easyJet (EZJ.UK) stock fell over 4.0% on Monday after the budget airline announced that its Chief Operating Officer Peter Bellew has resigned effective July 1 to “pursue other business opportunities and in the meantime is committed to ensuring a smooth transition” and that David Morgan will act as interim COO.

The British low-cost carrier stock price came under pressure after the company canceled thousands of flights scheduled for holiday season in order to contain the disruption caused to passengers from staff shortages in the air and on the ground. According to some estimates, no airline has canceled more flights than easyJet in recent weeks. Meanwhile its competitors WizzAir and Ryanair, which operate in the same macro-conditions surrounding airports and targeting a similar customer base, recorded rising passenger traffic. Ryanair load factor, which measures how well an airline is filling available seats, jumped to 95%, a level not seen since early stages of the pandemic.

However, according to John Strickland, director at air transport consultancy JLS Consulting, external factors are largely to blame for recent problems.

“They have needed to pre-plan more cancellations to increase resilience but have been hit by external factors such as localized ATC (Air Traffic Control) issues at Gatwick which is by far their largest airport for operations.” Strickland believes that the company's reputation was not permanently damaged in the short term.

On the other hand, if the level of customer dissatisfaction continues, then competition will benefit even more, which could put easyJet into even more serious problems.

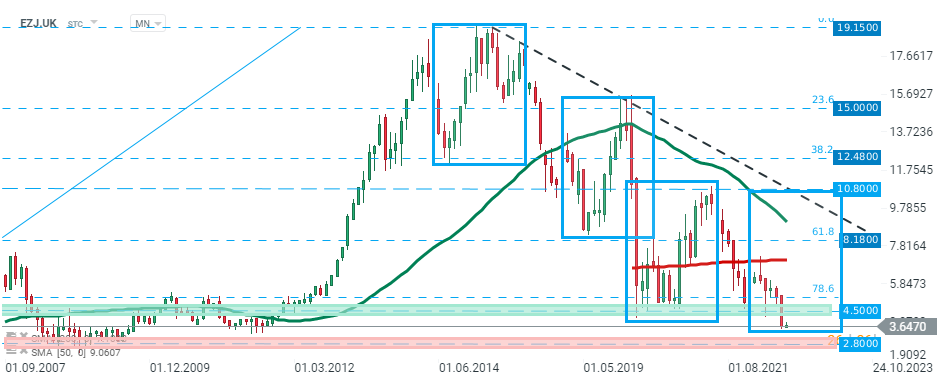

easyJet (EZJ.UK) stock fell to the lowest level since September 2011 and if current sentiment prevails, downward move may accelerate towards support at £2.80, where lows from 2008 are located. The nearest major resistance lies at £4.50 and is marked with previous price reactions. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.