Remy Cointreau (RCO.FR) stock jumped over 11% during today's session after the French drinks group announced that earnings doubled in the first half of the year thanks to strong demand for its premium cognac in China, the United States and Europe, price effects and good cost control. The group recorded operating profit of 212.9 million euros ($238.5 million) in the six months to Sept. 30, twice that of the same period last year. Net profit came to EUR134 million, more than doubling on the year.

Eric Vallat, Remy Cointreau’s CEO, commented: “It has been an amazing semester for Rémy Cointreau, reflecting our market share gains and the solid progress made on our strategic priorities. These results will reinforce our ability to become the worldwide leader in exceptional spirits".

As a result of the strong first half performance, the company raised its full-year outlook and now expects "very strong" organic growth in current operating profit in the 2021/22 financial year. It had previously targeted "strong" growth. However Remy warned, that second-half earnings will be affected by higher spending on marketing and communication and by inventory management in the year’s final quarter. The company did not provide any specific earnings forecasts for the full year.

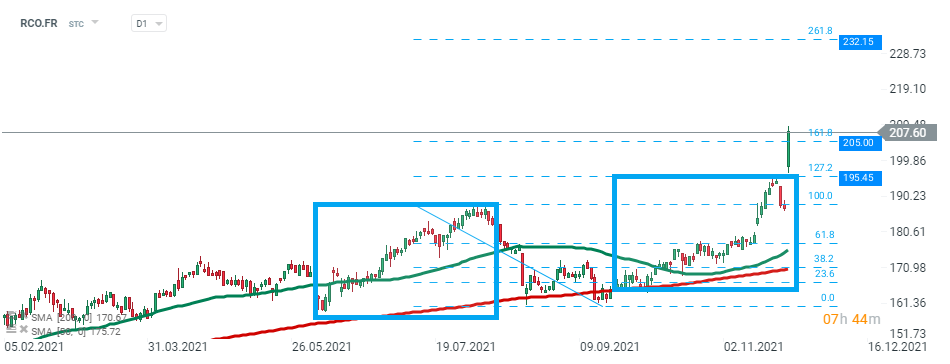

Remy Cointreau (RCO.FR) stock launched today's session sharply higher, tested support at €195.45 and then skyrocketed to new all-time high at €205.00. If current sentiment prevails, upward move may accelerate towards €232.15 which coincides with 261.8% external Fibonacci retracement of the last downward wave. Source: xStation5

TSMC Earnings Preview: Will the Key Semiconductor Supplier Surprise the Market?

US Open: American Indices Rally on Anticipated End of Fed Balance Sheet Reduction

Bank of America, Wells Fargo, and Morgan Stanley: Q3 2025 Earnings Overview

Abbott reports no surprises in Q3, but tariff risks and lowered forecasts drag the share price down💡

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.