The European Central Bank (ECB) left its key interest rates unchanged, with the deposit facility rate at 2% since June 2025. ECB President Christine Lagarde is set to speak in Frankfurt, where she will explain the rationale behind the decision and discuss recent developments in the eurozone economy.

Key insights from ECB's Lagarde:

-

The latest developments confirm inflation setting in the ECB's 2-percent target. Inflation continued to ease, mainly thanks to falling energy prices. Goods inflation ticked up slightly, while services inflation cooled. Long-term inflation expectations remain well anchored at 2%.

-

Eurozone economy grew 0.3% in Q4, showing modest but continued expansion despite a still-uncertain global backdrop. Growth was supported by information & communication services, while manufacturing showed resilience, easing earlier fears of a deeper industrial slowdown.

-

Construction activity is gaining momentum, partly driven by stronger public spending. Business sentiment is improving and firms are gradually lifting investment even amid lingering uncertainty.

-

Labour market conditions improved, with unemployment edging down to 6.2% from 6.3% in November. Rising real wages are supporting household consumption, while government spending is adding to domestic demand.

-

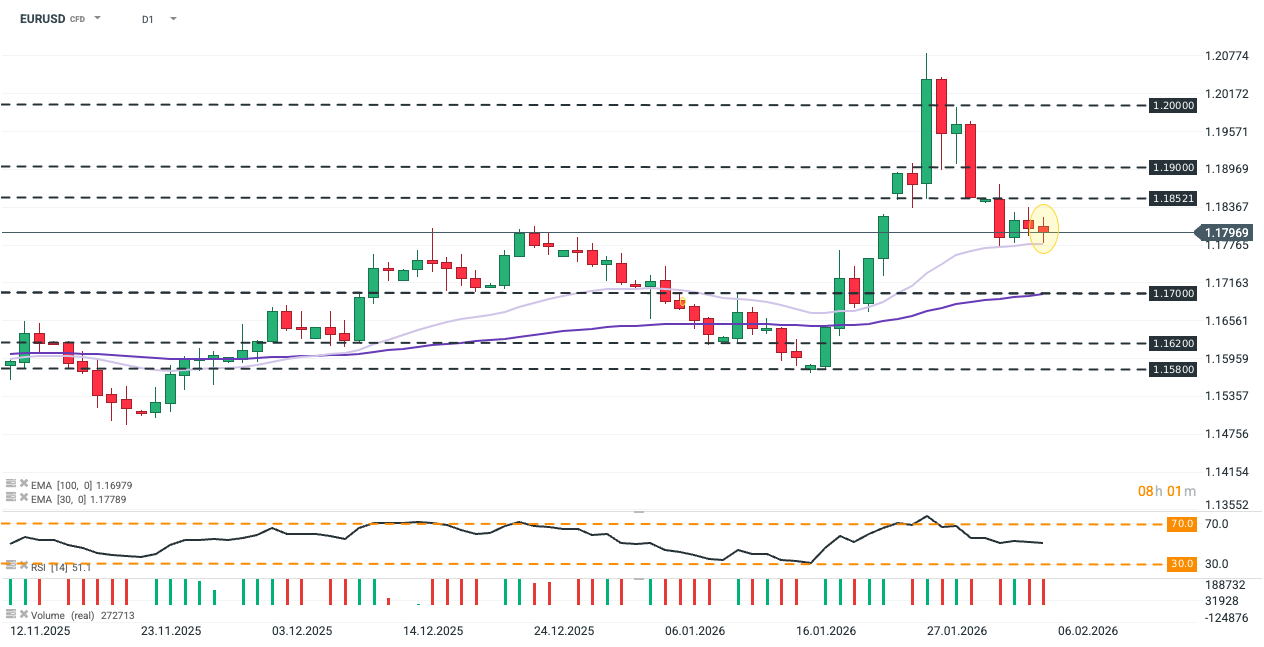

Stronger euro could push inflation below the target. The Governing Council discussed the EURUSD exchange rate during today's meeting. The impact of the appreciation of the euro is well incorporated, as the dollar's weakness has been developing gradually over almost a year and is staying within the expected range. Nevertheless, ECB doesn't target the rate with its policy.

-

ECB views further financial integration as one of the key conditions for the economic development of the Eurozone.

-

The monetary policy remains agile.

In conclusion, the ECB’s February decision reaffirmed a status-quo outlook for both the Eurozone economy and the policy path. Inflation remains on track toward the 2% medium-term target, while activity is gradually rebounding amid improved risk sentiment, stronger business confidence, and rising consumer spending. The EUR/USD exchange rate was discussed, though the ECB does not target a specific level and views the euro’s appreciation as already reflected in its outlook. The pair traded calmly during the conference, hovering around 1.18.

Source: xStation5

Daily summary: Red dominates on both sides of Atlantic

Disaster for Volvo shares. Is this the end of an iconic brand?

🚨US100 loses 2% amid US technology stocks sell-off

Technical analysis: Bitcoin deepens decline falling to $66.5k 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.