Micron is up 10% today to $153 per share after Citi raised its price target to $175 (from $150).

The upcycle in the memory market remains intact thanks to high barriers to entry, thus limited supply, and stronger-than-expected demand — especially from data centers and AI. Micron will report its fiscal Q4 results on September 23. Citi expects results roughly in line with consensus (~$2.62 EPS on $11.2bn revenue), but guidance clearly above expectations, driven by higher DRAM and NAND volumes and pricing. Citi’s FY26 EPS estimate is 26% above consensus.

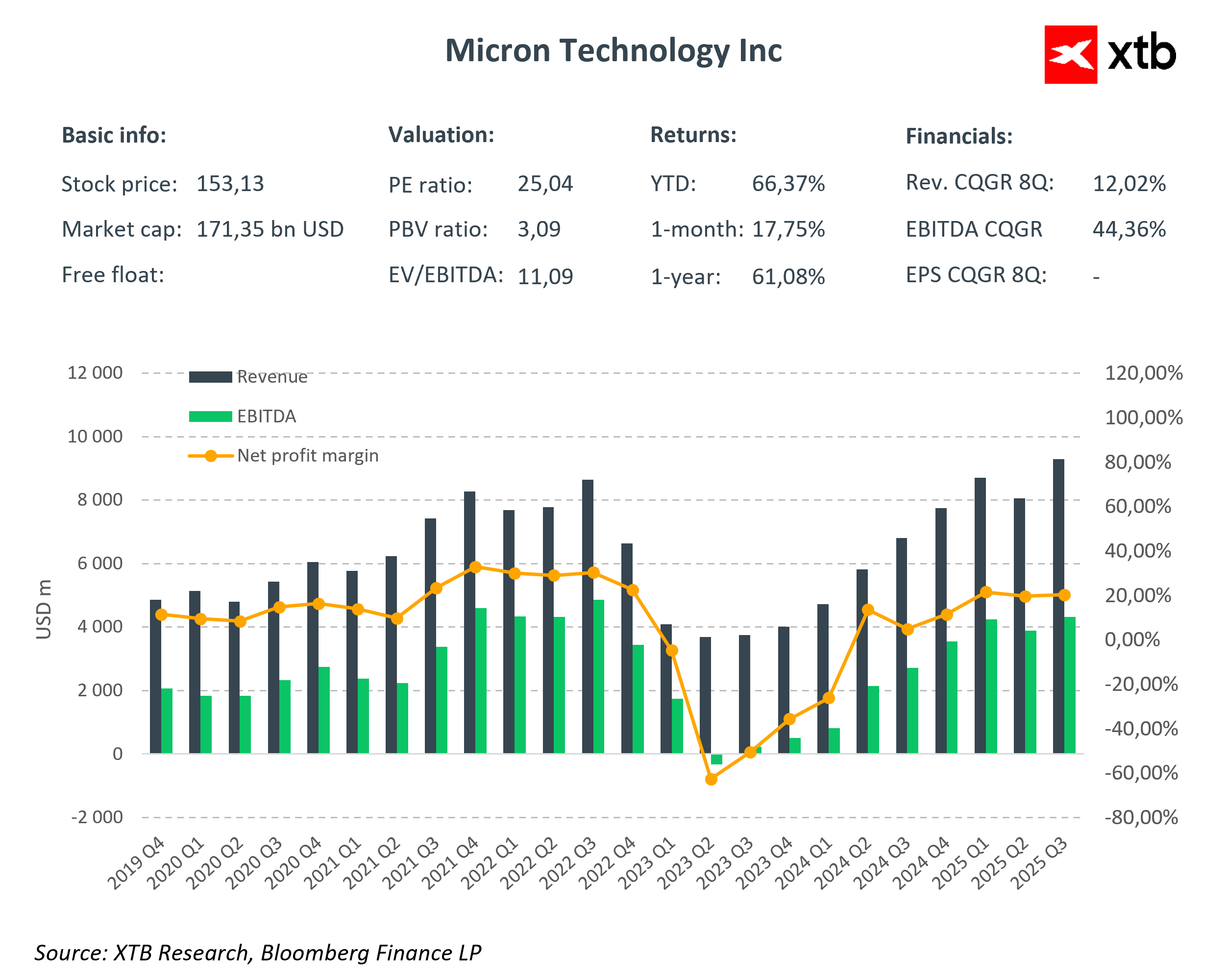

Micron financial dashboard

Morgan Stanley estimates that AI-related NAND demand could reach 34% of the global market by 2029, expanding TAM (total addressable market) by ~$29bn. As a leading NAND supplier, Micron has the opportunity to become a leader in the enterprise SSD segment.

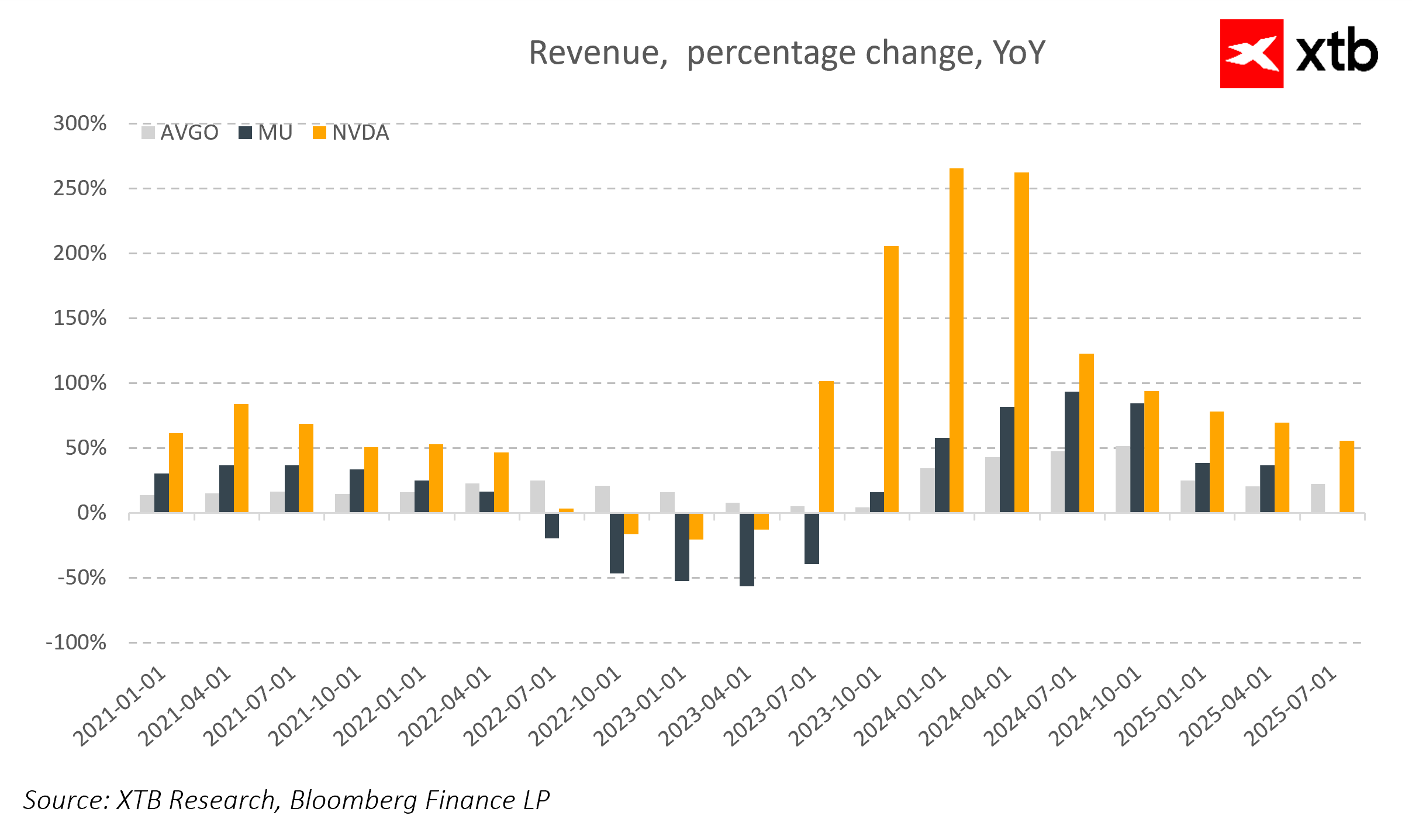

Micron’s revenue momentum has been significantly stronger in recent quarters, though still far below Nvidia in absolute terms. However, forecasts for 2026 appear optimistic for the company.

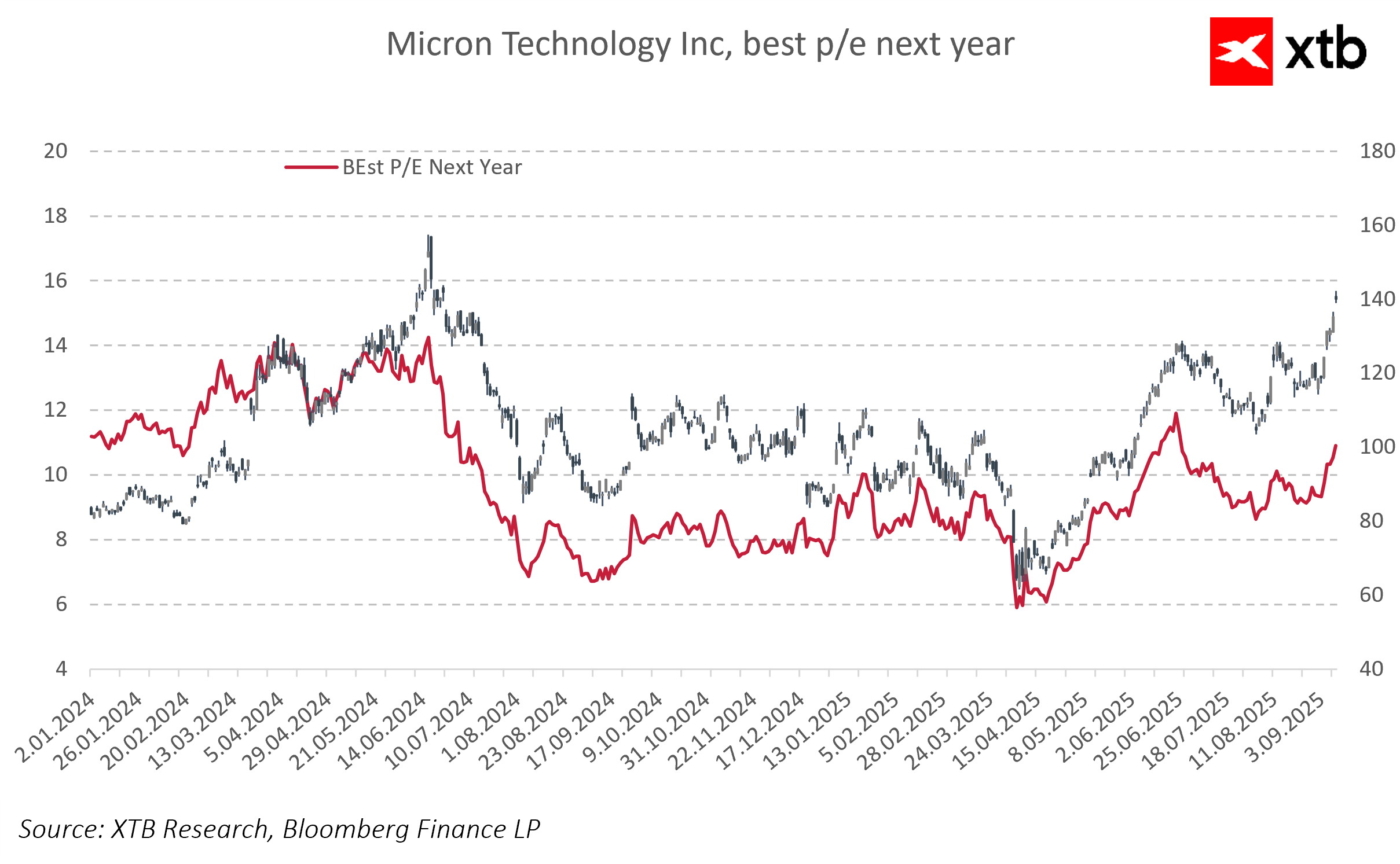

Valuation also does not appear overly stretched. Forward PE for next year stands at just around 11 compared with the current PE above 25.

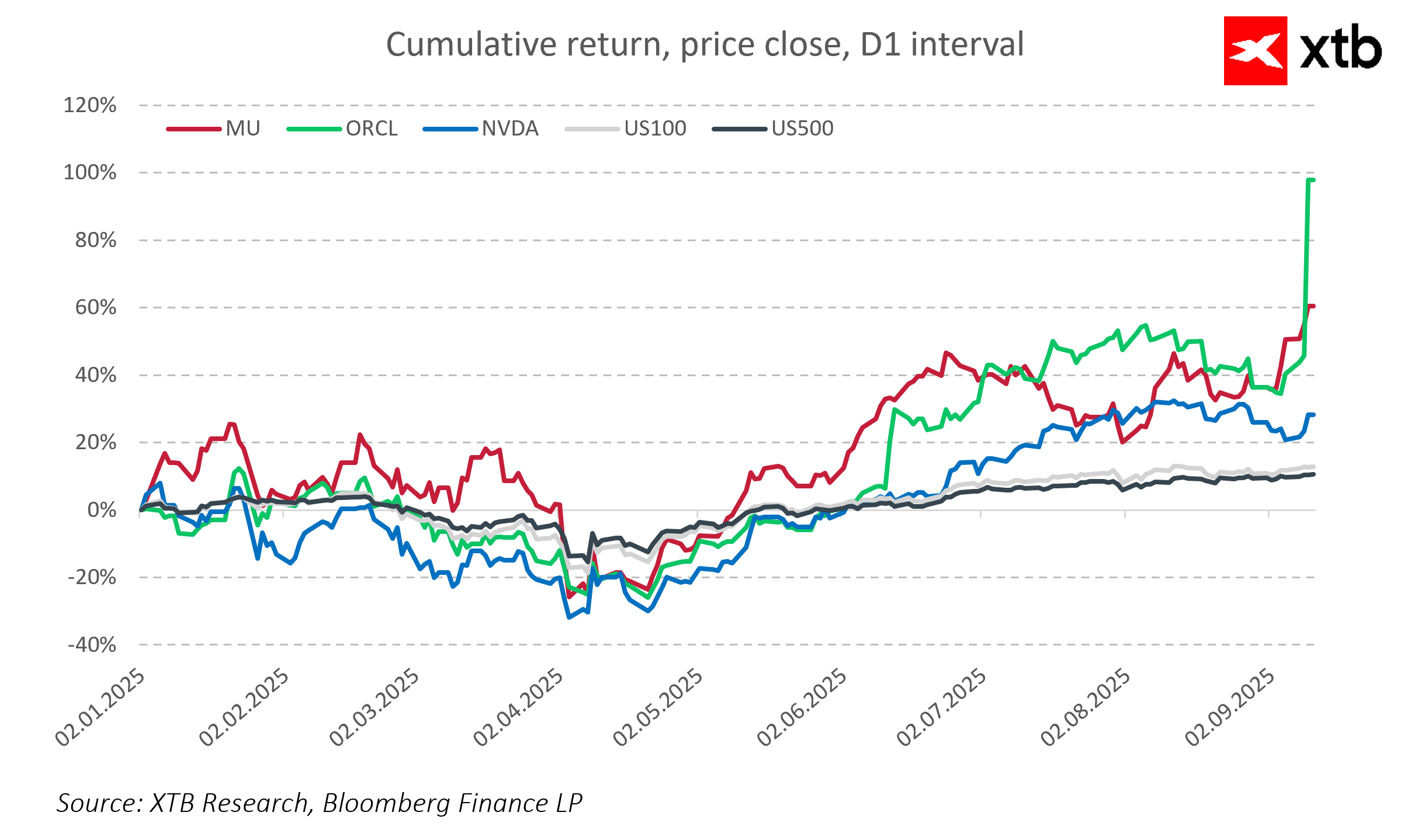

Micron is up 10% today and already more than 60% year-to-date — comparable to other semiconductor peers and clearly outperforming the US500 and US100 indices.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.