- German leader of armed industry published earnings that impressed investors and reassured market

- Massive growth in sales and income across most areas of operation

- Order backlog keeps growing

- Operating margin slightly lower due to massive investments

- Civilian market remains weak

- Optimistic outlook for the fourth quarter presented

- German leader of armed industry published earnings that impressed investors and reassured market

- Massive growth in sales and income across most areas of operation

- Order backlog keeps growing

- Operating margin slightly lower due to massive investments

- Civilian market remains weak

- Optimistic outlook for the fourth quarter presented

The German group Rheinmetall published its results today. The European arms manufacturer has seen spectacular growth in revenues and valuations in recent quarters. Riding the wave of massive increases in military spending by European countries, the company's valuations are reaching record after record. Investor expectations are growing, and valuation metrics leave little room for error or disappointment. Did the company's results meet investor expectations?

The company rose by about 3% at the opening after the results were published, indicating that the company passed another test set by the market. Rheinmetall Group is achieving consistent growth rarely seen on the European stock exchange, especially among industrial companies.

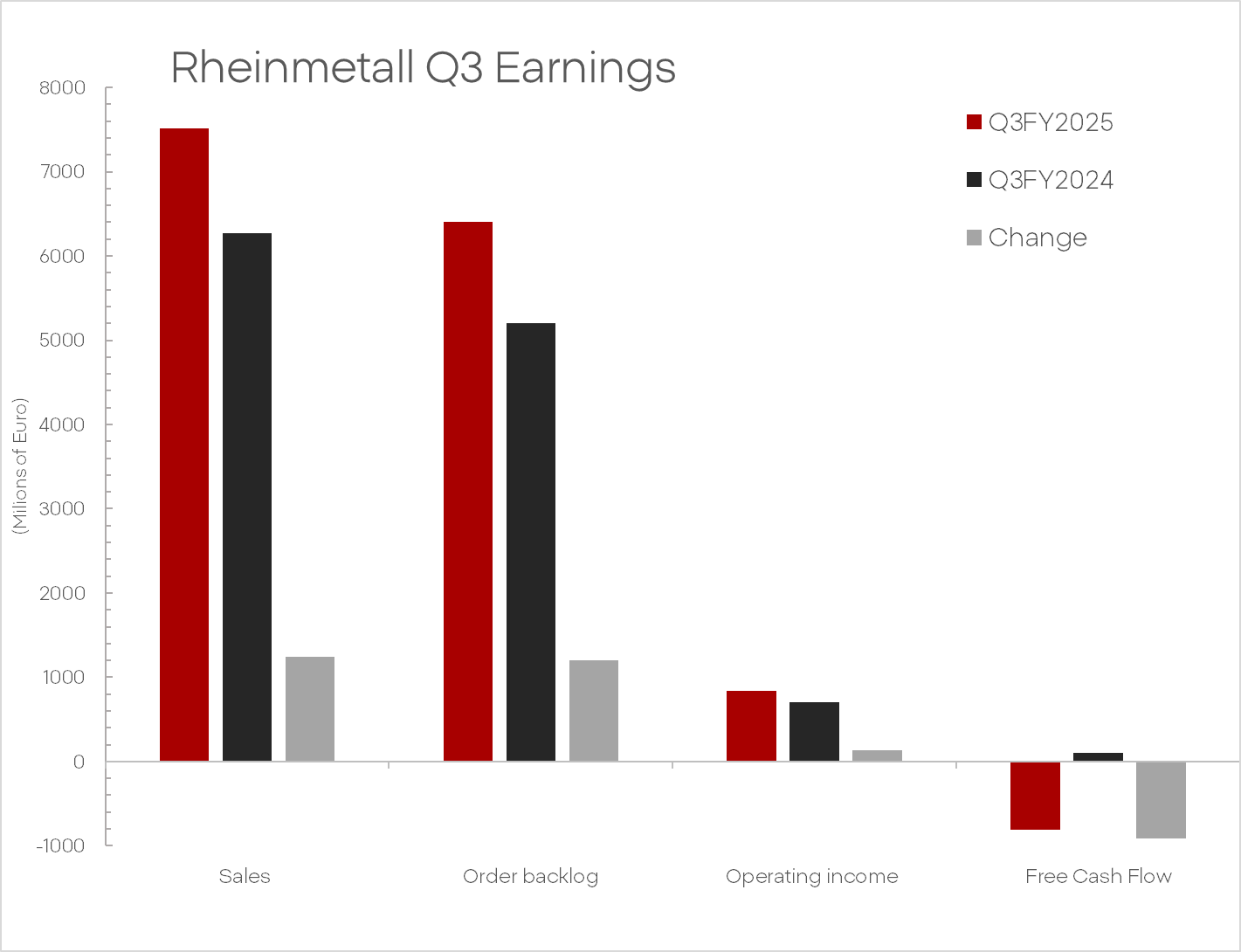

- Sales in Europe increased to 7.5 billion euros compared to 6.2 billion the previous year, growing by 20%.

- Operating profit amounted to 835 million euros compared to 705 million last year, representing an 18% increase.

- The already impressive order backlog also positively surprised. It increased to 64 billion euros, growing by another 12 billion this year.

- As important as historical data are the company's forecasts and goals. The company's management maintained its year-end goals, which include overall sales growth of 25-30% and an optimistic operating margin of 15.5%.

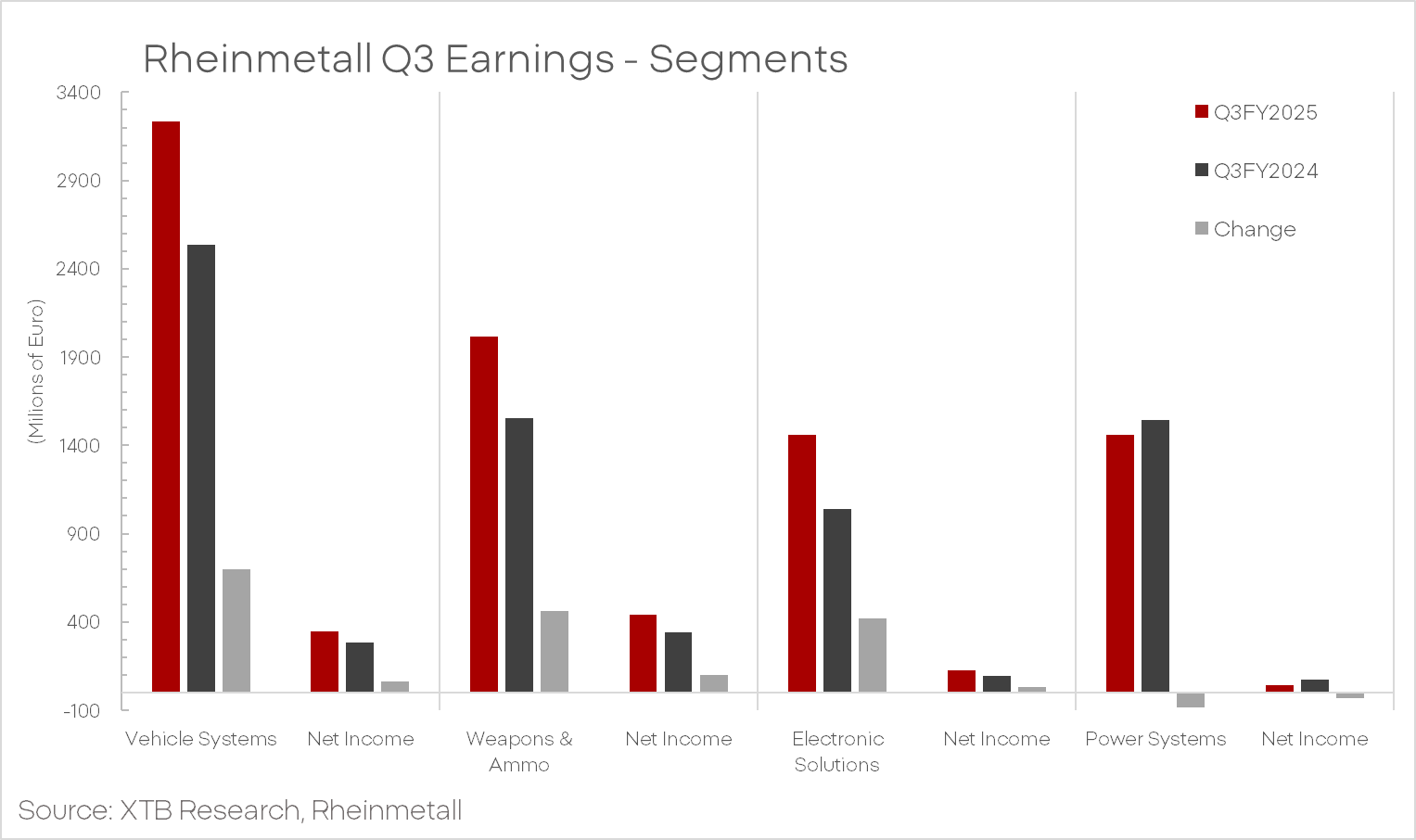

It's also worth looking at the individual segments of the company's operations. The core of the company's revenues remains the land vehicle segment. This part of the company's operations generated 3.2 billion euros in revenue, which is a 28% increase compared to the previous year, and operating profit rose to 346 million.

The ammunition and electronics segments are also performing well. In the weapons and ammunition segment, the company registered a revenue increase of 30% to over 2 billion euros. The segment also recorded an increase in operating margin to 22% despite "rising labor and material costs." The electronics systems branch recorded a record growth, with sales increasing to 1.46 billion euros, representing a 41% increase compared to the previous year.

However, not all information provided by the company is positive. The company's operations based on engines and power systems recorded a decline in sales from 1.54 billion euros to 1.45 billion. A strategic decision was made to separate "Power Systems" from the rest of the group so that revenues from the civilian market are concentrated in one subgroup. As seen from the report and management comments, this segment remains under pressure from structural weaknesses in the market and consumer. However, this is not the only challenge for the company.

Primarily, the consolidated operating margin fell from 11.3% to 11.1%, and free cash flow dropped by a staggering 912 million euros to -813 million euros.

The company clearly states that this is due to very intensive investments and expansion in all major areas of the company's operations. These investments include the production line for F-35 hulls and the "Nidersachsen" ammunition factory.

Ultimately, the earnings conference satisfied investors. The financial report reassured investors about the continued revenue growth dynamics, and management comments calmed most of the negative sentiment. Large investment expenditures are acceptable to the market, especially in the context of record orders, but failing to meet the ambitious operating margin target by the end of the fiscal year could lead to a significant price correction for the company.

RHE.DE (D1)

Source: xStation5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Arista Networks closes 2025 with record results!

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.