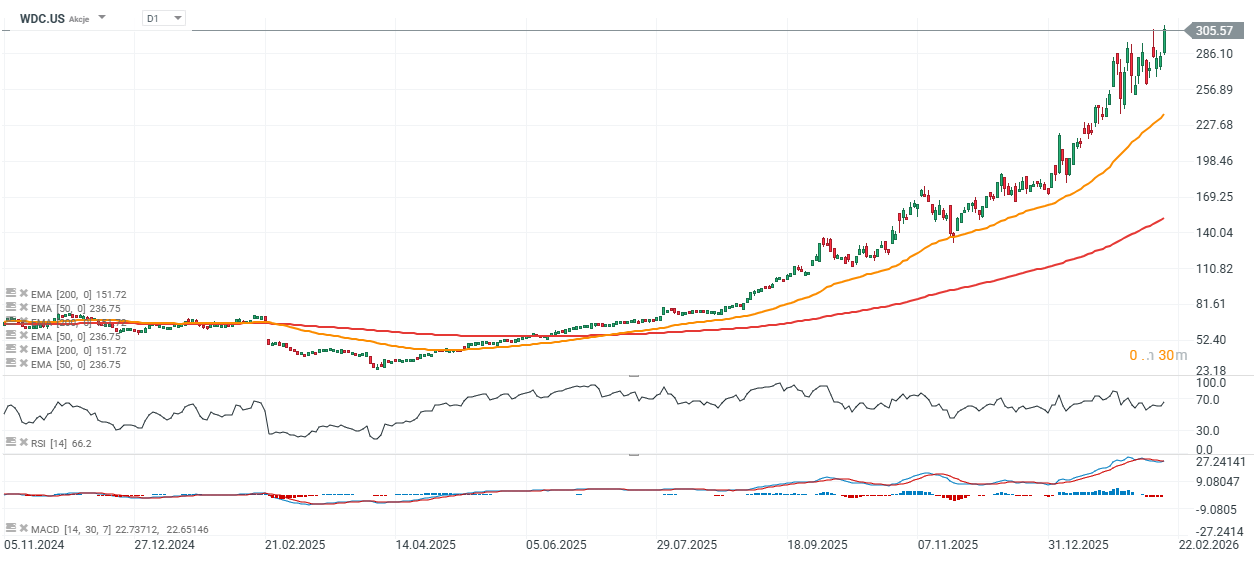

Source: xStation5

Daily summary: Wall Street and oil gain 📈 EURUSD slides 0.5%

Strong Quarter for Analog Devices and Record Outlook

US Open: US100 gains 1% 📈 Nvidia gains amid big orders from Meta

Palo Alto earnings: Is security cheap now?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.