MicroStrategy’s preferred shares have lost nearly 7.0% and 13.5% this month as sentiment in the cryptocurrency market deteriorated. As a result, the decline in preferred shares raises questions about the company’s ability to continue financing Bitcoin purchases and covering cash-paid dividend obligations.

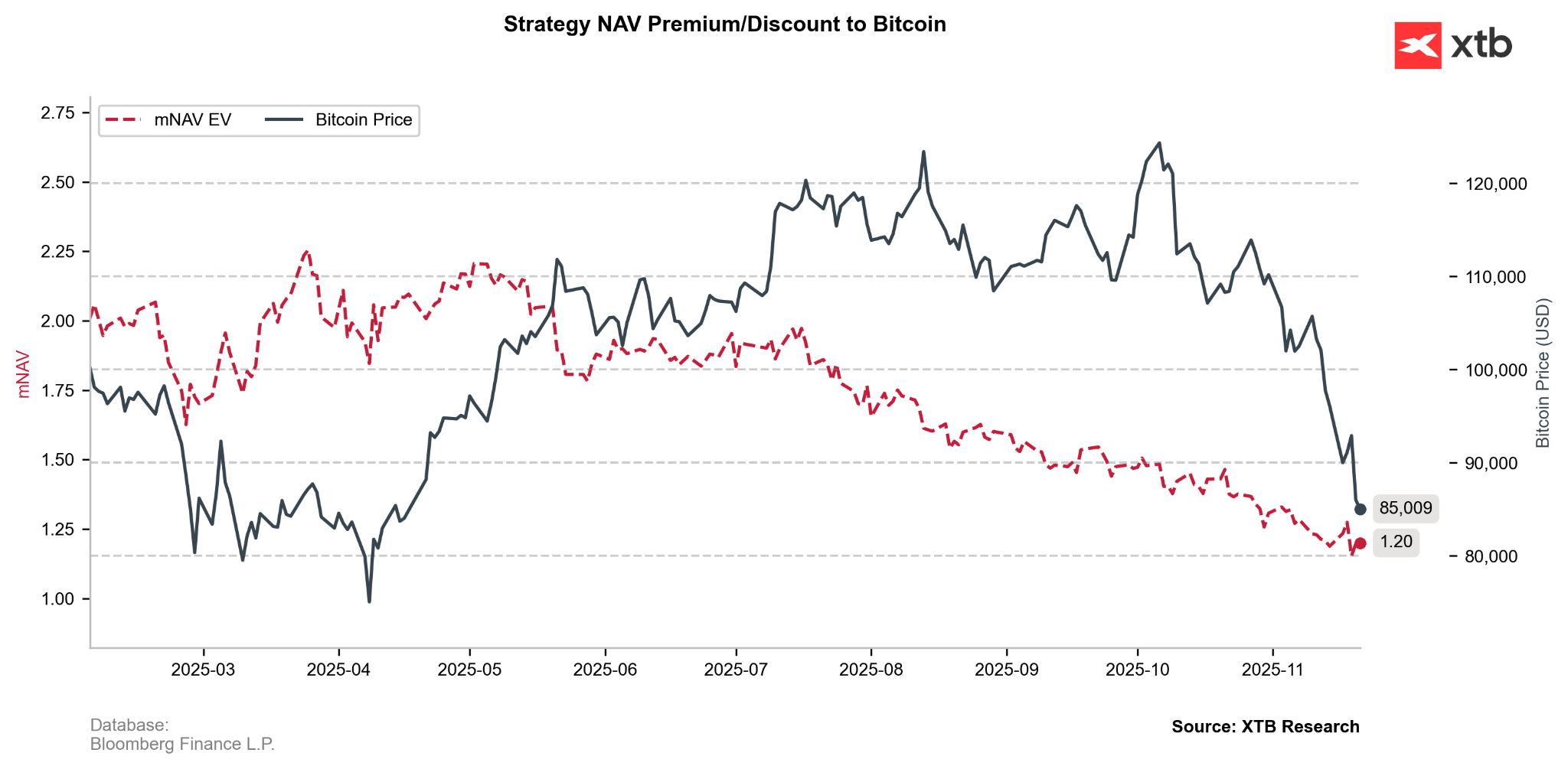

The company’s premium, which historically allowed Strategy (MSTR.US) to raise capital more cheaply than buying Bitcoin directly, has been declining steadily since mid-2025 (mNAV = EV/BTC holding).

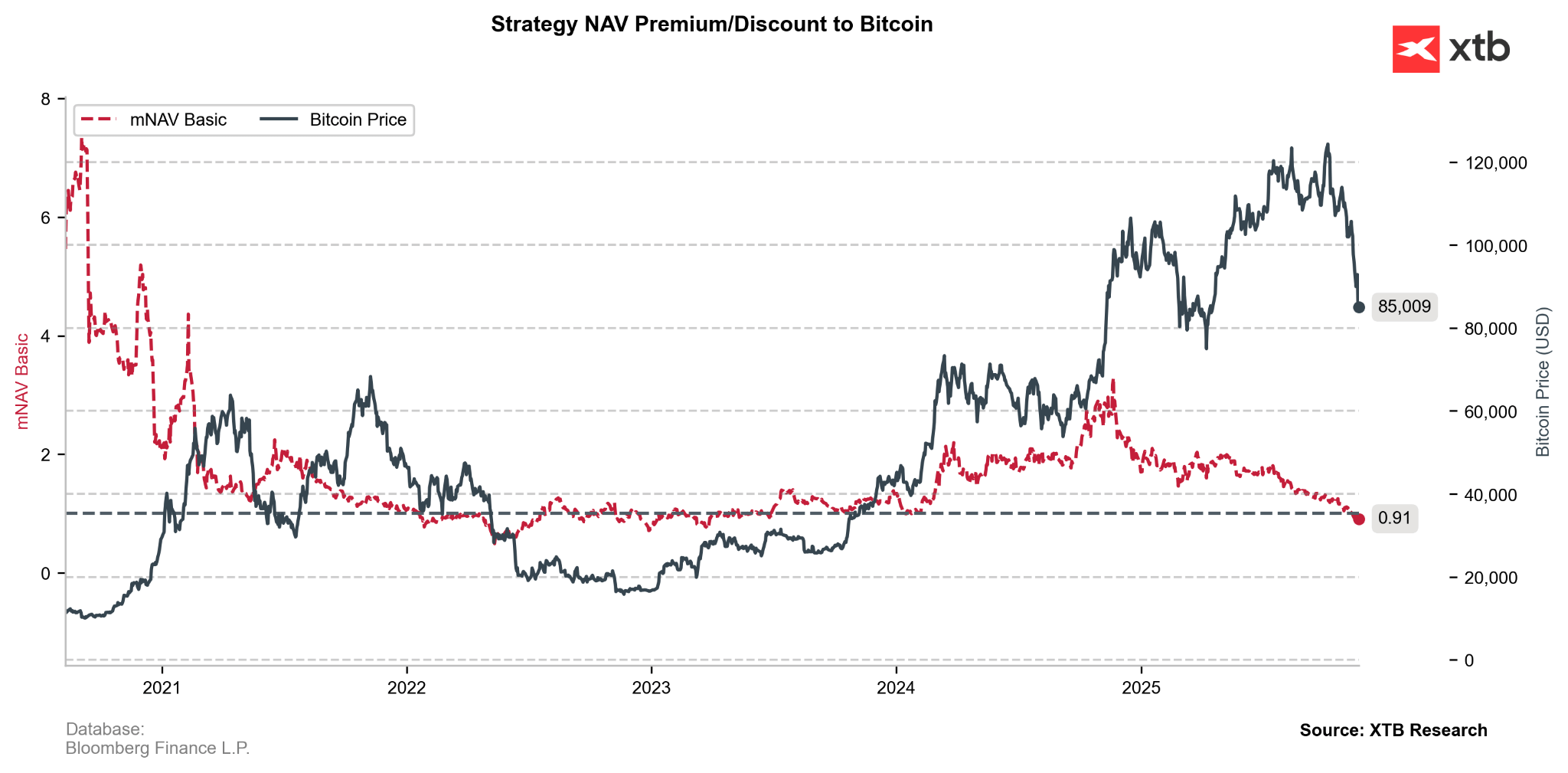

The mNAV Basic ratio (mcap / BTC holding) has fallen below 1, meaning the company’s total market capitalization is now lower than the value of the Bitcoin it holds at current prices. JPMorgan also warned that MicroStrategy could be removed from major MSCI indices, which could trigger outflows of 2.8–8.8 billion USD.

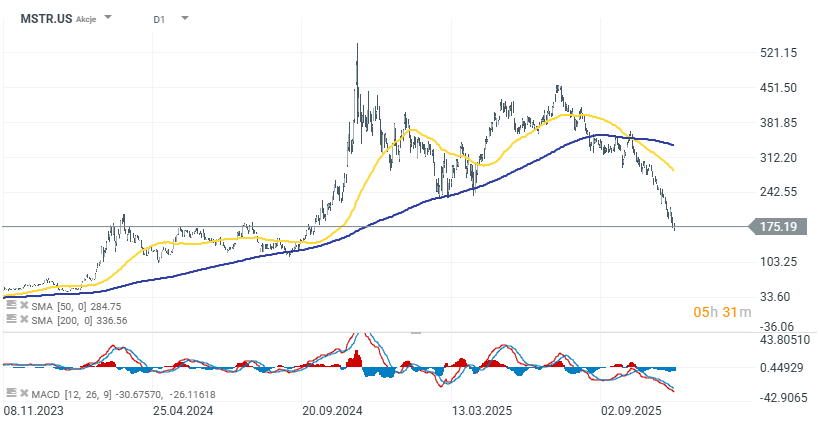

MSTR shares have fallen 10% this week, 55% over the past six months, and 60% year-over-year — much more sharply than Bitcoin itself, which is down 32% from the peak. The stock is trading near 52-week lows amid very high volatility. The company continues to raise capital through new preferred-share issuances, but rising funding costs and the risk of index removal remain key risk factors for investors. In the short term, the most important element appears to be stopping the decline in Bitcoin. Strategy is not facing a liquidity threat, as the nearest debt obligations mature only in 2027 (a small portion) and in the years that follow.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.