Microsoft denied reports from The Information, which claimed the company had lowered sales growth targets and limits for selected AI products after some sales teams failed to meet their plans. The report cited sources within Azure and indicated that:

- The Carlyle Group reduced spending on Copilot Studio due to data-integration issues;

- Microsoft Foundry failed to meet assumptions tied to customer spending.

Microsoft rejected these allegations, arguing that the report mixes growth expectations with sales quotas, which — as the company emphasizes — have not been reduced. The entire situation comes amid growing market concerns that AI adoption is progressing more slowly than expected, and that only a small portion of projects move beyond the pilot phase. At the same time, tech giants are under increasing pressure to prove that massive AI investments — including Microsoft’s record-breaking 35 billion USD in capital expenditures last quarter — will translate into lasting revenue.

Despite the challenges, Microsoft continues to report solid Azure growth and expects capacity constraints to persist until mid-2026 due to strong demand. The company remains one of the primary beneficiaries of AI infrastructure, although slower implementation and reports of customer-side issues are increasing investor caution and prompting comparisons to earlier tech bubbles.

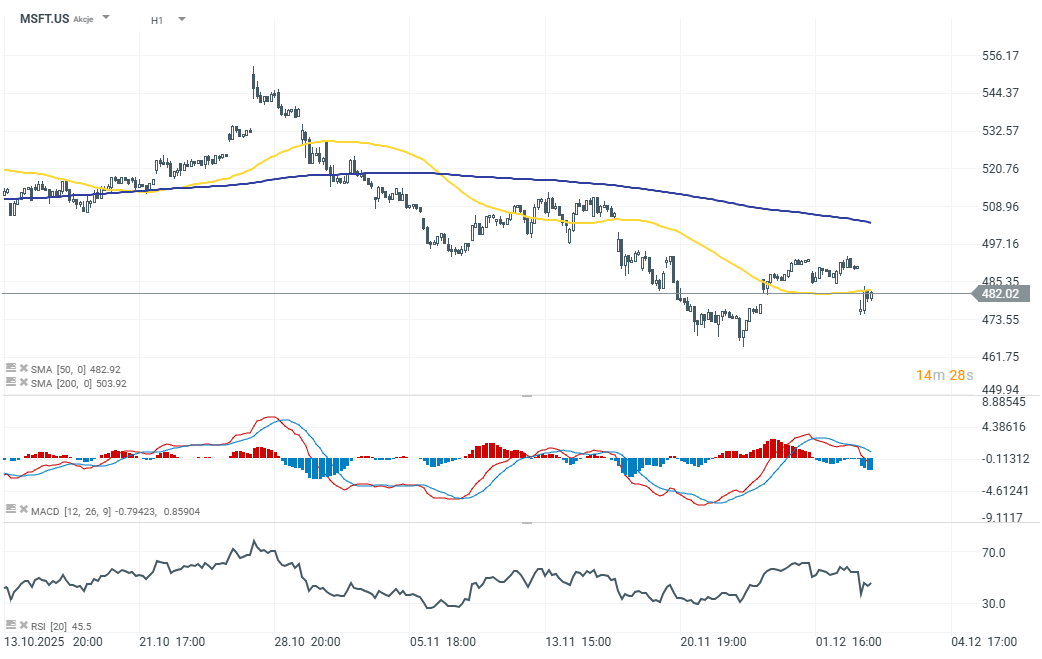

After The Information published its report, Microsoft shares initially fell nearly -3% to around 475 USD. However, they have since partially recovered to about -1.65%, trading near 481 USD.

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.