- Futures point to a mixed opening for the cash session in Europe.

- The focus is on technology companies, defense contractors, and the real estate market.

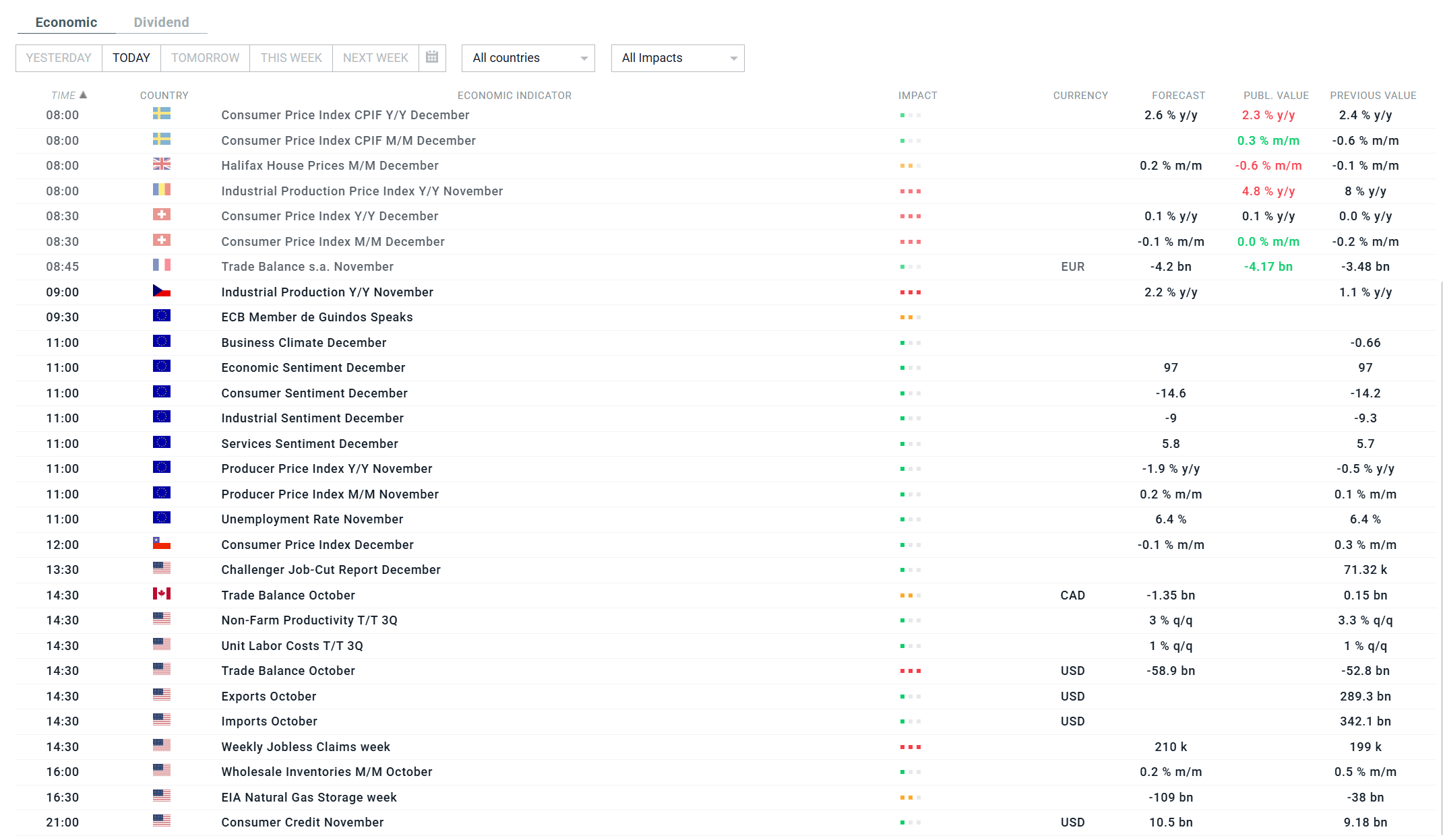

- The calendar includes, among other things: the US trade balance, jobless claims data, and the Challenger report on the labor market.

- Futures point to a mixed opening for the cash session in Europe.

- The focus is on technology companies, defense contractors, and the real estate market.

- The calendar includes, among other things: the US trade balance, jobless claims data, and the Challenger report on the labor market.

Fifteen minutes before the opening of the cash session in Europe, futures contracts point to a mixed picture for today's session, with a slight bias towards declines. The DE40 is currently down 0.1%, while the VSTOXX contract, which reflects volatility on the European trading floor, is up 0.63%. Markets are retreating after yesterday's comments by Trump, which hit real estate and defense companies, causing significant sell-offs in their shares. However, tech companies centered around Nvidia may be a light at the end of the tunnel after the Chinese establishment announced a moment ago that China will once again approve certain purchases of Nvidia H200 processors this quarter, mainly for purely commercial purposes. Beijing is expected to continue to ban the use of H200 processors in government agencies and critical infrastructure. This news may provide some enthusiasm as trading begins in the US, unless the markets take a different direction.

Detailed macro calendar for the day (CET time):

Daily summary: Markets recover optimism at the end of the week

Three Markets to Watch Next Week (09.01.2026)

What does newest NFP report tells us?

US OPEN: Investors exercise caution in the face of uncertainty.

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.