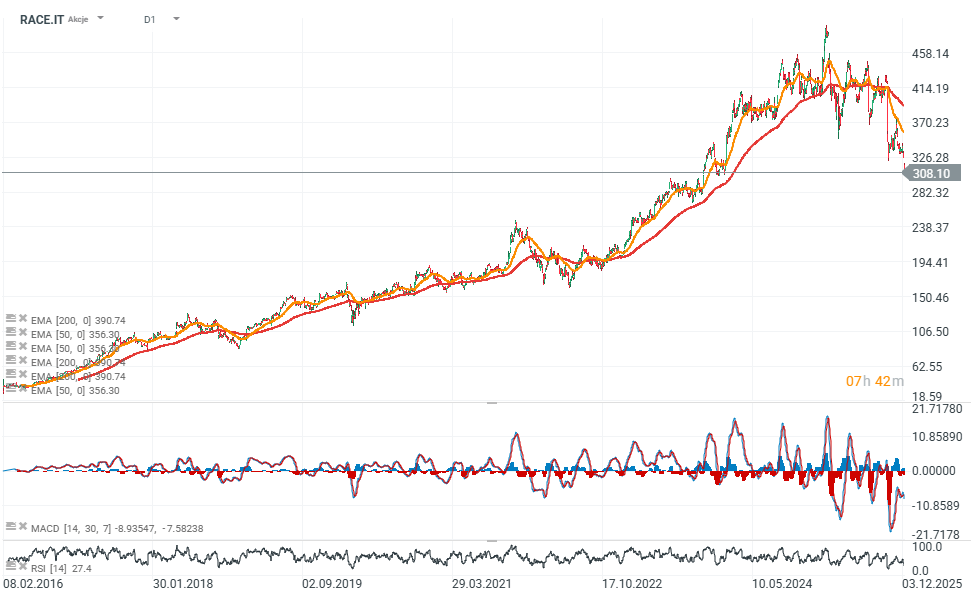

Ferrari (RACE.IT) shares dropped to their lowest level in nearly two years (23 months), falling to €312.90 after yet another analyst downgrade. Oddo BHF cut its rating for the second time this week, lowering it from Outperform to Neutral and reducing the price target from €430 to €340. The downgrade is partly due to a slower-than-expected rollout of the F80 model; the 2026 delivery forecast was reduced from 250 to 200 units. Oddo also lowered its 2026 EBIT estimate by 3.4%, indicating that results may remain below consensus.

- Earlier, Morgan Stanley also downgraded Ferrari, reducing its price target to $367 and pointing to limited volume growth through 2030. According to analysts, the strategy of protecting brand exclusivity is positive but implies more moderate short-term growth.

- Ferrari’s revenue growth is expected to remain below 5% over the next three quarters, mainly due to slower shipments and delays in new launches. Morgan Stanley also highlighted uncertainty surrounding the upcoming electric model and ongoing concerns about residual values, which are currently capping the company’s valuation multiples.

- Since the beginning of the year, Ferrari shares are down around 25%; earnings forecasts have been revised lower, and valuation multiples have corrected from last year’s highs.

- Jefferies analysts also lowered Ferrari’s price target from €345 to €310, maintaining a Hold rating as the stock trades near its 52-week low after a 20% decline over the past six months.

- The downgrade reflects revised 2026 forecasts, with Jefferies accounting for Ferrari’s steady pace of new model introductions planned for next year.

- The firm expects these launches to temporarily reduce vehicle shipments and put pressure on margins due to rising depreciation and amortization expenses. The reduced price target reflects valuation headwinds that may persist as consensus estimates continue to be revised downward.

- Jefferies now forecasts 6.7% growth and €9.32 EPS in 2026, below the market consensus of 8.2% growth and €10.05 EPS. Ferrari recently secured a €350 million revolving credit facility for general corporate and working capital purposes. The facility was arranged with a consortium of twelve banks.

Analyst sentiment toward Ferrari remains mixed, with current recommendations as follows:

-

Morgan Stanley downgraded the stock to Equalweight, citing limited volume growth until 2030.

-

UBS raised its price target to $563 and maintained a Buy rating, arguing that Ferrari’s growth targets are conservative.

-

Goldman Sachs initiated coverage with a Buy rating, expecting Ferrari to outperform consensus in 2026 and 2027 thanks to rising average selling prices.

-

Morgan Stanley also initiated coverage of Ferrari’s European listing with an Equalweight rating and a €367 price target.

Source: xStation5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.