- Commodity Slump: Oil and silver prices dropped sharply after President Trump signaled a pause in potential military action against Iran and held off on imposing new tariffs on critical minerals.

- TSMC Earnings Beat: Taiwan Semiconductor Manufacturing Co. reported better-than-expected quarterly profits of NT$505.7 billion ($16 billion), boosting sentiment for technology stocks and artificial intelligence demand.

- Market Rotation: Despite the volatility in raw materials, analysts view the current price action as a rotation of capital rather than a sign of lasting trend fatigue.

- Commodity Slump: Oil and silver prices dropped sharply after President Trump signaled a pause in potential military action against Iran and held off on imposing new tariffs on critical minerals.

- TSMC Earnings Beat: Taiwan Semiconductor Manufacturing Co. reported better-than-expected quarterly profits of NT$505.7 billion ($16 billion), boosting sentiment for technology stocks and artificial intelligence demand.

- Market Rotation: Despite the volatility in raw materials, analysts view the current price action as a rotation of capital rather than a sign of lasting trend fatigue.

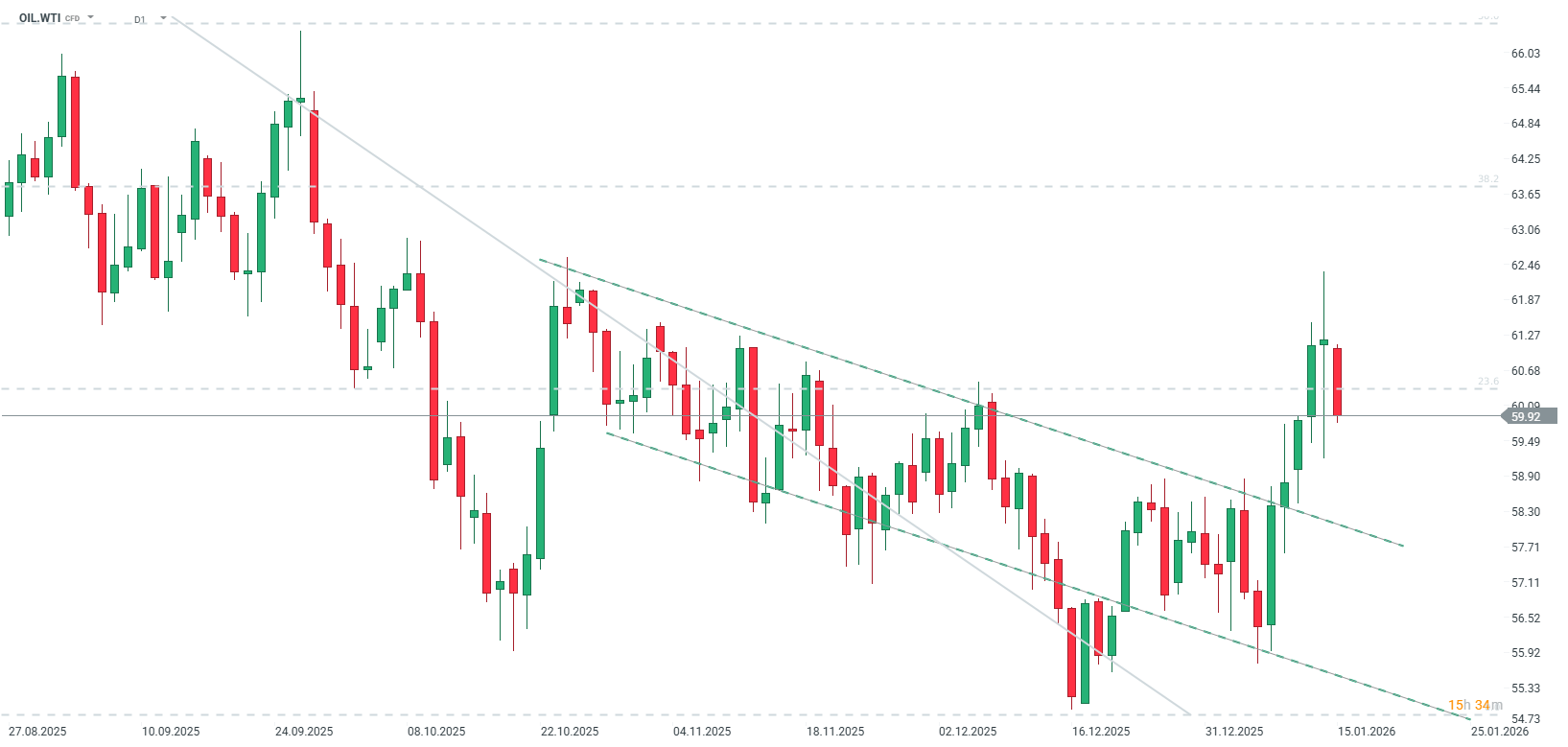

Crude Prices Slump on Easing Tensions

Oil prices have fallen for the first time in six days. This correction is primarily driven by signals from Washington regarding a potential de-escalation of geopolitical friction:

- Strategic Pause: President Trump indicated he may hold off on any military action against Iran for the time being.

- Diplomatic Assurances: The President stated he was reassured by sources that the government in Tehran would cease the killing of individuals involved in widespread protests.

- Price Action: West Texas Intermediate (WTI) crude has dropped from levels near $61 to trade below $60 per barrel. Brent crude also saw a significant decline of 2.9%.

- Market Structure: Current futures pricing shows the market in backwardation through March 2027—meaning spot prices command a premium over near-term futures—before shifting into a significant contango thereafter.

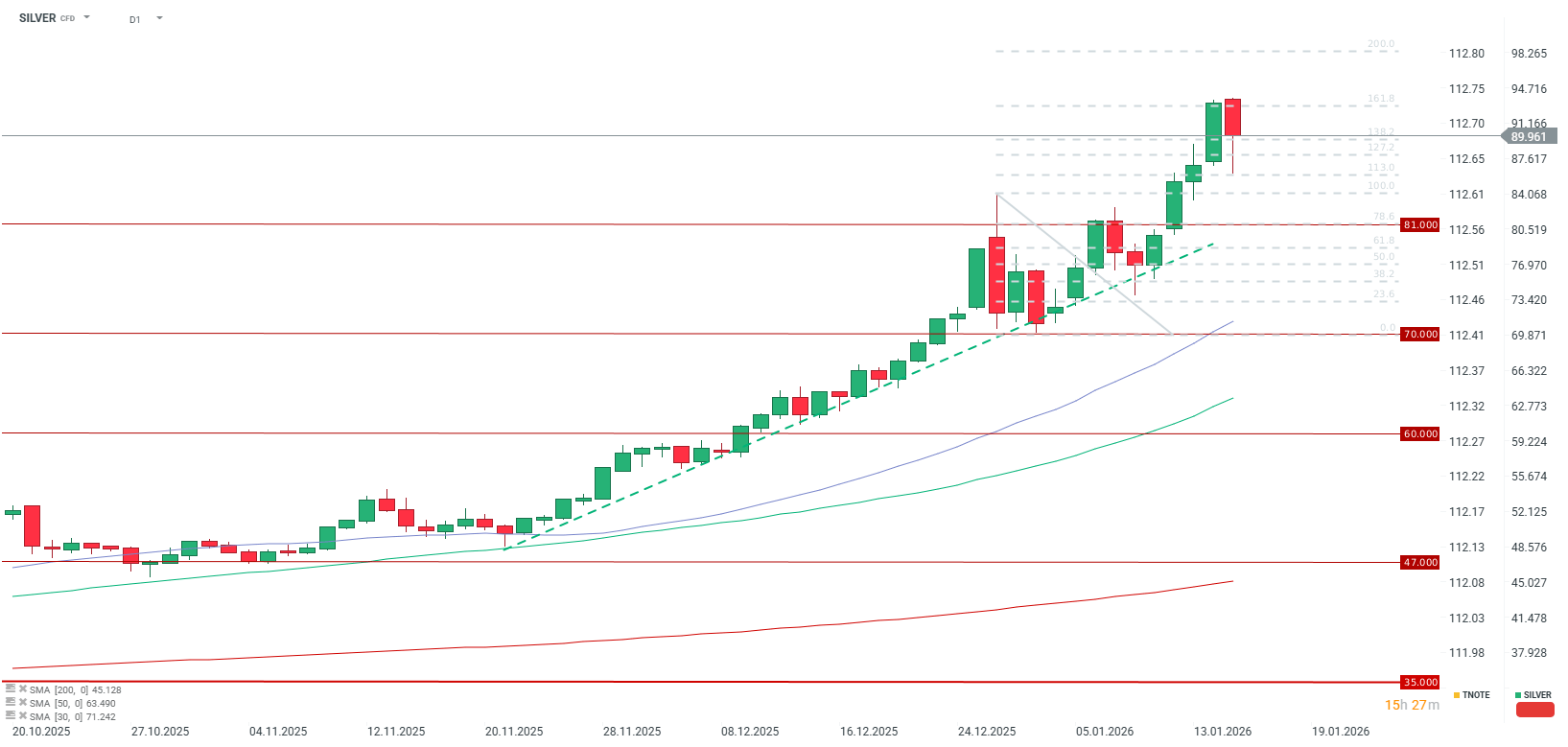

Silver Correction Follows "Frenzied" Buying

Silver, alongside other precious metals, has retreated from recent record highs. This pullback is notable as it follows a period of "frenzied" buying in both the US and China.

- Tariff Reprieve: Silver tumbled after President Trump held off on imposing new tariffs on critical mineral imports. While the immediate drop was recorded at 4%, intraday volatility saw the metal fall from near $93 toward $86 per ounce.

- Policy Shift: The administration has proposed negotiating bilateral agreements and floating "price floors" for imports rather than traditional percentage-based levies.

- Relative Performance: Silver's decline is being exacerbated by the broader reduction in geopolitical risk; meanwhile, gold has proved more resilient, losing only approximately 0.4%.

Broader Market Context: Rotation Over Fatigue

Despite Thursday's weakness, market analysts suggest these declines are currently too modest to derail the powerful bull trends established throughout 2025 and early 2026. The consensus is that the market is undergoing a capital rotation rather than a permanent trend reversal.

Investor sentiment was further bolstered by stellar results from Taiwan Semiconductor Manufacturing Co. (TSMC). The chipmaking bellwether reported net income of NT$505.7bn ($16bn) for the December quarter, easily surpassing analyst estimates of NT$467bn. While US and European equity-index futures rose on the news, TSMC shares saw a slight 1% dip in local trading following a marginal gain in US after-hours sessions.

Amazon shares tumble 10% as investors recoil at the price of AI dominance

Daily summary: Red dominates on both sides of Atlantic

US OPEN: Market under pressure from lacklustre tech earnings season

Palantir after earnings: another quarter, another record

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.