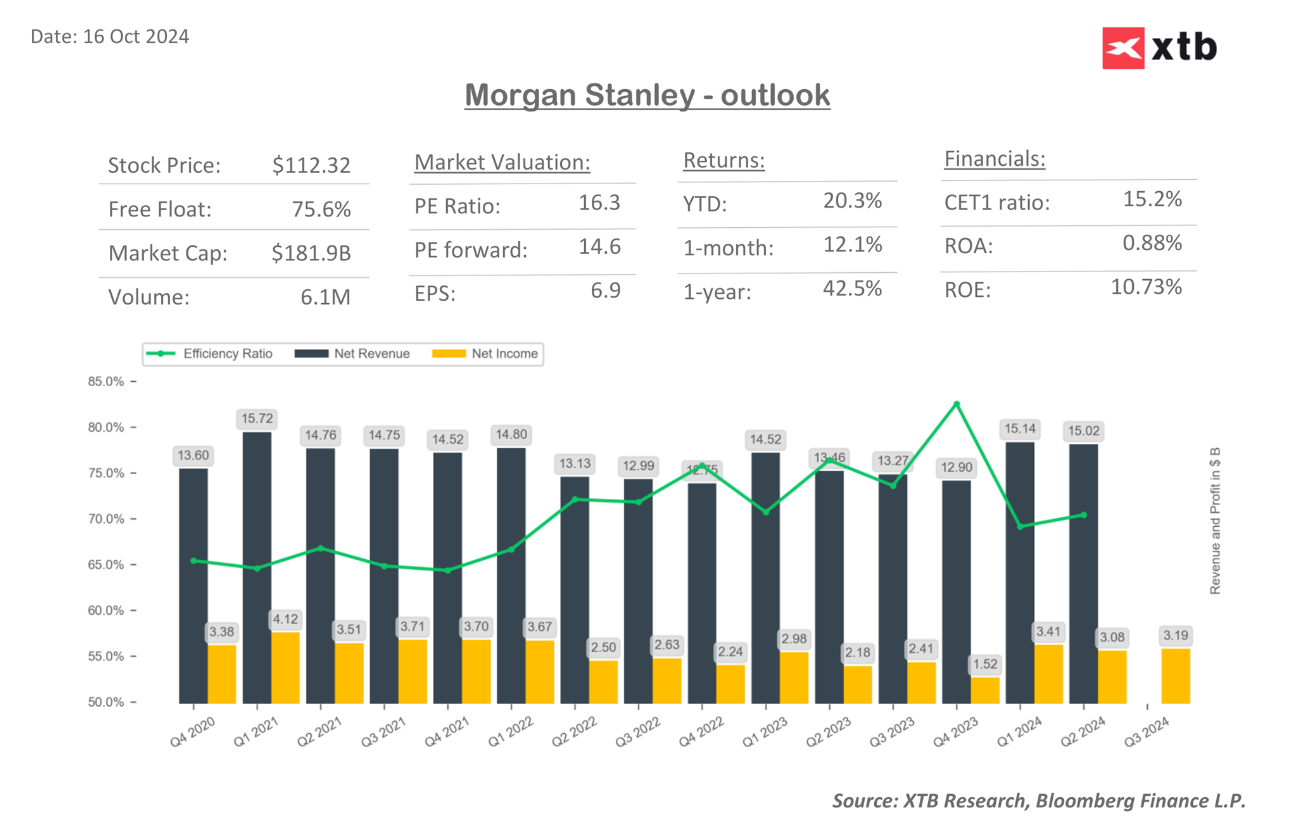

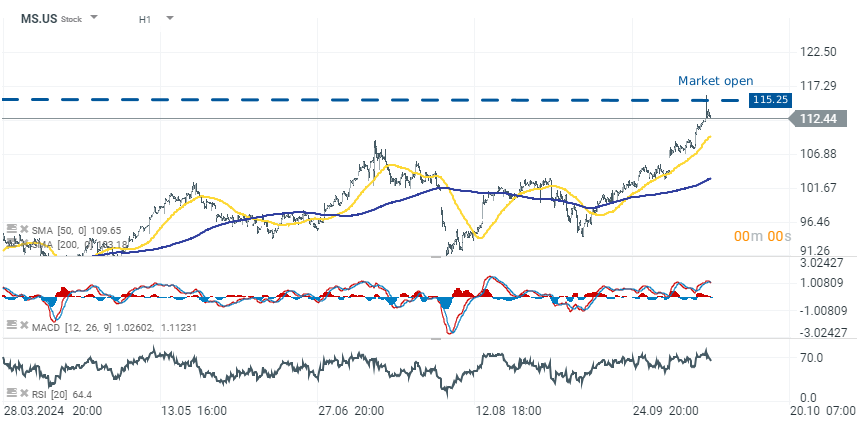

Morgan Stanley gains 2.70% to $115.25 after releasing a better-than-expected Q3 report.

- Earnings per Share (EPS): $1.88, up 32% from $1.42 in Q3 2023.

- Revenue: $15.38 billion, a 16% increase from $13.3 billion in Q3 2023.

- Wealth Management Revenue: $7.27 billion, up 14% year-over-year.

- Investment Banking Revenue: $1.46 billion, a 56% increase from last year.

- Equity Trading Revenue: $3.05 billion, up 21% from $2.52 billion in Q3 2023.

- Fixed Income Revenue: $2 billion, up 3% year-over-year.

- Return on Tangible Common Equity (ROTCE): 17.5%.

Morgan Stanley exceeded analyst expectations for Q3 2024, reporting a 32% rise in profit to $3.2 billion, or $1.88 per share, compared to a $1.58 estimate. Revenue increased by 16% to $15.38 billion, surpassing the $14.41 billion forecast. All key divisions performed well, with Wealth Management revenue up 14% and Investment Banking revenue soaring 56%. Strong trading activity and improved market conditions contributed to robust earnings, and shares rose by 3.8% following the release.

Wealth Management achieved record revenues of $7.3 billion, driven by increased client asset inflows and robust transactional revenues. The firm added $64 billion in net new assets, pushing total client assets to $6 trillion. Institutional Securities reported a 20% year-over-year revenue increase, largely due to strong trading in equities and fixed income.

Investment Management also saw growth, with a 9% increase in revenues to $1.46 billion, driven by higher assets under management (AUM) and positive net flows. CEO Ted Pick highlighted the firm’s capital generation and strong returns with a 17.5% return on tangible common equity (ROTCE) for the quarter.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.