The Reserve Bank of New Zealand (RBNZ) left the Official Cash Rate unchanged at 2.25%, delivering a balanced and cautious statement. The Bank’s policy remains accommodative, and the tone was not hawkish, but subtly more firm than in November, reflecting improved growth prospects and greater confidence that inflation is returning toward target.

Monetary policy stance: accommodative but conditional

The Committee emphasized that monetary conditions will remain supportive “for some time.” Policymakers agreed that withdrawing stimulus too early could jeopardize the recovery and risk inflation falling back below the midpoint of the 1–3% target range.

Key points from the statement:

- OCR maintained at 2.25% (unanimous decision).

- Inflation recently exceeded the 1–3% target range, but a quick return within the band is expected.

- Inflation is projected to stabilize near 2% (the midpoint of the target) within the next 12 months.

- The economy still shows significant spare capacity (negative output gap).

- Wage growth remains moderate; core inflation is under control.

- Policy normalization will be gradual and dependent on further strengthening of the recovery.

The updated OCR path was slightly revised higher compared to November, suggesting the possibility of an earlier rate hike than previously assumed. However, this information did not support the NZD, which fell sharply during the session.

Inflation outlook: returning toward target

Annual CPI inflation rose to around 3.1% at the end of 2025, exceeding the upper bound of the target range. The increase was driven mainly by food prices, electricity costs, and volatile tradable goods components. The Bank remains confident that inflation will return toward 2%. Risks to inflation are assessed as balanced.

Growth and labor market: recovery underway but uneven

The RBNZ described the recovery as early but stable. Growth is supported by high commodity prices and previous rate cuts, though momentum remains uneven across sectors. GDP is rebounding after a contraction in mid-2025, and unemployment remains elevated (around 5.4%) but is stabilizing.

Press conference – key remarks from Governor Anna Breman

Governor Anna Breman maintained a cautious tone and distanced herself from interpretations suggesting an imminent start to a hiking cycle. Breman has served as RBNZ Governor since December last year.

Key messages:

- The OCR path is conditional, not a commitment.

- A rate hike by year-end is possible, but not planned.

- The Bank does not intend to raise rates until it sees clearly stronger growth and inflation pressure.

- Any tightening would be gradual.

- A fourth-quarter hike is not fully embedded in projections.

- The housing market is not expected to experience a sharp surge in prices.

The communication clearly aimed to prevent the market from pricing in an aggressive tightening cycle.

Market reaction

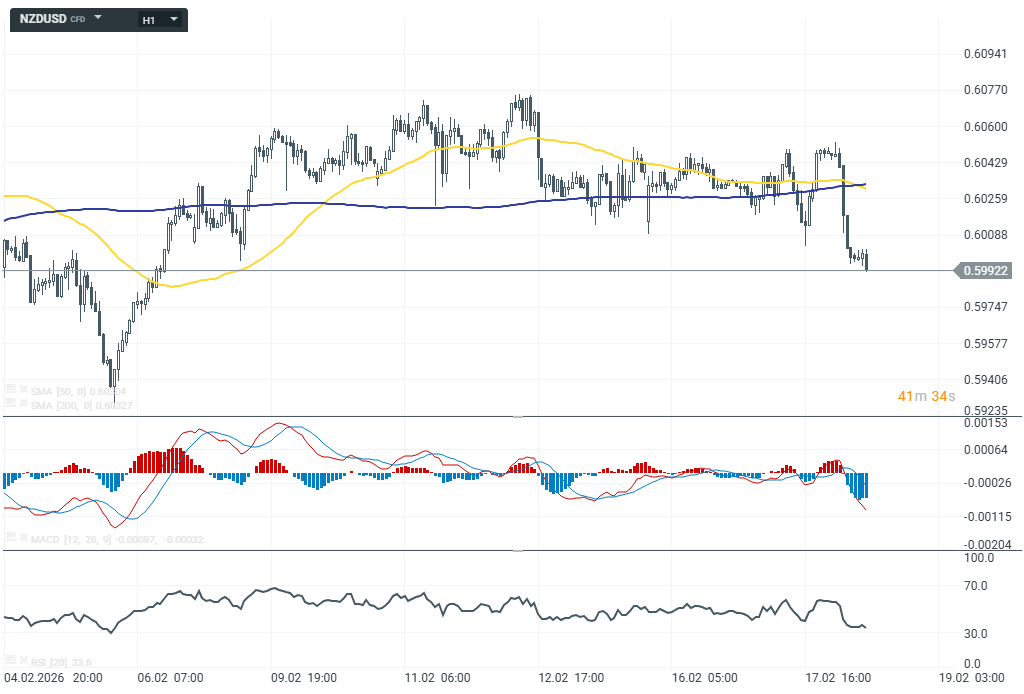

Despite the slightly higher rate path, the market interpreted the message as dovish rather than hawkish. The New Zealand dollar weakened noticeably after the decision.

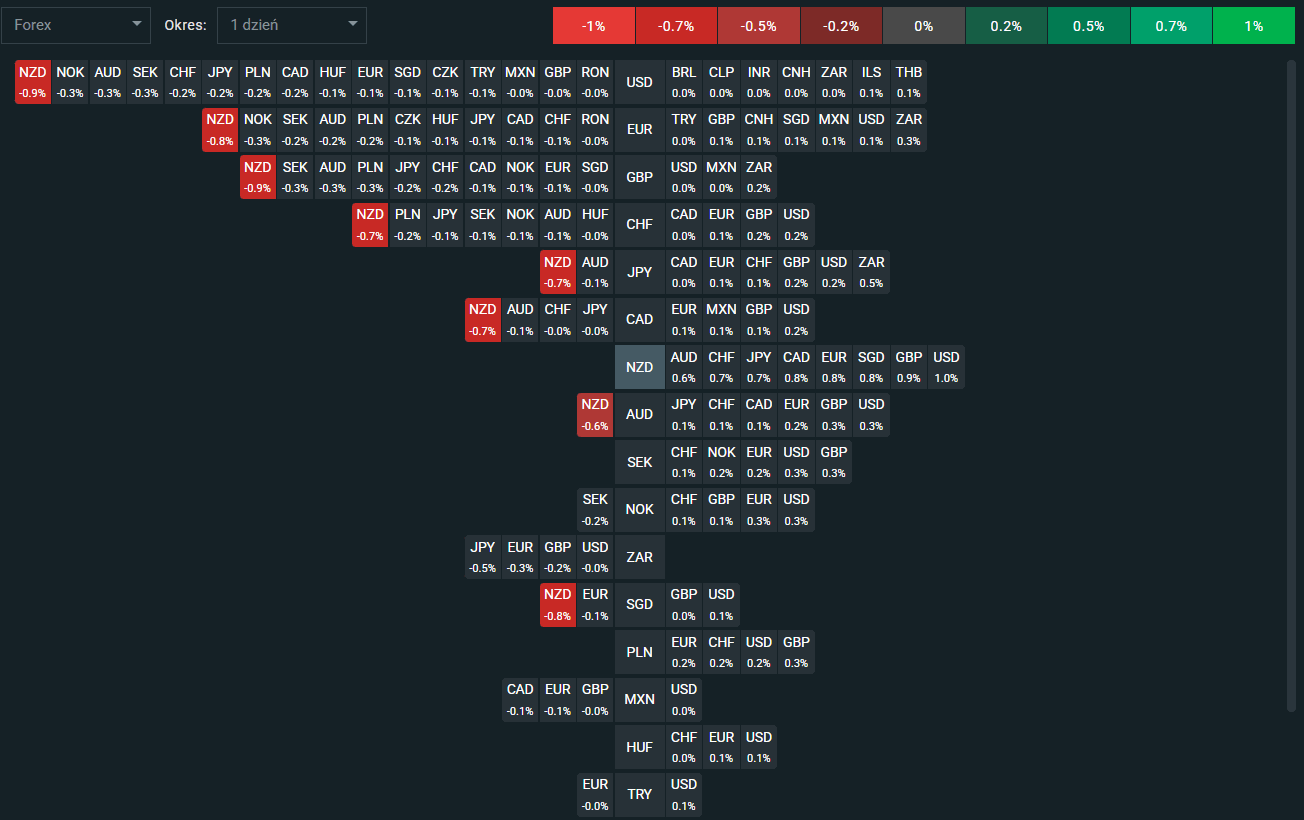

- NZD was the weakest major currency of the day, falling around 0.6–0.9% against the currency basket.

- NZDUSD declined by approximately 0.92% during the session.

The market reaction suggests that investors had been positioned for a stronger tightening signal and instead received a message emphasizing patience and data dependence.

Economic calendar: US industrial production and durable goods orders 📈

Morning wrap (18.02.2026)

Daily summary: The market looks for direction, oil and metals under pressure

Gold loses 2.5% amid US - Iran trade negotiations and dollar strength 📉ANZ lifts outlook

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.