- Record Alphabet CAPEX, are they no longer enough?

- Gloomy picture of labor market

- Qualcomm recovers from initial decline amid bad forecasts

- Broadcom benefits from CAPEX race

- Record Alphabet CAPEX, are they no longer enough?

- Gloomy picture of labor market

- Qualcomm recovers from initial decline amid bad forecasts

- Broadcom benefits from CAPEX race

US indices remain under selling pressure in Thursday’s session. Since the start of the week, the main Wall Street indices have already fallen by more than 6%. The key drivers are disappointments regarding earnings from some technology giants, as well as doubts about the justification and pace of the next interest-rate cut cycle in light of incoming data.

At the US session open:

- S&P 500 futures are down approx. 1.5%.

- Nasdaq 100 futures are down approx. 1.2%.

- Russell 2000 futures are down approx. 0.7%.

- Dow futures are down 0.4%.

Macroeconomic data:

- Challenger published its layoffs report. The reading rose in January from 35k to 108k.

- Initial jobless claims data in the US were also released. The initial claims figure came in above market consensus. Investors expected an increase to 213k, but the reading showed 231k.

- Continuing claims came in below expectations. They also increased, but only to 1.844 million versus 1.850 million expected.

- JOLTS has also shown greater than expected cooling: 6,5 milion vs expected 7,2 milion jobs were added. This registers decline from 6,9 milion month prior.

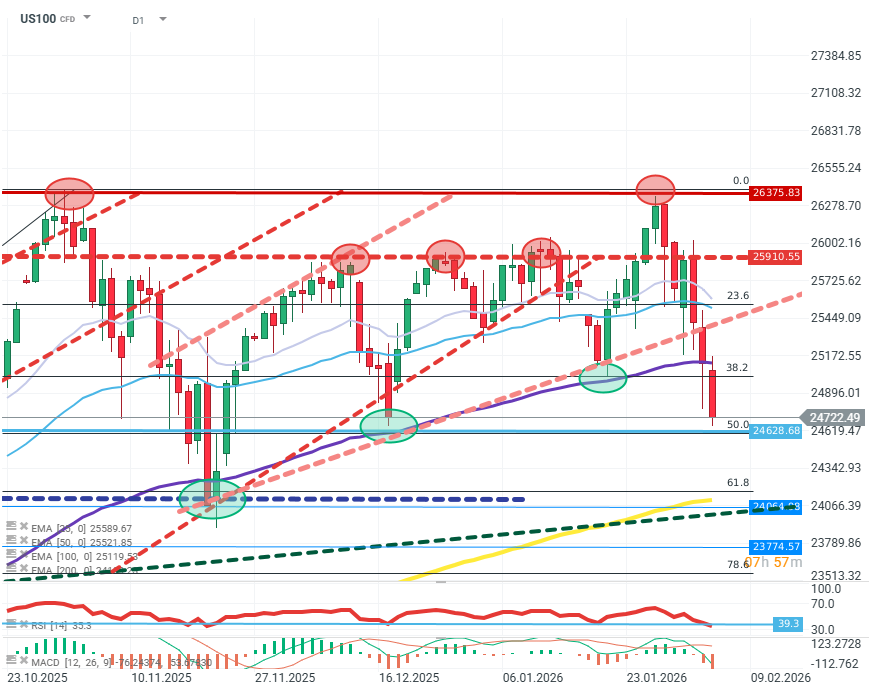

US100 (D1)

Source: xStation5

The index price clearly and sharply broke the uptrend line that had been in place since November 2025. Sellers decisively took control, moving below the 38.2% Fibonacci support level and the 100-period EMA as well. The first strong resistance zone encountered is the 50% Fibonacci level. If buyers want to halt potential declines, a quick return above the 38.2% Fibonacci level will be necessary. If that fails, a further drop toward the 61.8% Fibonacci level is likely.

Company news:

- Alphabet (GOOGL.US): Shares are falling after the announcement of massive capital expenditures—up to USD 185bn in 2026. The stock is down nearly 4%.

- ARM Holdings (): The company initially declines after earnings on the back of weak sales guidance, especially in the smartphone market, but later recovers losses. The price is up around 2%.

- Hershey Company (): The food conglomerate posted results above expectations. The company points to rising prices, new product lines, and resilient consumers.

- Qualcomm (): During its earnings call, the company delivered exceptionally disappointing sales guidance. Management notes that memory prices have entered a demand-destruction phase, weighing on the broader electronics device market. Shares are down nearly 10%.

- Broadcom (): The semiconductor manufacturer gains as much as 4% on the back of new, record-high capex plans from technology giants.

- Carrier Global (): The HVAC solutions maker posted weak sales results; the stock is down more than 6%.

Amazon shares tumble 10% as investors recoil at the price of AI dominance

Daily summary: Red dominates on both sides of Atlantic

Palantir after earnings: another quarter, another record

Economic Calendar: US Data Distorted by Government Shutdown

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.