Sentiment on Wall Street is weak in early Monday trading, with US500 futures down nearly 1.3%. The primary reason is that investors still see no signs of a de-escalation in trade tensions from either the U.S. or China. Beijing has reiterated that it will not accept what it calls the U.S.’s 'imperial' stance, and once again launched military drills in the Taiwan Strait.

- Additionally, there is no major trade agreement on the horizon. Japanese diplomats have not signed any deal with the U.S., signaling that American trade proposals may still be deemed ‘unacceptable’ by several nations.

- Uncertainty surrounding Federal Reserve policy is also weighing on stocks. The U.S. dollar (USDIDX) has dropped to its lowest level since March 2022, after Donald Trump threatened that he is willing—and able—to fire Fed Chair Jerome Powell.

- Today, commercial lines casualty and property insurance company, W R Berkley (WRB.US) is the largest companies that will report earnings. Comerica (CMA.US) reported better than expected results, shares of regional banking company are up almost 11% in US pre-market.

Tomorrow GE Aerospace, RTX Corp and Lockheed Martin will report earnings before the market open. After the US session, Tesla, Intuitive Machines and SAP will report. Chinese CATL launched new generation of batteries for Chinese EV models, and market may see this fact as further pressure on Tesla business.

Start investing today or test a free demo

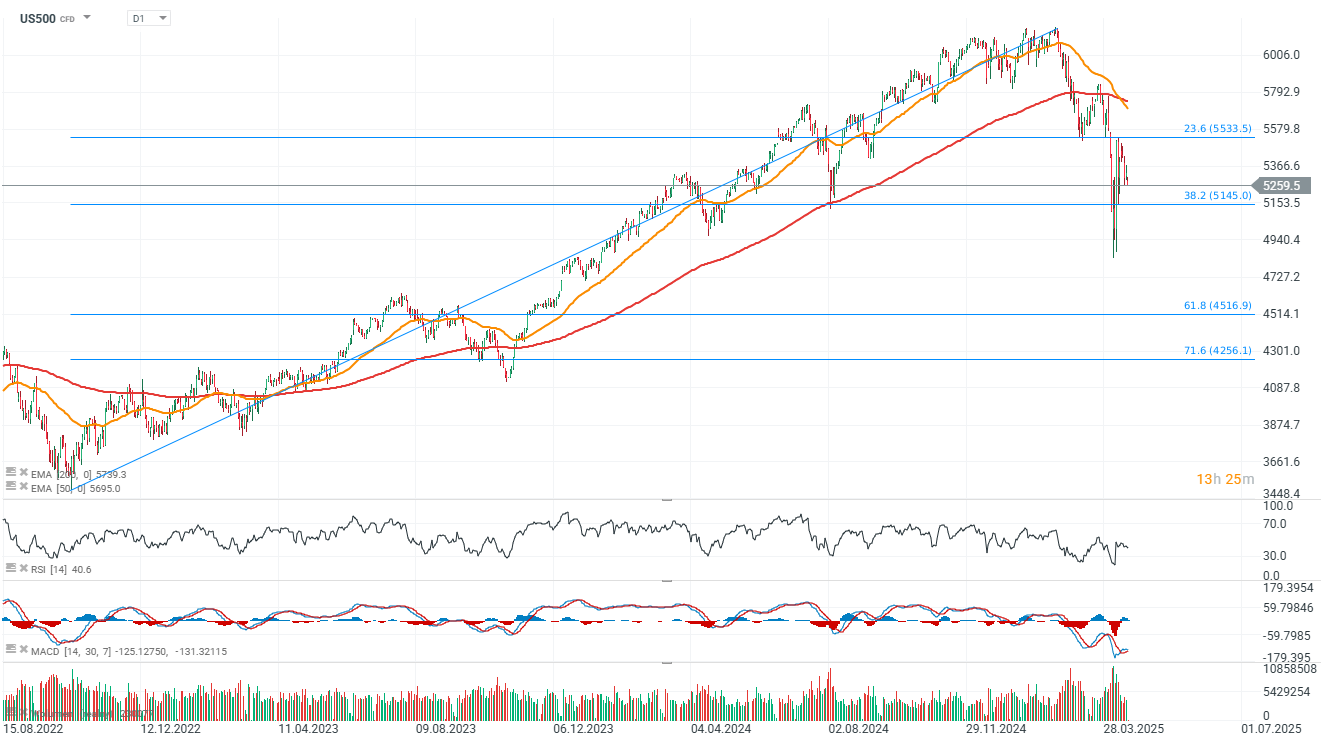

Create account Try a demo Download mobile app Download mobile appUS500 (D1 interval)

Source: xStation5

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.