Meta Platforms (META.US) shares have become one of the winners of the artificial intelligence trend, bouncing nearly 550% from the 2022 low. The company will be the first U.S. company with a capitalization of more than $1 trillion to report Q1 results, opening a season of 'BigTech' reports that could significantly impact stock market sentiment.

- Wall Street sentiment around the company's shares has been improving over the past several months, when the widely expected recession did not arrive, supporting the prosperity of the advertising industry and the performance of Meta, which gathers more than 3 billion users in applications (Facebook / Messenger, WhatsApp, Instagram).

- What's more, the company's involvement in AI may give it some 'first mover' advantage, over competitors in the social media industry. Wall Street, in a report published today, after the US session, will be looking for the first signs of how much the likely costly work on AI has supported the company's business, and what Meta itself expects.

Q1 Expectations

The company has beaten revenue estimates for 6 consecutive quarters and profit forecasts for 4 consecutive quarters. Disappointment in this regard, as well as the failure to revise upward the positive forecasts so far, could be negatively perceived by Wall Street and provide an excuse to take profits.

- Expected revenues: $36.16 billion vs. $28.65 billion in Q1 2023 (the upper range of the company's estimate of $34.5 billion to $37.0 billion)

- Expected earnings per share (EPS): $4.32 vs. $2.20 in Q1 2023

For the FY 2024 earnings per share are projected to rise 35% YoY to $20.07 per share, with revenues rising to of $158.48 17.5% YoY. Investors expect also higher profits due to layoffs, thanks to it Meta will limit expenses by $30 billion in 2024, as the company become leaner, trying to generate profits faster and with lower capital costs. Q4 ad impressions and price per ad impressions delivered by meta apps grew by 21% YoY, with average price per ad higher 2% on YoY measures. Faster dynamic than that may be another catalyst to Meta.

What to watch for: AI and China

Meta said that its latest AI model (Llama 3) outperformed Google Gemini, Anthropic Claude 3, and Mistral AI, which in pair with Zuckerberg planning buying Nvidia H100 AI GPU's for $1 billion suggesting, that AI will be probably the most important during the company conference call.

- Roth Capital suggested that the market's expectations are quite high, in view of potentially costly for the company and still unresolved regulations in the European market. However, the fund expects that investors can expect to beat and raise forecasts, with revenue higher than $37 billion and second-quarter guidance to be raised to around $39.5 billion. At the same time, underlying factors and the uncertainty surrounding the possible risk of recession in the US, as well as globally (a pro-cyclical advertising industry) mean that investors may refrain from large investments in Meta, over the horizon of the next few months.

- Additional attention will be given to the impact of advertisers from China (1/3 of Meta's ad sector growth, in 2023), where the company faces intervention from state regulators. The company may also see a pullback related to China's slowing economy and modest consumption in the country, which is likely to put broader pressure on advertising revenues. At the same time, Meta's business fundamentals are improving, and AI capabilities and access to massive amounts of data could improve profits in the future; moreover, Meta is seeing higher growth in advertiser interest than smaller competitors, according to analysts.

New Products and Instagram Reels

- Goldman Sachs expects the digital advertising market to remain strong in the coming twelve months, making Meta an obvious beneficiary of such a situation. Analysts see also catalyst of monetizing the relatively new Reels channel. According to Goldman, advertiser interest regularly shifts toward virtual platforms; monetization of short videos, among other things, has improved. Instagram Reels has reached, in Goldman's assessment, a tipping point in terms of revenue and should remain a key driver of Meta's growth momentum, in the years ahead;

- Wall Street will turn its attention to improving profitability, although it expects higher capital expenditures related to, among other things, the introduction of a new version of Meta AI (AI in WhatsApp and Messenger, and implementation in Instagram and Facebook). Certainly, investors are also hoping that other, as yet undiscussed AI use cases will be presented by Meta at a conference with analysts;

- Meta is likely to increase investment in its data center and GPU in response to its commitment to AI development (positive for Arista Networks (ANET.US). JP Morgan believes that the AI used by Meta will likely be the first generative AI used by global users, so the scale and role of the company's implementation of this will be enormous, as will the expectations associated with it. Analysts expect that with Meta AI, the company will gain the chance to capture traffic related to user queries;

- Wells Fargo expects growth in overall e-commerce industry and advertising revenue in the first quarter of the year. Still, analysts believe the trend will weaken in the second quarter of the year, as the market keeps a close eye on Meta's new products and their real business impact. Wells pointed out that as the positive impact of macroeconomic factors slows, attention will shift to the profitability and quality of the company's new products. Instagram Reels ads continued to grow, increasing 22% compared to 16.4% in January; despite the weakness of rival TikTok.

In a nutshell, Wall Street hopes AI will bring the company new areas of business, data aggregation and monetization; as a result, the market is poised to higher stock valuation. Pew Research data from February 2024 showed that 23% of American adults used ChatGPT; Meta could potentially benefit from additional searches and personalized interactions. Investors would like to see that positive influence of AI implementation is seen as fast as it's possible and if Meta's Q1 report will show it, sentiments may improve. On the other hand lack of seeing improvement and no specific guidance may lead to disappointment.

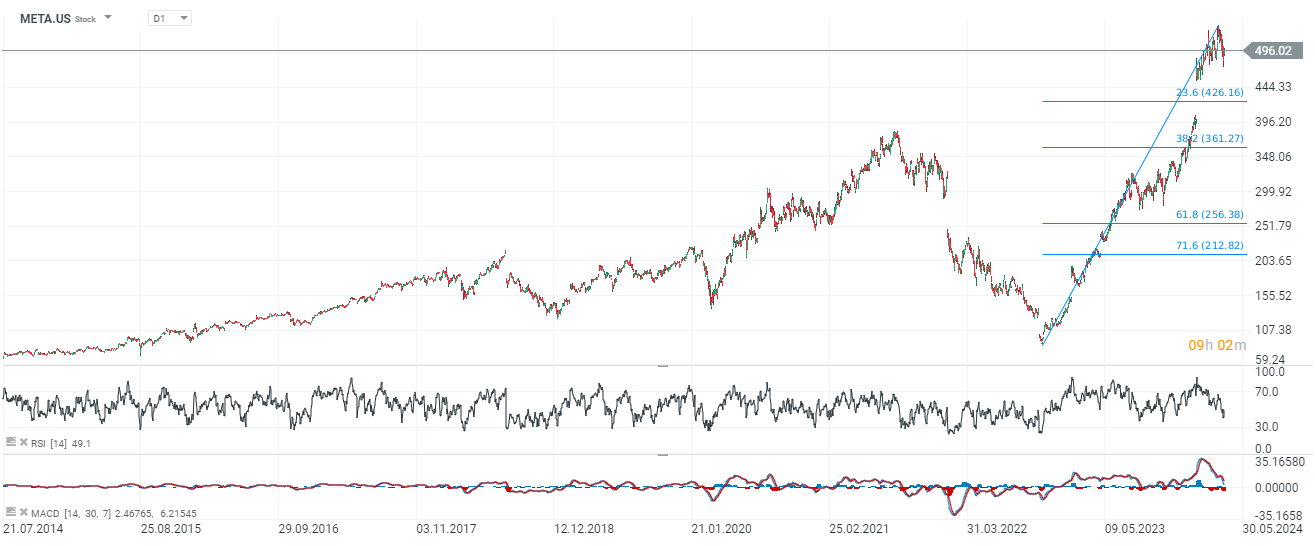

Meta Platforms shares (D1 interval)

The years between 2022 and 2024 have seen unprecedented growth for the company, both in terms of capitalization and the sheer momentum of its share price. Currently, Meta's shares are trading about 10% below the historical highs of March 2024.

Source: xStation5

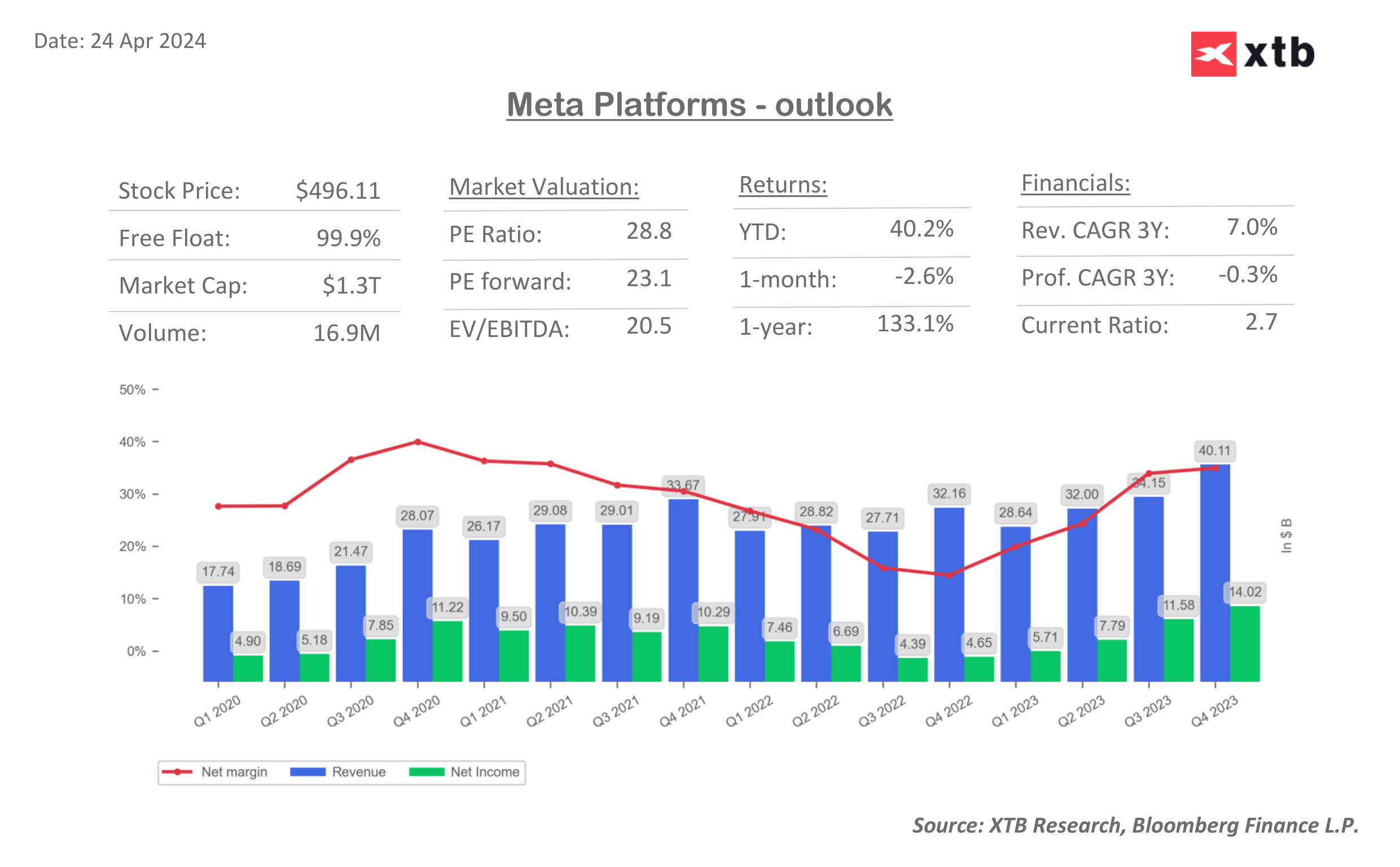

Meta's net margins are still several percent lower than they were in 2020-2021. Will AI help the company achieve productivity gains, and how quickly will investments in this field turn into profits? Source: Bloomberg Finance LP, XTB Research

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.