The shares of the oldest operating bank in the world, Italy's Monte dei Paschi di Siena (BMPS.IT) are gaining nearly 4% in the face of an announcement by the Italian Treasury that it intends to sell off nearly 64% of the Bank's shares. However, there is a condition, such an option is only considered if it would be financially advantageous and provided that any, significant new investor would manage the Bank in line with the Italian national interest.

It is worth recalling that the commitments made with the European Union at the time of the Bank's rescue in 2017 bind Italy to the eventual resale of Monte dei Paschi di Siena. The government wants the Bank to be acquired by one of Italy's existing banking conglomerates, such as UniCredit (UCG.IT) or Banco BPM SpA (BAMI.IT). At this point, however, these institutions deny any interest in a potential takeover of BMPS. Prime Minister Giorgia Meloni has repeatedly said that the privatisation of MPS should foster the creation of several large banking groups in the country.

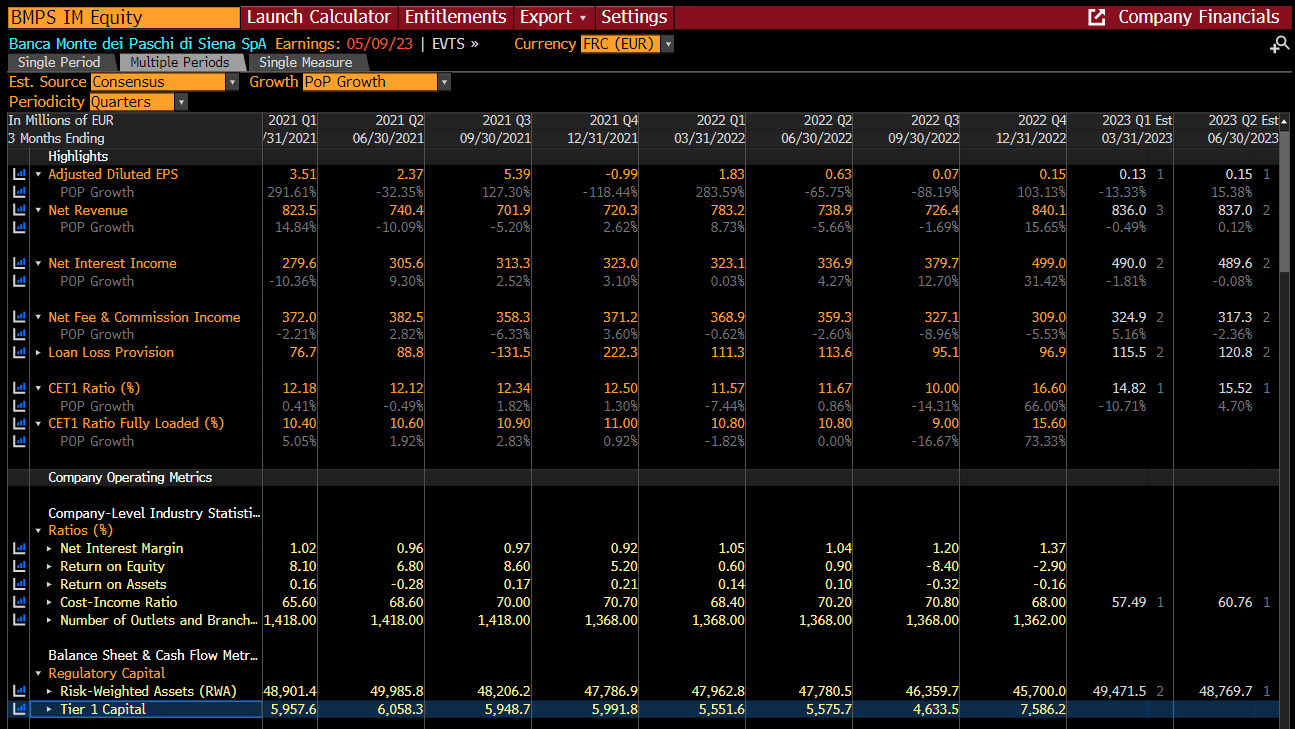

Despite the fact that the Bank's shares have already been trading in a dynamic downtrend for many years, State aid and the preventive plans implemented seem to be supporting the business operability of Monte dei Paschi di Siena (BMPS.IT). Performance is improving, which may support the entity's attractiveness towards future M&A opportunities. The latest quarterly results will be presented tomorrow. Source: Bloomberg

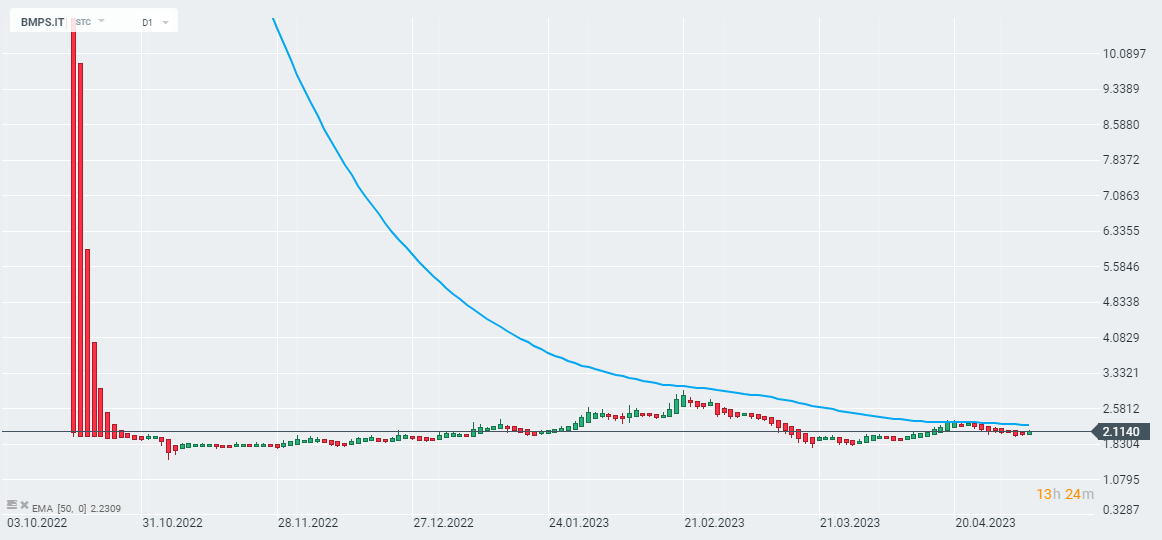

Heikin Ashi chart of Monte dei Paschi di Siena (BMPS.IT) shares. Source: xStation 5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.