-

French inflation miss: Annual CPI fell to 0.3% against an expected 0.6%, signaling a sharp cooling of price pressures in the Eurozone's second-largest economy.

-

US data blackout: The ongoing government shutdown has halted BLS operations, leading to an official delay of this Friday's Non-Farm Payrolls report.

-

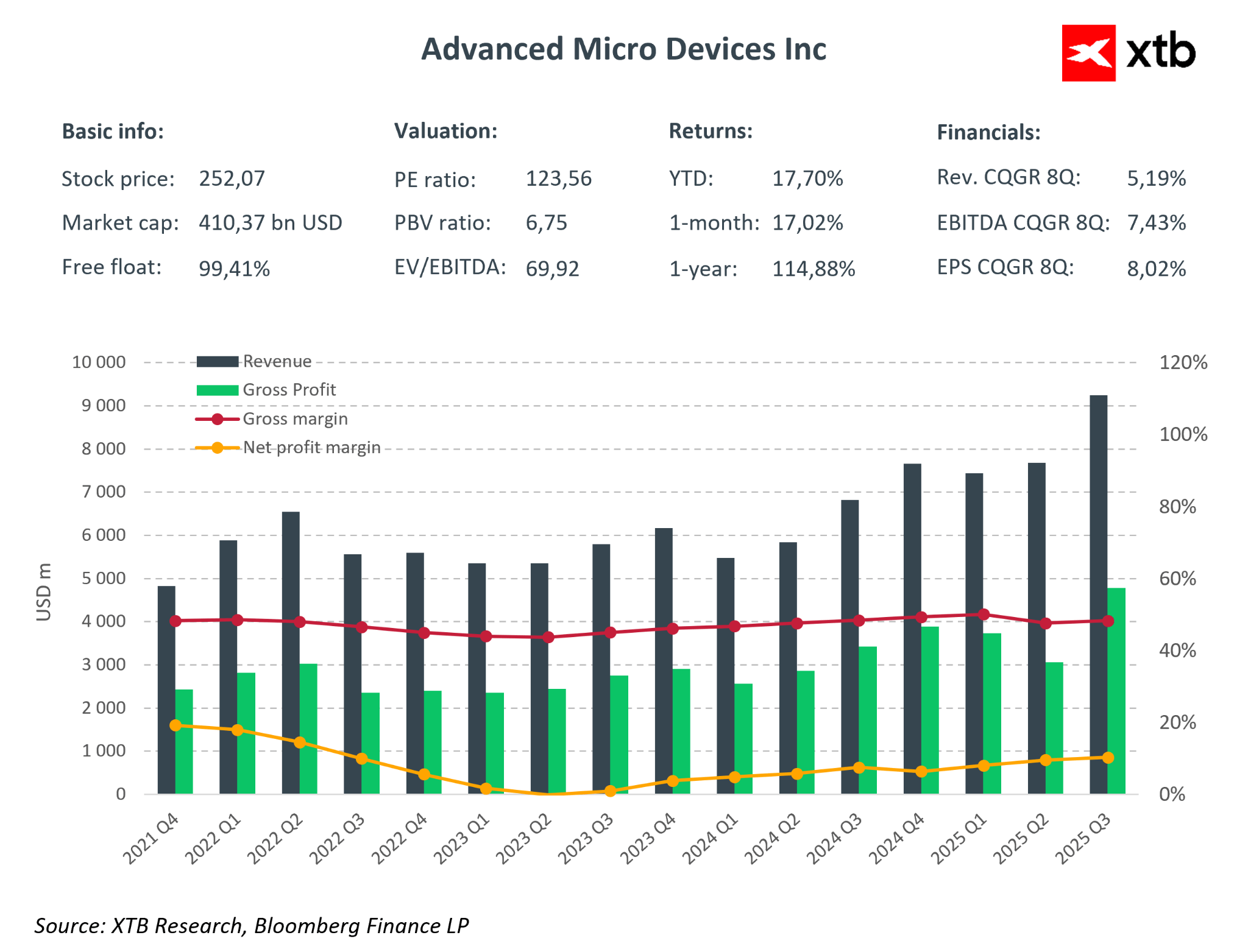

Corporate focus: Markets await AMD's results tonight, with the chipmaker expected to post a 27% revenue surge to $9.67bn amid high AI-driven expectations.

-

French inflation miss: Annual CPI fell to 0.3% against an expected 0.6%, signaling a sharp cooling of price pressures in the Eurozone's second-largest economy.

-

US data blackout: The ongoing government shutdown has halted BLS operations, leading to an official delay of this Friday's Non-Farm Payrolls report.

-

Corporate focus: Markets await AMD's results tonight, with the chipmaker expected to post a 27% revenue surge to $9.67bn amid high AI-driven expectations.

The global macroeconomic schedule for the European and North American sessions is relatively light following earlier significant releases. Markets have already digested the Reserve Bank of Australia’s decision to hike interest rates—a move that defied forecasts from several investment banks that had expected the RBA to hold steady for longer. Meanwhile, inflation data out of France continues to surprise to the downside. French annual CPI slowed to just 0.3% year-on-year, missing the 0.6% consensus and cooling significantly from the previous 0.8%. On a monthly basis, prices fell by a sharp 0.3%.

The primary focus for market participants this week remains the operational paralysis in Washington. The ongoing US government shutdown has shuttered key federal agencies, including the Bureau of Labor Statistics (BLS). Consequently, the highly anticipated Non-Farm Payrolls (NFP) report, originally slated for this Friday, has been officially delayed.

In the absence of top-tier US employment data, today’s agenda shifts to central bank rhetoric, private inventory data, and New Zealand’s labor market update. Investors also remain laser-focused on the corporate earnings cycle, with AMD set to report after the closing bell in New York.

Economic Calendar (All times GMT)

-

13:00 – Fed’s Barkin speaks

-

14:40 – Fed’s Bowman speaks

-

21:40 – API Weekly Crude Oil Stock Report

-

21:45 – New Zealand Labour Market Data (Q4):

-

Employment Change: Exp. 0.5% q/q; Prev. 0.5% q/q

-

Labor Cost Index: Exp. 0.3% q/q; Prev. 0.0% q/q

-

Unemployment Rate: Exp. 5.3%; Prev. 5.3%

-

-

22:00 – Australia Services PMI: Exp. 56; Prev. 51.1

Corporate Earnings

-

AMD (AMD.US) – After market close

-

Merck (MRK.US) – Pre-market

-

PepsiCo (PEP.US) – Pre-market

-

Pfizer (PFE.US) – Pre-market

AMD is expected to post revenue of $9.67bn, representing a 27% year-on-year increase. Should the company meet these targets, it would build on the momentum from Q3, where revenues beat the consensus by 5%. Consensus EPS stands at $1.32. Historically, AMD has a track record of moderate outperformance, beating revenue estimates by an average of just over 2% over the past eight quarters.

Amazon shares tumble 10% as investors recoil at the price of AI dominance

Daily summary: Red dominates on both sides of Atlantic

US OPEN: Market under pressure from lacklustre tech earnings season

Palantir after earnings: another quarter, another record

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.