The market remains dominated by the ongoing sell-off in technology stocks and renewed pressure on precious metals, with overall tension expected to rise ahead of today’s high-impact macroeconomic releases.

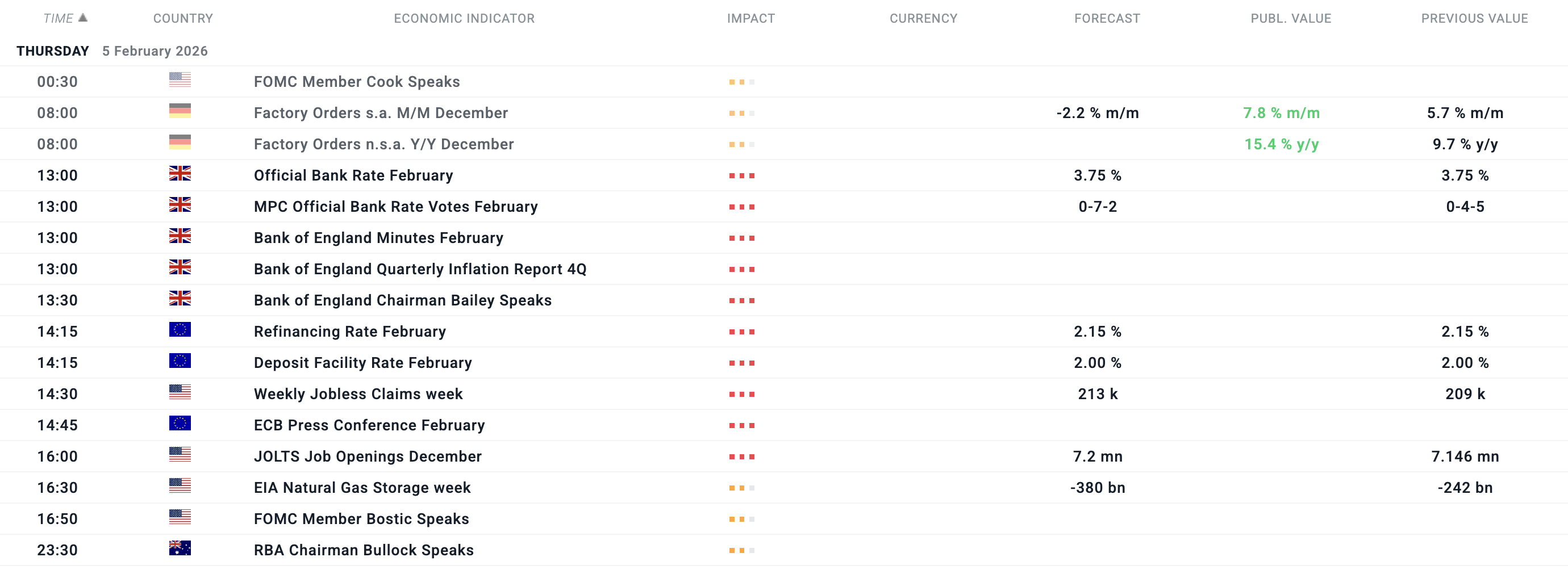

Thursday will be primarily shaped by central bank decisions in Europe. The Bank of England (BoE) will publish its interest rate decision at 12:00 PM GMT, followed by the European Central Bank (ECB) at 1:15 GMT.

While both institutions are expected to keep rates unchanged, the focus will be on the accompanying rhetoric. The BoE may signal a readiness for further cuts in the coming months, whereas the ECB is likely to reaffirm a favorable balance of risks, characterized by inflation reaching its target and gradual, albeit uneven, economic recovery in the Eurozone.

In the U.S., investors await another series of labor market data. Alongside weekly jobless claims, the JOLTS report on job openings will be released. Yesterday’s weaker-than-expected ADP employment report (showing only 22,000 new jobs) set a relatively pessimistic tone; therefore, any further signs of labor market weakness could stall the current gains seen in the U.S. dollar.

Financial results will be presented by companies including: Amazon, Shell, UniCredit, BNP Paribas, Philip Morris.

All times CET (GMT+1). Filtered by US, UK, Eurozone, Germany, France, Japan, Australia, New Zealand, medium and high importance. Source: xStation5

Daily summary: Red dominates on both sides of Atlantic

Disaster for Volvo shares. Is this the end of an iconic brand?

🚨US100 loses 2% amid US technology stocks sell-off

Technical analysis: Bitcoin deepens decline falling to $66.5k 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.